Source: Maurice Jackson for Streetwise Reports 07/10/2020

David Cole, CEO of EMX Royalty, sits down with Maurice Jackson of Proven and Probable to discuss the dynamic value proposition the royalty generator presents to the market.

Maurice Jackson: My guest today is David Cole, CEO of EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American).

Mr. Cole, as a very proud shareholder, let me be the first to say congratulations, as EMX Royalty recently rewarded shareholders with a nine-year high. What an accomplishment.

David Cole: Thank you. We have 6X’d the stock price in the last four and a half years. It’s good to see the market recognize the portfolio growth.

Maurice Jackson: Let’s discover what distinguishes EMX Royalty and why, for the second year in a row, I plan to match my bullion purchases with shares in the royalty generator. Mr. Cole, for someone new to EMX Royalty, please introduce the business model and the opportunity the company presents to the market.

David Cole: It’s always good to focus on the business model of EMX Royalty Corp. because it is different than our royalty company peers. The bulk of the royalties in our portfolio were generated using the royalty generation method, which is the prospect generation business model focused on the royalty component.

We acquire large tracks of prospective mineral rights around the world utilizing our geologic talent, add value by building up geologic models to illustrate the prospectiveness, sell those onto an industry that’s hungry for new discovery opportunities for a combination of cash, shares, work commitments, annual payments, and always a royalty on the back-end.

We’ve been doing this now successfully for 17 years. We’ve sold 46 projects, created 46 new royalties, just in the last two and a half years, as an example.

The one thing that I’m proud of about EMX is the deal flow that we have on the generative side, through that royalty generation methodology.

But we don’t stop there. We also buy royalties to augment that portfolio and the integration of generating royalties, utilizing our geological expertise, and having those same entrepreneurial geologists identify royalty acquisition opportunities is very powerful. Some of the key royalties we have in our portfolio we were able to acquire because we found out about it and because we had feet on the ground and ears to the railroad tracks.

The third thing that we do to round out our unique business approach is to make strategic investments, where that same team of entrepreneurs is identifying strategic investment opportunities. Our return on invested capital on our 17-year history is a 40% internal rate of return on invested capital. It’s fantastic. That’s helped maintain our treasury throughout our history, puts us in a situation today where we have nearly as much money in the bank as all the money we have raised in the history of the company, plus 150-some mineral property positions around the world.

