By Dudley Baker

info@preciousmetalswarrants.com

The resource markets have been on fire lately and we are excited about where this will lead us in the coming months.

But not now!!

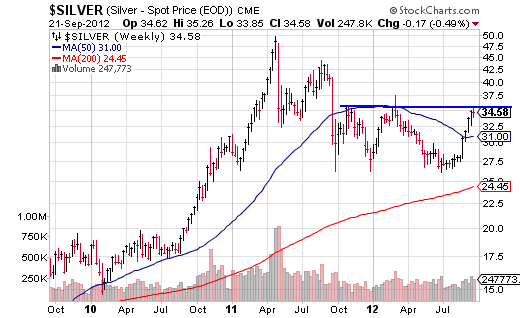

Even though on Friday, our #1 position (a silver company) and #2 position (a gold company) hit highs for multiple years, we must remain cautious.

Why? you ask.

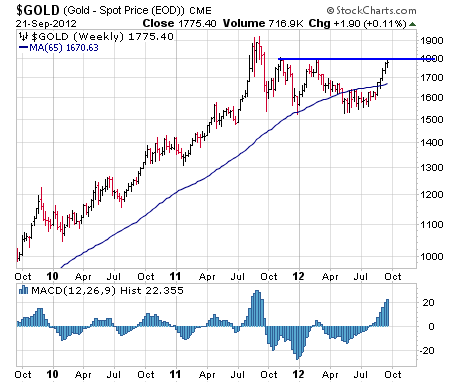

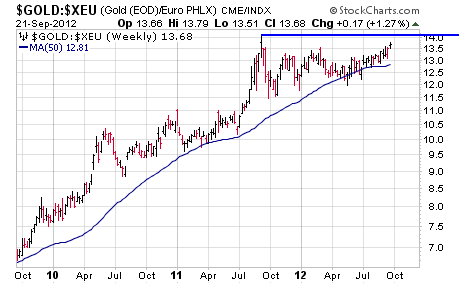

The markets are bucking serious overhead resistance as we show you in the gold charts and the silver chart below. It is so easy to get carried away with the excitement of the day but let’s stay rational and if you have some cash reserves, hold off deploying it at least for a few weeks. We will try and let you know as best we can the opportune time.

Our dates for the next projected peak have never changed for a few years now as we continue to look for as early as July 2013 out to our preferred target of Jan/Feb 2014.

I have preached patience many times to our followers. Patience as the markets were previously consolidating and searching for a bottom. Now we must use patience again as the markets approach serious overhead resistance so as not to chase higher prices.

Sure, this is easier said than done, but we want our subscribers and followers to be positioned with the lowest reasonable entry prices possible.

Those investors entering the markets later on will have no choice but to pay higher and higher prices as the markets zoom ahead. But those of you reading now do have a choice.

Our advice would be to hold your positions and look for buying opportunities over the next few weeks. If you have some large gains there is no reason why you should not take some profits by selling or scaling back your positions.

Now let’s look at those charts:

As you can clearly see, gold and gold in euros are bumping up against strong overhead resistance which will probably take some time to breach. Silver, while strong also needs to take a break. Gold could easily drop back to the 65 week moving average currently at $1,671.

As you can clearly see, gold and gold in euros are bumping up against strong overhead resistance which will probably take some time to breach. Silver, while strong also needs to take a break. Gold could easily drop back to the 65 week moving average currently at $1,671.

With rare exceptions, we believe it will prove wise to watch for a while from the sidelines and wait for some short term consolidations.