Source: Bob Moriarty for Streetwise Reports 06/21/2018

Bob Moriarty of 321 Gold calculates what South32’s acquisition offer for Arizona Mining means to the value of another company with a similar resource.

On June 17th, 2018 an Australian company named South32 Ltd. (S32:ASX) agreed to buy the remaining 83% of shares in Arizona Mining Inc. (AZ:TSX) in a deal that values all of Arizona Mining at $2.1 billion Canadian pesos. The fully funded price is an all cash offer.

When they read about the proposed takeover, the management of ZincX Resources Corp. (ZNX:TSX.V) all smiled. Now they know what an all cash offer would look like for their similar lead/zinc/silver project.

Most times it becomes difficult to measure one company against another since there are so many variables. In a comparison of ZincX to Arizona Mining, it’s actually fairly easy because their published 43-101 resources are so similar in nature.

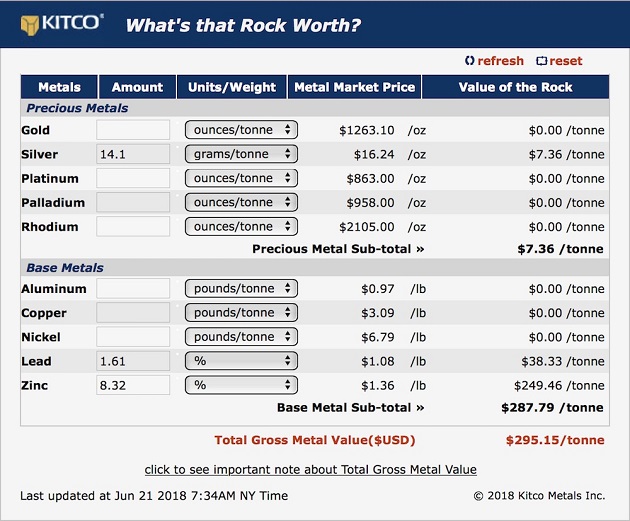

In the indicated 43-101 resource for Cardiac Creek of ZincX published in November of 2017, ZincX showed 22.7 million tons with a metal in the ground value of $295.15 per ton for a total of about $6.7 billion USD.

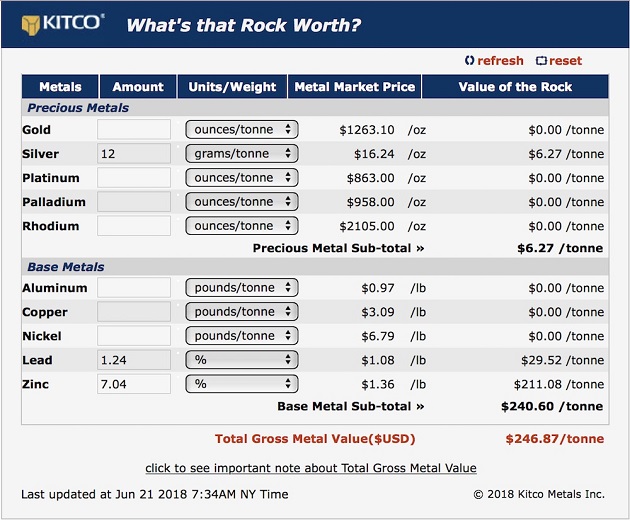

The same table for the 43-101 resource in the inferred category for the Cardiac Creek deposit shows just over 7.5 million tons with a metal in the ground value of $246.87 and a total of about $1.86 billion USD.

For Arizona Mining in the M&I category their most current 43-101 from January of this year shows 100,958,000 tons with a metal in the ground value of $257.65.

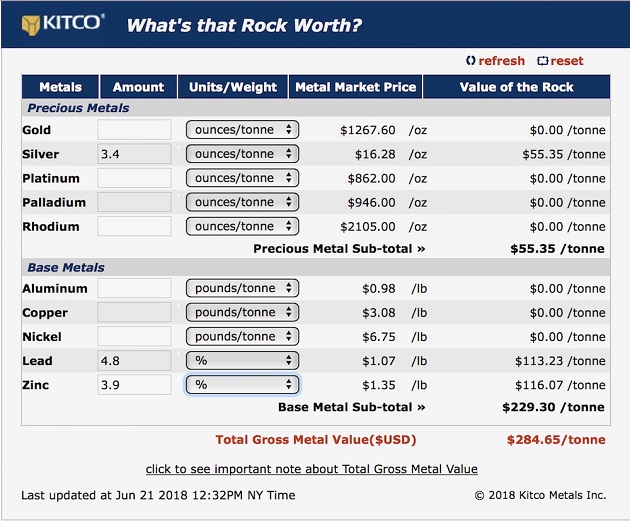

In the inferred category the same 43-101 reported 43,069,000 tons with an in the ground value of $284.65 per ton.

Those numbers were easy to compare because they are measuring similar type metal deposits. The Indicated resource for ZincX is about 20% higher than the M&I resource for Arizona Mining. The Inferred 43-101 resource for Cardiac Creek of ZincX is about 20% lower than the Inferred numbers for the Taylor Deposit of Arizona Mining.

If you work out the numbers roughly given that we are working with tons and the USD values, for the Taylor Deposit of Arizona Mining we get a total in the ground value of just over $38 billion. Of course that isn’t their only project, they also post numbers for what they call the Central Deposit but here you have a problem of mixing apples and oranges. With almost 70 million tons of rock, the Central Deposit has great value but it’s really a manganese deposit with some zinc and silver added in. In any case, I worked up rough numbers and figured that the Central Deposit has an additional $30 billion worth of rock in the ground.

So for Arizona Mining we have a total of about $68 billion USD in an in the ground rough value and a total purchase price by South32 of $2.1 billion Canadian. Which is about $1.575 billion USD. So South32 is paying 2.31% of the rough metal in the ground value for Arizona Mining.

As I write, ZincX shares are selling for $0.35 CAD. That gives the company a market cap right now of $58.2 million CAD or $43.9 million USD. If South32 paid the right price for Arizona Mining (and it’s all in cash) and they paid 2.31% of the metal in the ground value, it’s a simple math problem to say that ZincX with a similar silver/lead/zinc project should be worth 2.31% of $8.56 billion USD or $197 million USD or $262 million CAD.

That makes ZincX very cheap. Cardiac Creek is 100% owned. Arizona Mining uses a figure of 3% for an average NSR. ZincX has no NSR. There are a whole bunch of differences between the two companies all of which are more favorable to ZincX.

ZincX just released a PEA on June 20th giving very interesting numbers. Shares in ZincX are up almost 50% in a week since the South32/Arizona Mining announcement. I think they are going to go a lot higher. I’m not the only person doing the math.

ZincX is an advertiser and naturally I am biased. Do your own due diligence. I have bought shares in the open market.

ZincX Resources

ZNX-V $0.35 (Jun 20, 2018)

CZXMF-OTCBB 167.2 million shares

ZincX Resources website.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: ZincX Resources. ZincX Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or …read more

From:: The Gold Report