This post Take Your Pick: $10,000 or $57,435? appeared first on Daily Reckoning.

Looking to get rich quick?

Well, today’s roadmap isn’t going to help.

But if you’re looking to get rich MORE QUICKLY … then I have a very simple way for you to do that.

It begins with dividend-paying stocks.

When you pick the right dividend stocks, you set yourself up for dependable income no matter what happens next in the markets or even with the underlying investment’s price itself.

That’s the very cornerstone of steadily rising wealth.

Of course, good dividend stocks are just the beginning.

If you really want to see your future income skyrocket, you also need to consider Dividend Reinvestment Plans (DRIPs).

Normally, when you hold a dividend-paying stock, the company sends you checks or deposits the dividends directly into your bank account.

But with DRIPs, you can use those dividends to buy additional shares directly from the company on the dividend payment date.

Generally, the purchases are commission free.

You often get a discount to the current market price.

And some DRIPs even allow you to purchase extra shares under the same terms.

The company benefits as well, especially since shareholders who participate in DRIPs are more likely to be long-term investors.

More than 5,000 stocks have their own DRIPs available.

You can find a lot of information on individual plans here and here.

If your stocks are held at a brokerage, many firms will also let you buy shares (or fractional shares) with your dividends … whether the company itself has a DRIP plan or not.

Some brokers will even allow you to reinvest dividends paid by mutual funds and ETFs!

One of the great aspects of reinvesting your dividends is that you can accumulate more and more shares over time.

If the market ever starts sliding and your stock’s price drops, your dividends will actually buy MORE shares during those times.

That alone can increase your chance for bigger long-term gains down the line.

And the power of compounding is what really makes dividend reinvestment so powerful.

Compounding is that snowball effect of your earnings generating even more future earnings.

As a famous quote, which is widely-attributed to Albert Einstein, reminds us …

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

It’s true, no matter who actually said it.

In the case of dividend reinvestment, your reinvested dividends are buying more shares.

Then, those shares are producing more dividends, which buy even more shares in the future. The cycle repeats and the numbers keep getting bigger.

Here’s a hypothetical example …

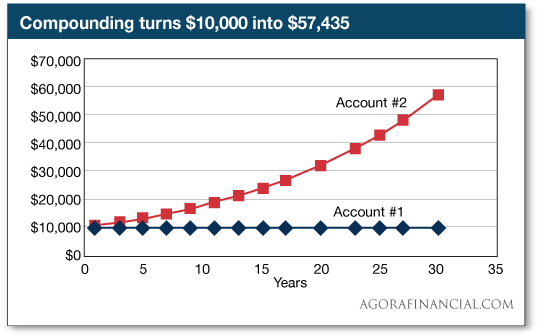

Suppose you start with two separate $10,000 accounts. Both hold the same investments and earn 6%, or $600, a year.

Your plan is to withdraw the earnings from account #1 each year while reinvesting account #2’s earnings.

You can see in the chart below that as you withdraw the earnings from account #1, its value stays at $10,000.

However, in account #2 where the earnings are reinvested, the power of compounding becomes evident …

In 10 years, account …read more

Source:: Daily Reckoning feed

The post Take Your Pick: $10,000 or $57,435? appeared first on Junior Mining Analyst.