By Jody Chudley

This post SHOCKER: Buffett Bets On Asia… Confirms Our Trend appeared first on Daily Reckoning.

In early August, I wrote about how one of the best hedge fund managers of the past twenty years has put a staggering 40 percent of his fund into stocks in India.

That isn’t just a bold bet. That’s a “putting your career on the line bet,” which suggests an incredibly high level of conviction.

The hedge fund manager I’m talking about is Monish Pabrai. Since founding his fund in 2000, he has generated a cumulative return of 967 percent for his investors. That performance smashes the 168 percent that the S&P 500 has produced over the same time period.

After doing some sleuthing, I discovered that Pabrai is especially bullish the Indian finance sector, which is essentially still in its infancy and growing incredibly fast.

Pabrai’s huge conviction bet put the Indian finance sector on my radar.

Now, something else has happened that has even further increased my interest…

Warren Buffett Jumps On This Indian Opportunity

Just a few days ago, news broke that Warren Buffett’s Berkshire Hathaway had purchased a stake in Paytm, India’s largest digital payments company.

Like Pabrai, Buffett’s investment shows that he sees value in the Indian finance sector. The investment in Paytm is the first ever direct investment in India for Buffett’s Berkshire Hathaway.

As part of the deal, Berkshire’s investing lieutenant Todd Combs has joined the Paytm Board of Directors. That tells us that not only is this is going to be a long-term holding for Berkshire, but that we can expect Berkshire to increase the size of its investment over time.

Even more intriguing, Buffett’s Berkshire wasn’t the only mega-cap corporation investing in Indian e-commerce/finance in August. Walmart (WMT) closed a deal to acquire a 77 percent stake in Flipkart, India’s largest e-commerce platform, for a smooth $16 billion. That is a big commitment, even for Walmart.

The reason for all this interest is the growth that India has in front of it. Fuelled by the combination of rising incomes and a surge in the number of people using the internet, Indian e-commerce specifically is about to blast off like a rocket ship.

A study by PWC India estimates that the Indian e-commerce market is going to increase fourfold in just five years, from $36 billion in 2017 to $150 billion by 2022.1 Keep in mind, we get pretty excited here in North America with 3 percent GDP growth, but the Indian e-commerce industry is growing at an annualized clip of almost 35 percent!

No wonder Pabrai, Buffett and Walmart have all jumped on board.

Success in business is much easier when you are operating in an industry that has the wind at its back. Indian e-commerce and the Indian finance sector in general don’t just have a tailwind behind it, this is more like a category five hurricane!

This Is Your Passport To Invest In This Indian Opportunity

Fairfax India (FFXDF) is a publicly traded company that was formed specifically to take advantage of the opportunity that a rapidly growing India presents. The company was founded by Prem Watsa, who is often referred to as the “Canadian Warren Buffett.”

Watsa has led the Canadian reinsurance company, Fairfax Financial (FRFHF), to an incredible 33-year track record.

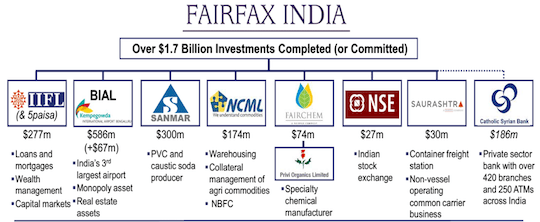

Today, Fairfax India has made investments in India that are approaching $2 billion. Those investments are focused on giving Fairfax controlling interests in the companies that it has taken a position in.

Thirty percent of those investments have direct exposure to the Indian finance sector that Pabrai and Buffett are so bullish about. The other investments include the third largest airport in India, a soda producer and an agriculture finance business.

What I love about this is that Watsa is a world class investor who is applying his skills to a much less efficient market. That is a recipe for success, and I believe it’s just the start of more good things to come.

Here’s to looking through the windshield,

Jody Chudley

Financial Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com

1India’s e-commerce market to grow fourfold to $150 billion by 2022 , LiveMint

The post SHOCKER: Buffett Bets On Asia… Confirms Our Trend appeared first on Daily Reckoning.

From:: Daily Reckoning