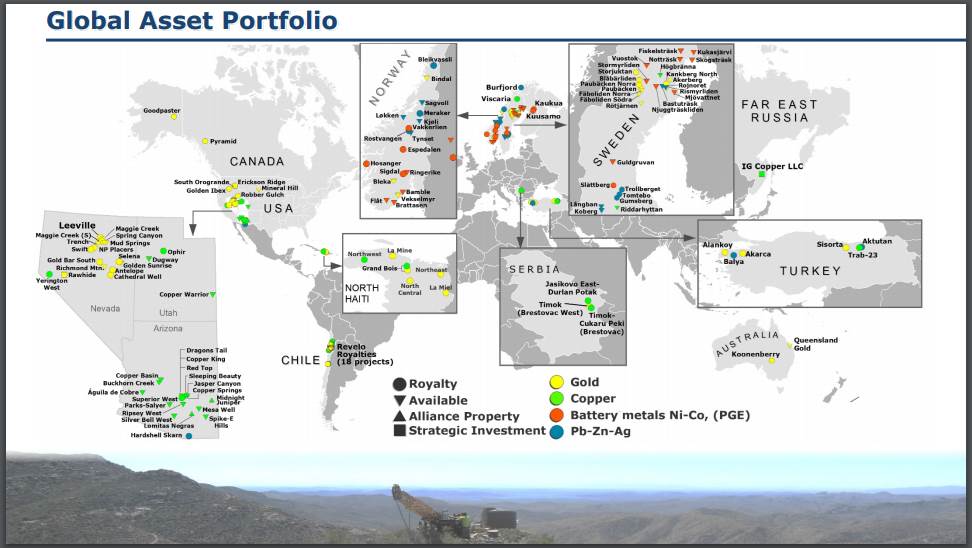

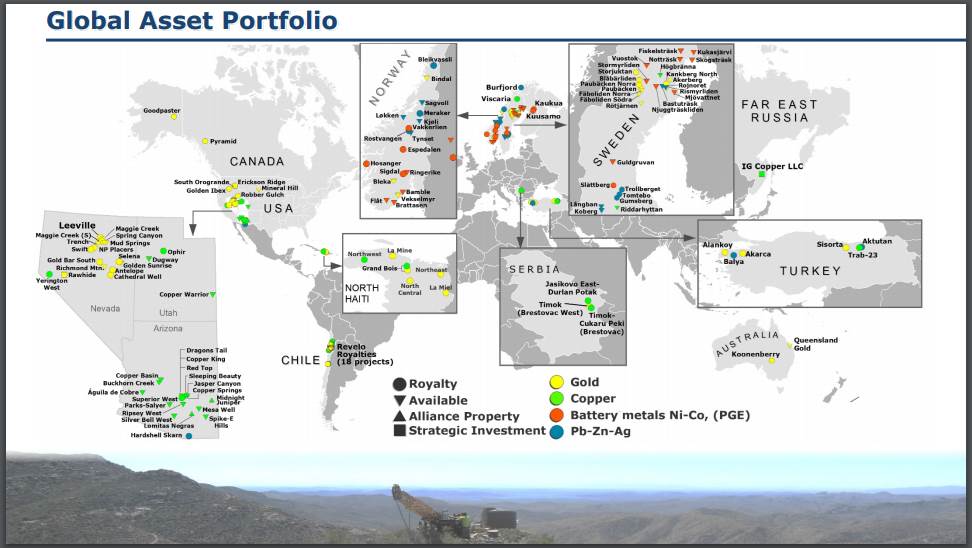

Maurice Jackson: One of the things that resonated with me in our last interview, you said that royalties are powerful financial instruments. They certainly are and we’re going to out exactly why here in today’s interview. EMX Royalty has a commanding global property bank () filled with generative projects that continue to demonstrate the company’s proof of concept and business and geological acumen.

Let’s visit some of your projects and find out the latest details that have shareholders excited, beginning in Turkey. Take us to the Balya lead-zinc-silver property and provide us with some background on the transaction. When does EMX Royalty expect to start seeing a sizable royalty payment from the property, and what kind of cash flow are you expecting?

David Cole: That’s a good question, Maurice. We’ve been in Turkey for a long time. We cycled through over 250 licenses in that country, executing our business model, and three mines are being built and constructed on our properties where we have royalties. The most important one is the Balya, as you are highlighting. That one goes into full-scale commercial production in late 2020, so another five months from now. It might go a little over into the first quarter of 2021, but it’s expected to ramp up into 2022 into full production. A 5,000-ton-per-day mill has been constructed, and we’re very excited about this.

We expect to see multiple millions of dollars per annum and cash flow up to 4.5%, depending upon throughput and lead-zinc-silver prices from this asset. This asset alone, which has organically grown through the royalty generation model, will be worth more money than all the money that I’ve spent in royalty generation in the history of the company. It speaks volumes to the astute allocation of capital and intellect that royalty generation is.

Maurice Jackson: If you like the numbers on the Balya, wait till you hear about the Timok copper-gold mine in Serbia. Ladies and gentlemen, this project is a monster. Mr. Cole, provide us with an overview of the Timok and what can shareholders expect to see regarding cash flow in the treasury here?

David Cole: The Timok is the monster in the portfolio, and you mentioned that royalties are phenomenal financial instruments. That’s because of their embedded optionality to the royalty holder that comes at no cost to the royalty holder.

We own a portfolio of royalties in the Timok Magmatic Complex in Serbia, which is Europe’s largest historical copper and gold-producing region and the site of one of the most significant copper and gold development stories on the planet, now being advanced by Zijin, a Chinese company, which has signed a memorandum of understanding with the Serbian government to invest $474 million to put into production the upper high-grade portion of a big deposit that they have found there.

