Source: Ron Struthers for Streetwise Reports 07/08/2020

Ron Struthers of the Struthers Resource Stock Report spotlights Golden Lake Exploration and its flagship, Jewel Ridge.

I wanted to see a solid breakout for gold above $1,800/ounce, but we have traded several days at new highs so I am convinced another breakout is underway. This is exactly like the trading action we had in January, where we eventually went through $1,600 up to $1,700. We are essentially trading at the 2011 highs. My next target is $2,000; that will continue the uptrend channel (ignores the March anomaly).

As I mentioned last month, to get maximum benefit from this new bull market, my plan is to buy a basket of quality juniors in good jurisdictions like Mexico, Canada, Australia and Nevada. And Nevada is a state that is a gold country in its own right. Consider this about Nevada:

- Gold is the state’s top overseas export by value, accounting for $4.9 billion, or 44%, of the state’s $11 billion of exports in 2018. A year earlier, gold accounted for more than half the total. The top destinations are Switzerland and India, where Nevada-mined gold is refined.

- The state produces more than 80% of the gold mined annually in the United States. If it were a separate country, Nevada would be the world’s fifth-largest producer, behind China, Australia, Russia and Canada.

- Over the past decade, gold production has averaged about 5.5 million ounces/year. The value of that production in 2018 was just over $7 billion, representing 84% of all mining production in the state.

I have come across another hidden gem in Nevada. This is a new company with a low number of shares out, top-notch management and a Nevada property with all kinds of gold but only drilled to shallow depths.

Golden Lake Exploration Inc. (GLM:CSE)

Recent price: $0.20/share

52-week trading range: $0.07–0.22

Shares outstanding: 27.8 million

Highlights:

- Very low market capitalization

- Top notch management and technical team

- Jewel Ridge project, a great location in Nevada

- Advance stage with over 300 historic drill holes

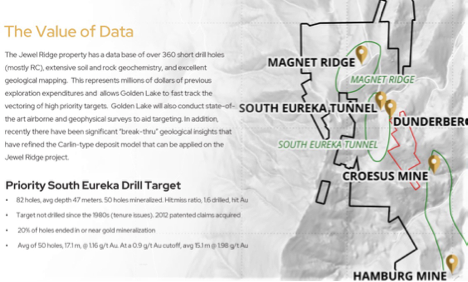

- South Eureka zone has not had much drilling since 1980s, with 50 shallow holes (average depth: 47.5 meters)

- Historic holes returned an average thickness of 17.1 meters (17.1m) assaying 1.16 g/t gold

Management (sourced from the company website)

Michael B. England, CEO and president, is an astute team builder and has been involved in the public markets since 1983. Since 1995, Mr. England has been directly involved with public companies in various roles, including investor relations, directorships and senior officer positions. To date, Mr. England has been directly responsible for raising in excess of $60 million for mineral exploration and acquisitions.

Vic Bradley, chairman, has more than 50 years’ experience in the mining industry, including more than 15 years with Cominco Ltd. and McIntyre Mines Ltd. in a wide variety of senior financial positions from Controller to COO. Over the past 30 years Vic has founded, financed and operated several mining and advanced-stage exploration and development companies, including the original Yamana Gold Inc., Aura Minerals Inc. and Nevoro Inc. (sold to Starfield Resources). Vic founded the original Yamana in early 1994, and served as president and CEO and then chairman of the board and lead director until 2008. He served as chairman of Osisko Mining Corp. from November 2006 up to its sale for $4.1 billion to Agnico Eagle and Yamana in June 2014. He served as a director of Osisko Gold Royalties Ltd. (spun out of the Osisko Mining sale) from June 2014 to May 2018 and as chairman of Nevada Copper Corp. from February 2012 to February 2017. He now serves as chairman of Osisko Bermuda Ltd., Osisko Gold Royalties’ offshore subsidiary that controls all of its assets outside of North America.

Robert Weicker, chief geologist, is an associate of Ross Beatty and has extensive mining experience, including a five-year stint at the famous Hemlo mine and including the role of chief geologist at the Williams Mine. Bob also has extensive exploration experience in the Hemlo, Thunder Bay area, and Abitibi greenstone belts, for gold and VMS (volcanogenic massive sulfide) deposits. In the U.S., Bob was with Equinox Resources Ltd. (taken over by Hecla Mining Co.) and involved with the exploration, permitting and underground development of the Rosebud gold deposit in Nevada, which was successful mined by Hecla and Newmont.

