By Zach Scheidt

This post Buy This “Trade War-Proof” ETF appeared first on Daily Reckoning.

Yesterday morning, I woke up to a handful of frenzied news alerts on my iPhone.

The headlines pointed to the “plummeting” markets, thanks to the latest round of trade war threats between the Trump administration and China.

“Oh brother, here we go again,” I mumbled as I turned on the news channel. The pre-market futures were pointing to a 400 point drop in the Dow to start the day.

You may have had a similar experience. It’s not exactly the way we like to start our days as investors.

But as bad as the media made the news sound, I knew that things weren’t going to be as dismal as they painted the situation out to be. Especially for a select group of investments that essentially “don’t care” about the trade disputes in the headlines right now.

Today, I want to show you how this specific group can help you sidestep the trade war risk, while at the same time adding valuable growth to your hard-earned nest egg…

Turbo-Charged Growth With Minimal Trade War Risk

In today’s market, it’s important to pay attention to what’s actually happening, instead of getting distracted by dozens of different opinions on what could happen.

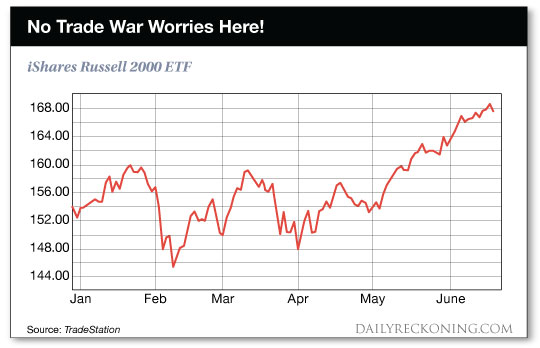

For instance, take a look at the chart below. I clipped this chart from my trading platform midway through the carnage of yesterday’s “plummeting” market meltdown (sarcasm intended).

This chart is for the iShares Russell 2000 ETF (IWM), a fund that trades in-line with the Russell 2000 small cap index. You can buy shares of IWM in your brokerage account just like any other stock or ETF.

Let me ask you a quick question…

Does this look like a market that is concerned about a trade war with China?

Does it look like investors in this market are concerned about anything?

The fact is, despite all of the media attention given to Trump, new tariffs, and retaliatory measures from different countries, the stocks in this index just keep moving higher!

How could that be?

If You’re Doing Business in America, You’re Safe

The special thing about the Russell 2000 small cap index is that it is made up of smaller companies that are primarily doing business inside the United States.

That’s important in a time when investors are worried about uncertainty in international markets.

Here in the U.S., things are actually very good!

We’re creating hundreds of thousands of new jobs each month. Companies are growing profits, and passing some of those gains on to workers in the form of raises and bonuses.

Technology is improving our lives. It’s also helping to make manufacturing and even services cheaper. That means we can do more with the money we have. And it means Americans have more discretionary spending money to do with as they please.

It’s important to keep this strength in mind, because this is what’s actually happening in our country. And that’s a very different story from what you’ll hear on the nightly news.

Also, remember that small cap companies are the ones with the best growth potential. Because small companies haven’t come anywhere close to saturating the markets they do business in. Instead, they have room to grow, and typically have smaller teams that are highly motivated to make their company succeed.

So it makes sense that today the Russell 2000 small cap index is not only one of the safest places that you can invest (thanks to relative immunity to trade war tensions), but also one of the best places for you to grow your wealth.

That’s why today, I recommend investing some of your capital in shares of IWM.

And if you’re into picking out specific stocks for your portfolio, you can find a helpful list of all the companies that are included in the Russell 2000 index here.

Don’t let the fear of a trade war keep you from protecting and growing your wealth. Our domestic economy is just too strong for you to be on the sidelines missing out.

Here’s to growing and protecting your wealth!

Zach Scheidt

Editor, The Daily Edge

Twitter ❘ Facebook ❘ Email

The post Buy This “Trade War-Proof” ETF appeared first on Daily Reckoning.

From:: Daily Reckoning