We have a royalty that covers the upper zone as well as the lower zone. In the upper zone, according to the bankable feasibility study that was filed, we will see royalty income flow around $2.5 million per year at prevailing copper and gold prices. However, when they get into the lower zone, which is huge, Maurice, it’s a 1.7 billion-ton resource at 0.86% copper and 0.18 grams-per-ton gold and we have a one-half of 1% royalty on that. You can do the math.

It’s worth a whole lot of money, and that’s the company-making royalty in our portfolio. Not to speak poorly on any of the other royalty assets we have, but this one stands out as an absolute company-maker. We’re very pleased to have the exposure that those are both commodities that we like, and thanks to the most important part of royalty optionality, which is discovery, 12 drill rigs are turning on that property, continuing to delineate more resources to our benefit.

Maurice Jackson: Moving to the United States, take us to the Rawhide gold-silver mine, which is in the Walker Lane gold-silver belt of Nevada. What sort of annual cash flow are you expecting from that investment now and looking into the future?

David Cole: That’s an interesting one. This falls in the strategic investment camp, it’s not royalty. We bought those shares and we’re contributing to gain intellectually, as well as financially, to the success of this mining operation.

We own 19.9% of the private company that is in production, producing gold, currently producing about a hundred ounces of gold equivalent doré per day to double production with the permits that we have in hand to increase our crushing capacity there. We’re very bullish concerning cash flows. We do have a 43-101 report that is in progress and once that’s completed, then I can give specific details about our anticipated cash flow from the property.

But we do expect this investment to have a healthy internal rate of return. We bought that at $1,400 gold and modeled it at $1,400 gold, we mined that model in $1,350, it was a great investment. At $1,750, it’s an absolute cash cow. This will be another multimillion dollar-per-year dividend-paying asset that we have on our books.

Maurice Jackson: Moving up to Alaska, where EMX consummated a strategic investment a year ago that looks very promising in Millrock Resources on the 64North Project, what are the terms on the deal, and do you have any updates for our shareholders?

David Cole: That’s a really good deal. It’s a win-win. We think Millrock is doing a fabulous job. Greg Beischer is running a great ship there. They’ve got their hands on a tiger of a district. We’re very, very pleased with the work they’re doing. We’re happy that we were able to make a positive contribution.

The structure of the deal from EMX’s standpoint is that we invested money into share equity in Millrock and also purchased a block of royalties covering grounds in that district from them and put royalties onto projects that they had to help give them the money to be able to advance that forward, attract a good partner. Now they’ve got drill steel going in the ground and they’re hitting great geology.

Because of the move in the gold price augmentation in the capital markets on the natural resource side, as well as the very favorable geologic indicators that are coming out of the project, their shares have done very, very well. So by the time you factor in the increase in share value, those royalties have a negative cost basis to EMX. So we’re very, very, very pleased. We’re happy to have that optionality of owning the shares in Millrock in addition to 235,000 acre-percent, that’s our percent royalty times acres of which they are applied to, in the Goodpaster district around the Pogo mine.

Maurice Jackson: Speaking of another strategic investment, back in February, EMX Royalty made another remarkable transaction with Ensero Solutions. Can you walk us through, and what is this all about?

David Cole: This is another example of EMX thinking laterally and Ensero Solutions, if they’re anything, they’re just aqueous chemist geniuses. These guys have figured out methodologies for treating acid mine drainage incredibly well and inexpensively, making them very popular with people who are concerned about the environment. They also facilitate social license, and they have a track record of unlocking the mineral value of properties.

We help take them private. They were in a public company, Alexco, where they had an excellent beginning and a huge success story at the Keno Hill property in the Yukon. We provided the funds for them to go private, became a 7.5% equity holder in the company, and also have a preferred share that’s structured similar to a loan, where we put in $3.8 million, you get paid back $8.5 million over seven years, so it’s nice continued income flow immediately into EMX.

But the most important part of the whole deal is that we have a regional strategic alliance to find environmentally encumbered assets with high prospectivity to come in and solve the environmental problems and unlock the mineral potential. We see several different key assets in the West where we can accomplish this.