Peter Mah, director, is a mining engineer with 30 years of global mining industry experience. He is currently the COO of McEwen Mining Inc. Mr. Mah’s past positions include president of Avanti Kitsault Mines Ltd., chief operating officer (COO) of Alloycorp Mining Inc., COO and executive vice president (VP) of Luna Gold Corp., and group executive, Newmont Mining Corp. At Newmont, he led the early-stage exploration study teams defining over 15 million ounces (15 Moz) of gold resources for development in Canada, Nevada, Ghana and Peru. Most notable were the Leeville underground mine expansion in Nevada and the new Subika underground mine in Ghana.

Giulio Bonifacio, director, has over 30 years of experience in senior executive roles in the mining industry, many associated with Ian Telfor. Mr. Bonifacio is the founder and former director, president & CEO of Nevada Copper Corp., since its inception in 2005 until his retirement in February 2018. Among his many accomplishments, Mr. Bonifacio has raised directly over $700 million through equity and project debt financings for projects of merit as well as been involved in corporate transactions aggregating in excess of a billion dollars. Mr. Bonifacio has held previous senior executive roles with Getty Resources Ltd., TOTAL Energold Corp. (an energy and gold producer) as well as with Vengold Inc. (a gold producer) prior to founding Nevada Copper in 2005. Mr. Bonifacio is currently chairman and director of CopperBank Resources; CEO and director of Kerr Mines and independent director of Candente Copper Corp.

Richard Reid, technical advisor, is a senior geologist with over 39 years in the mining business, working for major mining companies, with a focus throughout Nevada. His roles with Newmont Mining Corp., now Newmont Goldcorp Corp., the largest producer of gold in the world, included Nevada District exploration manager, exploration business development manager and chief geologist for North America.

Projects—Jewel Ridge, Nevada

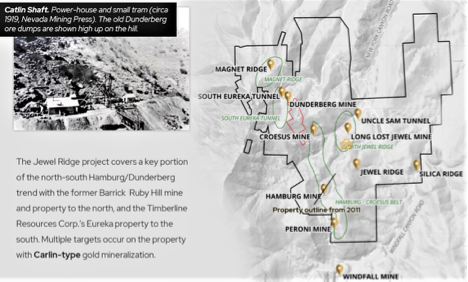

Jewel Ridge is located on the south end of Nevada’s prolific Battle Mountain–Eureka trend, strategically along strike and contiguous to the former Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) two-million-gold-ounce Archimedes/Ruby Hill mine to the north and Timberline Resources Corp.’s (TLR:NYSE.MKT) advanced-stage Lookout Mountain project to the south. The property claims cover approximately 728 hectares (1,800 acres). There is year-around road access to the property and it is 3.2 kilometers (3.2 km) south of Eureka.

The Jewel Ridge property contains several historic small gold mines that align along a north-south-trending stratigraphic contact of lower Paleozoic sedimentary rocks, as well as several other gold-mineralized zones with a variety of structural and lithological controls.

Historical drilling

The Jewel Ridge Project has been drilled by General Mineral Development LLC, Homestake Mining Co., Tenneco Minerals, Norse-Windfall Ventures, Rainbow Resources and Greencastle Resources (VGN:TSX.V). A total of 89,484 feet (89,484 ft) in 315 reverse circulation or rotary drill holes have been completed at Jewel Ridge. Most of the drilling was done in the 1980s and drill hole locations are approximate, but it is excellent information to guide exploration.

The most recent drilling included Greencastle, which completed three drilling campaigns after acquiring the property. In 2004 the drilling program totaled 11,210 feet in 22 reverse circulation holes. The best intercept was in HRC-11, 135 ft @ 2.1 g/t Au beginning at 310 ft depth, in bleached, decalcified Hamburg dolomite. It is encouraging that this was one of the few deeper holes and had very good results.

In 2006–2007 the drilling program totaled 8,860 feet in 18 reverse circulation holes, testing the Magnet Ridge, North Jewel Ridge, Silica Ridge and Hamburg-Croesus targets. The best intercept is 45 ft @ 0.950 g/t Au in hole GR-07-15. Intercepts in 2012 by Rainbow Resources (lessee) in its drilling program were DH12-5, with 35 ft @0.91 g/t Au; DH12-6 with 15 ft @1.95 g/t Au; and DH12-4 with 5 ft @1.67 g/t Au.

The South Eureka is the first priority drill target. It has 82 historic drill holes and 50 hit mineralization. The last drilling on this target was in the late 1980s and has not been drilled/explored since because tenure issues with the claims, which was resolved in 2012 with the purchase of 13 patented claims. This will be the first time in decades that this priority target will see modern exploration techniques and deeper drilling.

Financials

Last financials, as of Feb. 29, 2020, show $291,936 cash and no debt. Since then GLM closed a non-brokered private placement. The company issued 8,166,667 common share units at a price of $0.15 per unit for aggregate gross proceeds of $1,225,000. The shares and warrants comprising the units are subject to a four-month hold period expiring Oct. 10, 2020.

