Source: Michael J. Ballanger for Streetwise Reports 09/17/2018

Michael Ballanger discusses the current state of precious metal markets.

I shall pass along my thoughts on the tenth anniversary of the 2008 bank bailouts, currency chaos and the un-precious metals in no particular order and with no specific agenda. More important, I want to pay tribute to a writer whose work I truly love, Rolling Stone magazine’s Matt Taibbi. Taibbi’s work reminds me of an era-gone-by when reporters actually reported and where “fake news” was at the least an excuse for the originator to be blackballed from the journalistic fraternity and at the worst a jail sentence. The senior editors in the newspaper business demanded that their reporters verified facts by way of constant scrutinization of sources while chasing down leads for days on end in order to allow something controversial to hit the media screens. Matt covered the “Great Financial Crisis” ten years ago and immediately after that, he was the chap that nicknamed Goldman Sacks “a great vampire squid” whose claim to fame and prosperity was how it was “wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Matt has come out with his 10-year update on the anniversary of the “Great American Taxpayer Rip-off” and I urge all of you to take the time to read it. It is unlike the Wall-Street-sponsored CNBC anchor Andrew Ross Sorkin’s account by way of his best-seller “Too Big to Fail” would up glamorized the key criminals in the heist including Hank Paulson, Ben Bernanke and Tim Geithner. They have all since written books about how they singlehandedly saved the financial system from certain peril while conveniently omitting the billions upon billions of free money given to the bankers in bonuses while trillions in real estate and pension losses by Middle America remain. Here is the link and I offer a word of warning: Do not read this near any small children or beloved pets. Your response will be, shall we say, “unwelcomed.”

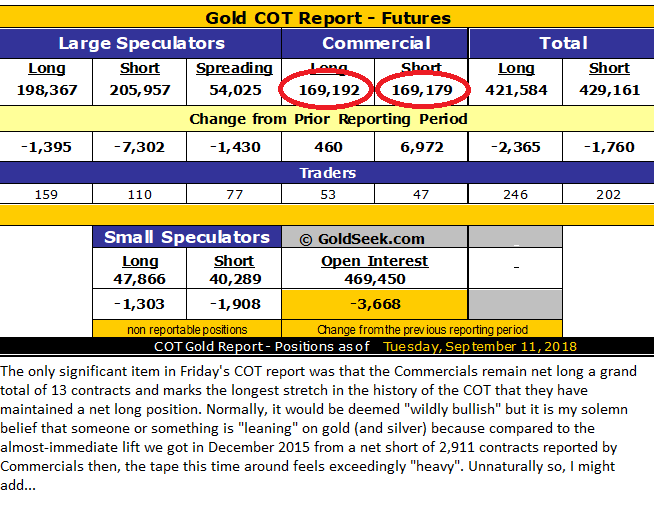

The Friday COT was a non-event and therefore all that can be said is that it remains in a massively bullish configuration in the manner of an inordinately stretched elastic band reaching the end of its elongation: one slip-up and the ensuing snapback will be violent and swift.

One of the classic buy signals I have used over the years has been the GDX:$GOLD ratio, which replaced the $HUI:$GOLD ratio with the arrival of the ETF’s to the financial arena. Gold mining shares often represent a precursor to trend changes in the underlying physical metals and while they do not always do so, they are more right than wrong since I first began to monitor the relationship between spot gold prices and the miners in early 1980s. There have been occasions when they gave false signals and none more glaring than in mid-January of 2016 when the $HUI crashed to 99.17 under the weight of massive forced liquidation by one of the very large oil-sensitive sovereign wealth funds despite rising gold and silver prices and a favorable COT structure. Here in September 2018, it seems that the outperformance of the GDX (Senior Miners ETF) is giving us a clue that the precious metals are itching for a rally and if the COT set-up is any clue, it will be a rip-your-face-off event with Large Spec shorts scrambling for safety while Commercials nudge prices higher and just “out of reach.”

The highly volatile TSX Venture Exchange has been outperforming the gold and silver markets since mid-August but then again there is nothing surprising in that trend. I learned a great many years ago that the best buying opportunities for the junior exploration issues—the “penny dreadfuls”—usually found lurking in the TSXV shadows arrive about two to three weeks before the kids are back in school but the bell that rings to mark the beginning of the junior exploration season goes off after the arrival of autumn as the lazy days of summer are replaced by “Back-to-Work” psychology and much more active TSXV markets. Despite the injection of non-precious metals components in the TSXV index in recent years, gold and silver issues still play a dominant role so the outperformance remains an important indicator and helpful tool in timing the turn in the metals.

This past weekend I was fortunate enough to have been able to grab a cellular signal while moored in the lovely Indian Harbour located in eastern Georgian Bay where the sunsets are as good as anywhere in the world and the water as clear as can be. I was able to enjoy three days of +25C weather during which I must have read over 50 research reports by the big banks, brokers and bloggers all waxing eloquently on the “next big trade.” What is consistent is that North American investors have a certain bias while Europeans have a distinctively different one. When the topic of gold and silver arises, it becomes blatantly obvious that the singular most important factor in whether or not one should own gold and silver is location, location, location. If you pay bills in emerging market locales where currency chaos can arrive at your doorstep literally overnight, there is a profound urgency to shift one’s bill-paying currency into gold on a regular basis in order to avoid calamitous declines in one’s purchasing power. This not because you expect volatility in your domestic currency; it is because you expect lunacy in the actions of politicians and central bankers in their responses to declining rates of exchange, which THEN results in erosion of the purchasing power of your savings. In other words, politicians purposely debase currencies in order to manage debt and when that debt is U.S. dollar-based, the printing presses are working overtime to make up the shortfall in interest coverage after which they …read more

From:: The Gold Report