Source: The Critical Investor for Streetwise Reports 09/17/2018

The Critical Investor discusses the recently released PEA for the largest lithium clay deposit in the Americas.

Drilling at Clayton Valley Lithium project, Nevada

1. Introduction

Despite negative sentiment in commodities and especially lithium of late, Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:FSE) keeps delivering the goods at its Clayton Valley Lithium project in Nevada at high speed. A Preliminary Economic Assessment (PEA) was announced at September 6, 2018, and the resulting economics were impressive. An after-tax NPV of US1.45 billion at an 8% discount rate and an after-tax IRR of 32.7% (LCE price of US$13,000/t) indicate the large size of Clayton Valley, making it a potential buyout or JV target for one of the major players like nearby Albemarle. This is exactly the kind of growth CEO Bill Willoughby had in mind when he signed up with Cypress Development, as he saw the potential for the large assets of Cypress one day gaining serious attention. Let’s have a look where Clayton Valley stands at the moment, after this PEA.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. PEA

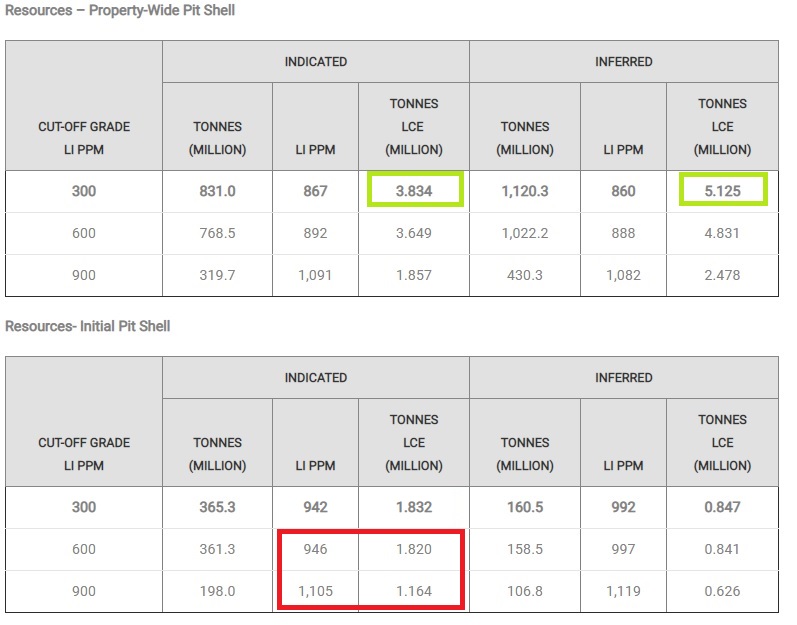

The new PEA wasn’t just an impressive study in itself, as it beat my expectations for NPV (my hypothetical NPV7.5 @US$12,000 would come in at US$966 million vs the PEA NPV8 of US$1,260 million; on the other hand the hypothetical IRR at 33.8% was slightly better vs the PEA IRR of 29%), Cypress Development also updated its resource statement. Notwithstanding the first NI-43-101 compliant resource estimate of 6.5Mt LCE that was already world class, the company now has almost 9Mt LCE (see green markers):

Again, as a continuous reminder, examples of world class sized LCE deposits in each category are brine projects like Cauchari/Olaroz (Orocobre 6.4Mt LCE, SQM/Lithium Americas 11.7Mt LCE), clay projects like Sonora or Thacker Pass (Bacanora: 7.2Mt LCE/Lithium Americas: 8.3Mt) or hard rock projects like Whabouchi (Nemaska: 4.06 Mt LCE). Although Cypress doesn’t have reserves yet, for size it is the largest clay-hosted deposit in the Americas at the moment.

For the PEA the company has elected to use only the high-grade portion to the east of the deposit (see red marker), with an average grade of plant feed ore of 1012 ppm Li. This is a viable option as the deposit is so big that high grading it results in a life of mine of 40 years at an annual production of 24,000t LCE anyway.