Conclusion

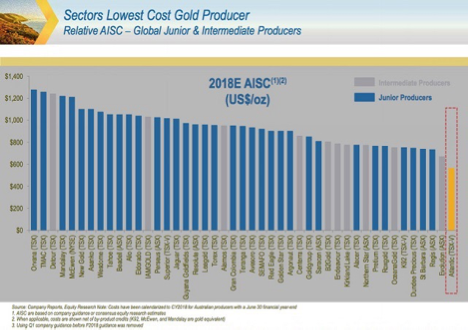

The average gold grade at the South Eureka target in 50 historic drill holes is 1.16 g/t Au. This is a very good grade for an oxide, heap-leach, open pit mine in Nevada, and indications are this gold is near surface. For example, Atlantic Gold was among the lowest cost producers in the world with their open pit Moose River mine in Nova Scotia. It was bought out by an Australian company, St Barbara Ltd.

Based on this comparison chart of 2018 costs, it highlights Atlantic Gold’s very low costs. As of March 25, 2019, the Atlantic Gold operation had a combined estimated 1.9 million ounces of gold in reserves at a grade of 1.12 grams per tonne. For full details, refer to the compliance documents at stbarbara.com.au/exploration/.

A recent new and low-grade gold mine that is providing strong cash flow is Victoria Gold Corp.’s (VGCX:TSX; VITFF:OTCMKTS) Eagle mine in the Yukon, grading 0.65 g/t Proven and Probable reserves. They just declared commercial production on July 1, and the mine is projected to have AISC of US$774 per ounce gold. Costs are higher in the Yukon compared to Nevada.

An example of a low-cost, high-margin Nevada producer is the Marigold Mine. Owned by SSR Mining Inc. (SSRM:NASDAQ; SSRM:TSX), Marigold stands out for its ultra-low grades of 0.46 g/t. In production since 1989, Marigold is a large run-of-mine operation. After blasting the ore, it doesn’t need to be crushed or ground and can go directly onto the leach pad, which significantly reduces costs.

The famous deposits in Nevada contain microscopic gold but it is found in almost every rock. The gold is low grade (under one gram per tonne) but plentiful. Between 1835 and 2008 a whopping 152 million ounces were pulled from the Carlin Trend and other gold trends in Nevada, including Cortez and Walker Lane, mostly through open-pit mining.

At GLM’s Jewel Ridge, the average historic grades would make for a robust mine if a large enough quantity of gold can be proven. This is historic data so we have to assume some risk with these numbers, but there is room for a margin of error. Deeper drilling might find higher grades as well; only time will tell. The key point is that this data represents $millions in exploration expenditures and provides a headstart on GLM’s exploration, as well as de-risking the project. The gold is there. GLM only needs to find enough to make a deposit.

On June 26 Golden Lake reported that its geological team has confirmed previous reported results on the Radio Tower target (source: press release May 14, 2020) and also has sampled a new mineralized zone designated as the A&E target (historic results up to 29.49 grams per tonne gold, 333.0 g/t silver):

Radio Tower target: Sampling by company personnel of dumps from adits, shafts, old trenches and outcrop have returned a median (based on gold values) of seven samples of 1.93 grams gold per tonne Au (g/t), 44.8 g/t silver (Ag), and 0.04% copper, 0.72% lead (Pb) and 1.18% zinc (Zn).

A & E target: Based on a compilation of the recently acquired historic third-party rock-chip database and geological reconnaissance by company personnel, another prospective target has been identified. Highlights include values up to 29.49 g/t Au, 333.0 g/t Ag, 1.35% Cu, 4.00% Pb and 9.53% Zn. The median (based on gold values) of nine samples on the two patented claims is 2.30 g/t Au, 47.4 g/t Ag, 0.18% Cu, 0.20% Pb and 0.62% Zn.

The A & E target has no known drill holes, but the area has been recently visited by company personnel to determine the logistics of accessing the area during the company’s forthcoming RC (reverse circulation) drill program, planned for July 2020. Samples comprise grab rock samples from dumps of old mine workings and rock outcrop exposures. Grab rock samples are not representative of the grade of mineralization of an occurrence, but are useful in determining prospectivity, and geological features.

As mentioned in the June 26 press release, drilling is expected to start this month, so I would suggest getting position as soon as possible.

You can see on the chart that the stock has been trading less than a year and volume just started picking up in April. The stock has recovered from the March panic selloff, but has yet to break resistance around $0.19. It looks like it was going to but the attempt failed. This pullback provides a good entry price closer to the bottom of the uptrend channel.

Ron Struthers founded Struthers’ Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 – $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Golden Lake Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Golden Lake Exploration is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

( Companies Mentioned: GLM:CSE,

)