Australia’s Lithium Power International (ASX:LPI) is moving forward with its plans to mine for lithium in Chile as it has submitted the environmental impact assessment (EIA) for its Maricunga project to the country’s environmental authority (Servicio de Evaluación Ambiental or SEA).

The company, which operates in the copper and lithium-rich South American nation through its 50%-owned Cerro Blanco firm, said Monday it expected final approval of the study by the end of 2019.

The Maricunga project has seen significant past exploration, with over $30 million expended to date.

Construction will begin as soon as it receives the permit to do so, which Lithium Power expects by as early as the first quarter of 2020.

The 11,400-page document is the culmination of more than two years of work that involved data gathering, a variety of environmental and engineering studies and monitoring campaigns carried out by experienced company management and consulting experts, the miner said.

It also included a process of social engagement with the Colla indigenous communities in the area, it noted.

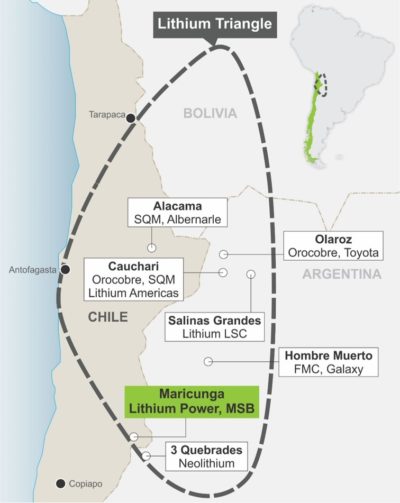

The little-known and remote Maricunga salt flat is far smaller than the vast Salar de Atacama (actually, less than 5 percent Atacama’s size), where top lithium producers US-based Albemarle and Chile’s SQM dominate.

But Lithium Power says the asset value is “outstanding,” which is expects to prove before the end of the year, when the definite feasibility study is finished.

Courtesy of Lithium Power International.

Bearing Lithium (TSX-V:BRZ), which holds a 17.7% interest in the brine project, goes even further, describing Maricunga as “the highest grade, undeveloped lithium salar in the Americas.”

The Australian junior says the deposit is second in grade only to the Salar de Atacama, which accounts for 100% of Chile’s lithium output and about 40% of global production.

The project has seen significant past exploration, with over $30 million expended to date.

World’s top copper producer Chile may have lost its crown as the No. 1 lithium producer to Australia (14,100 tonnes versus 18,700 tonnes in 2017), but the South American nation has the upper hand when it comes to reserves and cost of production.

According to the United States Geological Survey (USGS), Chile hosts an estimated 7.5 million tonnes — about 52% of the world’s known lithium reserves — compared to Australia’s 2.7 million tonnes of lithium reserves.

When it comes to production costs, Chile’s average per tonne comes in at $1,800, far below that of Australia where average lithium production costs are at $5,000 per tonne.

The nation owes its low production costs to the geological nature of its deposits and ideal climate. Unlike in Australia, where lithium is produced from hard-rock deposits, lithium is extracted in Chile from brine deposits with high lithium concentrations and high evaporation rates due to the intense sun and high altitude winds.

The country’s government expects lithium to soon become its second largest mining asset, just behind copper. It’s currently the country’s fourth biggest export.

The post Lithium Power closer to start mining for lithium at Chile’s Maricunga appeared first on MINING.com.

From:: Infomine