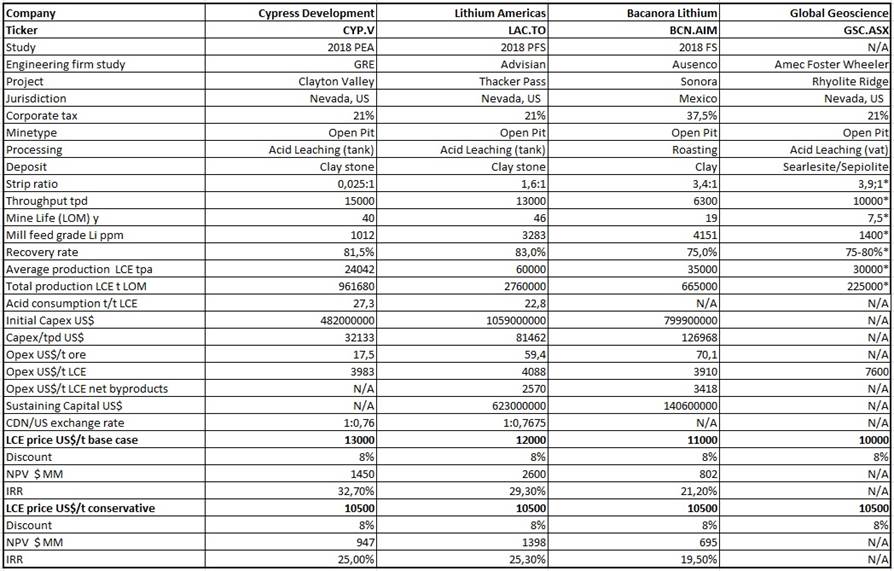

In order to discuss the PEA metrics a bit further, it is always useful to see those metrics lining up with the data of other peer projects. In this case there are three clay-hosted projects (although Rhyolite Ridge of Global Geoscience has low clay content), of which Bacanora’s Sonora is hectorite clay, which means it can’t be leached by acid at all, and needs very expensive roasting. Thacker Pass of Lithium Americas seems to have non hectorite bearing host rock (smectite and Illite clay) but sample material is called hectorite by metallurgical description, nevertheless it still can use acid leaching, and Rhyolite Ridge of Global Geoscience can use acid leaching as well. This last project is the only one without a completed economic study, but some work has been done already for a small (end target is a 30y LOM project) PFS study, and Australian companies can report these findings easier than Canadian ones, so some metrics are already available for the audience. On a side note: Global Geoscience has hired Amec Foster Wheeler for its upcoming PFS, and I consider Amec the single best engineering firm out there by a country mile, so in my view this study could become a future reference for likewise projects. Here we go:

*estimates by Global Geoscience

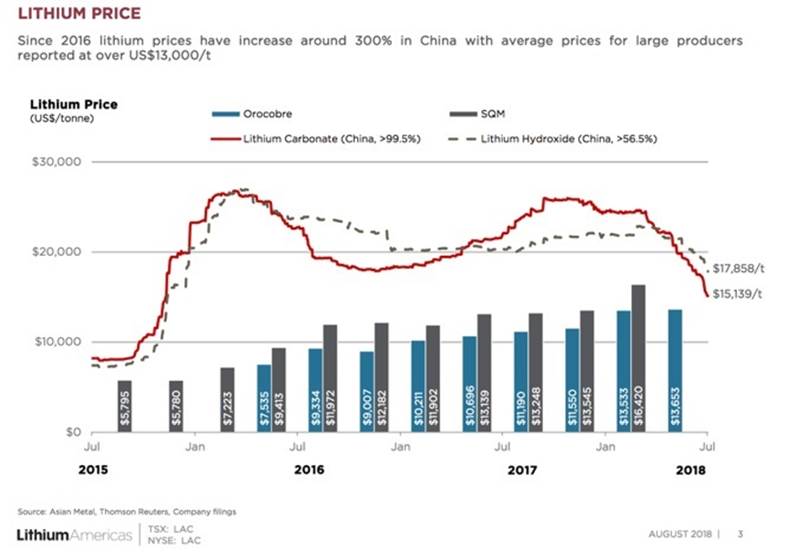

I have normalized the post-tax NPV and IRR for a lithium carbonate equivalent (LCE) price of $10,500/t, which I deem a reasonable and fairly conservative lithium product price. As we can see in the next chart, these prices have been much higher for the last two years or so, but the long-term contract prices are hovering around $13,000/t now, and as far as I am concerned this is the market where serious producers are doing business, and not the much smaller spot market, where prices are much more volatile:

Source: Presentation Lithium Americas

I can see this bottoming easily at $10,000–11,000/t so $10,500/t seems like a realistic midpoint to me. The very bearish Morgan Stanley report was timed to perfection in itself, but I don’t see, for example, SQM bringing online the projected 500kt LCE anytime soon, resulting in the dreaded oversupply from the end of 2019 onwards, as the company already has big issues expanding modestly as it is. It might be the case that the trade war between the U.S. and China is putting the brakes on the world economy, and in turn this could have an effect on electric vehicle (EV) demand, which means less demand for batteries and thus lithium, but as I don’t have a good grasp on the machinations of the lithium spot market, I don’t really have a good explanation on why lithium product prices dropped off so sharply over there the last six months or so. Maybe the negative commodity sentiment influenced small traders working with the most risky metals the most. Enough about the lithium price, let’s continue with the PEA.

When we look at the peer comparison, it will be clear that Thacker Pass comes closest to Clayton Valley, as both projects use acid tank leaching, and the ore is claystone hosted, although the ore from Thacker Pass seems to have slightly hectorite characteristics as mentioned. To what extent isn’t really clear, but what is clear is that opex and the capex/tpd ratio of Thacker Pass are significantly influenced by …read more

From:: The Energy Report