Maurice Jackson: Switching gears, let’s look at some numbers. Mr. Cole, please provide us with the current capital structure for EMX Royalty.

David Cole: it’s pretty simple and pretty good. We’re sitting here with plus US$45 million in cash, plus US$50 million in working capital and no debt.

Maurice Jackson: Speaking of the cash, what are your plans for that big pile of capital?

David Cole: So we’re going to continue to do what we’ve always done and that’s execute our three-pronged approach and we are continuing to fund our generative business, which is our bread and butter. That’s where the ideas come from for the strategic investments, and that’s where the opportunities come from to buy royalties.

Now, with more money in the bank, we can lever up our strategic investing and royalty purchasing, but not at the expense of our royalty generation business. That’s our core.

Maurice Jackson: Looking forward, multilayered question, what is the next unanswered question for EMX Royalty? When can we expect a response, and what determines success?

David Cole: Well, ultimately success is us continuing to ramp up the value of our portfolio, ramp up cash flow, and see the market recognize that and move our share price forward. I believe that our share price has lagged the growth of the portfolio in the recent past. We’re in the process of people starting to wake up and realize that, realize that we’re sitting on assets, such as the Timok project in Serbia, at the Leeville royalty in Nevada, operated now by Barrick where they’re finding a lot of gold. All these things cumulating up to a portfolio that is enhancing in value continually thanks to the positive optionality of these phenomenal financial instruments.

This is a buy-and-hold business model, and you’ve seen my insider trades, Maurice. You know I’ve been buying for seven years now.

Maurice Jackson: Yes.

David Cole: I haven’t sold shares of stock. I’ve been exercising my options holding them, been buying now at the open market. I accumulated roughly 200,000 shares during the COVID dip, as an example, and ultimately it’s going to be better market recognition of an enhanced value of our portfolio.

Maurice Jackson: Last question, sir. What did I forget to ask?

David Cole: Well, you’re always pretty good at covering things, Maurice, so let me think about that for a second. You always ask me that, so I should always have one on the sidelines.

Maurice Jackson: Well, how about this, has anyone told you that you look like David Letterman?

David Cole: I have heard that before. I had somebody come up to me on the streets of New York and just getting ready to ask me for an autograph and then I think they realized that I was probably a few years younger. But I need to come up with some good David Letterman lines.

Maurice Jackson: Well, one question I forgot to ask is, can you just share with us what is the prime objective of what you’re looking for, the minerals that you’re looking for in the global portfolio?

David Cole: We’ve always loved copper and gold, and we have a lot of geological expertise and our whole business premise starts with people. We have strategic advantage because of their intellect and their experience and then we build on that concerning the business model. We have a lot of geological expertise around the geological trench that hosts copper and gold deposits and a growing amount of expertise around polymetallic systems, volcanogenic massive sulfides.

We do believe that it behooves us to be exposed to copper-cobalt-nickel-PGEs, lead, zinc, other metals as well. So we’re happy to have a diversified portfolio focused on dominantly metal commodities.

Maurice Jackson: Mr. Cole, if someone wants to get more information on EMX Royalty, please share the website address.

David Cole: www.EMXroyalty.com.

Maurice Jackson: Mr. Cole, it’s always a pleasure, and I look forward to speaking to you in the very near future. Wishing you and EMX Royalty the absolute best, sir.

EMX Royalty trades on the (TSX.V: EMX | NYSE: EMX). EMX Royalty is a sponsor of Proven and Probable and we are proud shareholders for the virtues conveyed in today’s message.

Before you make your next bullion purchase, make sure you call me. I’m a licensed representative for Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio. From physical delivery, off-shore depositories, and precious metal IRAs. Call me at (855) 505-1900, or you may e-mail maurice@milesfranklin.com. Finally, please subscribe to Proven and Probable for mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: EMX Royalty and Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: EMX Royalty and Millrock Resources are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of EMX Royalty and Millrock Resources, companies mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: EMX:TSX.V; EMX:NYSE.American,

)