It is hardly a surprise that existing and future shareholders in the mining industry are predominantly concerned about returns on their investments. Regardless of whether investors are seeking a capital appreciation of their stock portfolio or plan to grow their money through dividend payments, or a combination of both, they typically make money when a company does.

Mining companies that provide a competitive and sustainable rate of return to their shareholders are highly sought-after targets for investors.

A company’s financial indicators, such as revenue and expenses, cannot always tell a reliable and comprehensive story about its financial performance. For instance, growing revenue, at a first glance, is usually considered to be a positive sign of a company’s financial health, but expenditures that outpace improving revenues can smudge the overall performance picture and will surely disappoint shareholders.

When it comes to the evaluation of a company’s financial health, net profit margin is one of the most important and powerful—yet simple—indicators to be taken into an arsenal of any group of investors in the mining and metals industry.

Net profit margin is equal to net income (or profit) divided by total revenue and represents how much profit each dollar of revenue generates.

Intuitively, net profit margin can be interpreted as an indicator of whether a company’s profitability is secure or not. Indeed, let’s consider a case where a company reported a USD$100 billion dollar in revenue but just a 3% net profit margin. While on paper this looks like the company is doing well, the low net profit margin means that this company is in a very vulnerable position; even an insignificant downward move in commodity prices, slightly lower ore grades, unfavourable exchange rates, or minor operational disruptions could push the previous year’s net profits into a net loss the following year. A high net profit margin provides a company with a solid buffer against even major negative events.

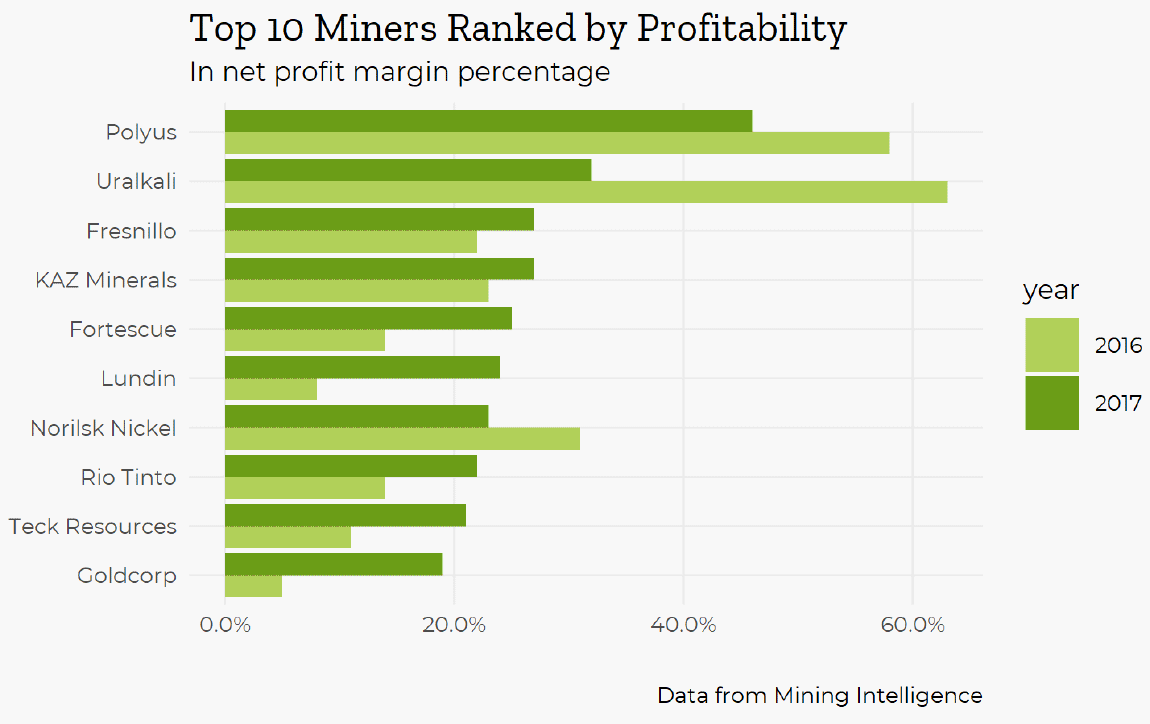

The following is the list of active mining companies compiled from data at Mining Intelligence that ranks by miners’ net profit margins yielded in 2017 and measured in percentages. Companies that generate a majority of their revenues outside of mining/mineral processing operations have been excluded from this ranking. The research focus was on net income earned from ongoing operating activities and not from one-time sources of “accounting” income such as debt restructuring and impairment reversals. The threshold net income level for companies considered for this analysis was set at USD$400 million.

Top 10 mining companies ranked by net profit margins in 2017 (%)

| Rank | Company | Sector | Net Profit, 2017, USD million | 2017 Net Profit Margin % | 2017 Net Profit Margin % |

| 1 | Polyus | Precious Metals | 1,241 | 46 | 58 |

| 2 | Uralkali | Potash | 875 | 32 | 63 |

| 3 | Fresnillo | Precious Metals | 561 | 27 | 22 |

| 4 | KAZ Minerals | Base Metals | 447 | 27 | 23 |

| 5 | Fortescue | Iron Ore | 2,004 | 25 | 14 |

| 6 | Lundin | Base Metals | 502 | 24 | 8 |

| 7 | Norilsk Nickel | Diversified | 2,129 | 23 | 31 |

| 8 | Rio Tinto | Diversified | 8,762 | 22 | 14 |

| 9 | Teck Resources | Diversified | 1,859 | 21 | 11 |

| 10 | Goldcorp | Precious Metals | 658 | 19 | 5 |

Data from Mining Intelligence

As can be seen, the top companies generating the highest net profit margins are from across the mining spectrum; from major gold producers such as Polyus and Goldcorp to potash behemoth Uralkali, and big diversified companies such as Rio Tinto and Teck Resources.

Common themes that contributed towards high net profit margins for these companies were expansions of mining operations, improved commodity market conditions, higher ore grades and higher metal recoveries, as well as successful implementation of portfolio optimization and cost reduction strategies.

Major contributors to decreased margins were losses on unfavourable currency exchange rates; production disruptions due to environmental, geopolitical and technical risks and challenges; lower ore grades; and negative price dynamics for a number of commodities.

What all the high net profit margin companies have in common is a decent margin of safety. This will help them weather even a significant storm on the mining markets and deliver competitive and secure shareholder returns in situations where other companies will struggle to survive.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Creative Commons image of robot miner courtesy of [White Bear].

The post Ranked: Mining companies that yielded highest profit margins in 2017 appeared first on MINING.com.

From:: Mining.com