This post Why Copper is the Best Metals Trade Right Now appeared first on Daily Reckoning.

Gold is waking up.

After cratering from more than $1,350 to a low of $1,270 in just four weeks, gold futures finally bounced this month. The fourth quarter has been kind to the metal so far as it briefly pushed back above $1,300 to start the trading week. The Midas metal is giving back some of those gains early this morning. It’s down about $12 so far today…

But gold’s not the metal that’s catching my eye this week.

Right now, I’m all about industrial metals.

A global economic recovery is starting to lift metals from their lows. Steel, nickel, aluminum and iron ore have all perked up recently. Palladium— an important component in catalytic converters— is streaking above $1,000 this week for the first time in 16 years.

One of the big catalysts behind the rally we’re seeing in industrial metals is strong data out of resource-hungry China.

China brought in more than 100 million tons of iron ore last month, Investor’s Business Daily notes. That’s 16% more than the country imported in August. Demand is much stronger than analysts anticipated. Copper imports also continue to surge.

Trumponomics are also helping metals catch a bid. The White House is now “requiring the use of North American-made steel, aluminum, copper and plastic resins in cars and trucks sold under North American Free Trade Agreement rules, as it seeks to give U.S. industry a boost,” Reuters reports.

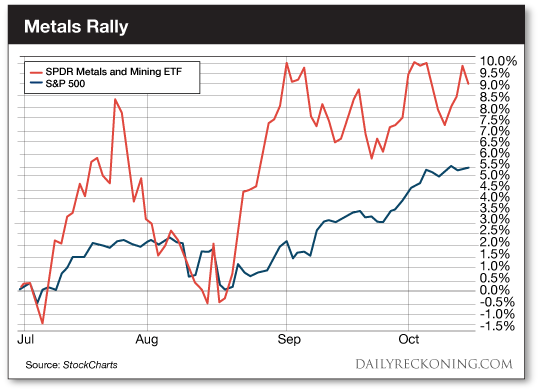

The results speak for themselves. It’s been a bumpy ride, but the metals and mining sector is finding new life during the second half of 2017. Since the beginning of the third quarter, these stocks are outperforming the S&P 500 by a significant margin.

The SPDR S&P Metals and Mining ETF is up more than 9% since July 1st. Meanwhile, the S&P 500 is up just shy of 5.5%.

Then there’s copper. The metal posted new 2017 highs yesterday, extending its breakout. It’s now sitting on year-to-date gains of almost 30%.

Back over the summer, we told you copper’s bounce off its summer lows was legit. Now it’s extending its comeback move.

You’ll recall that copper died a slow death after topping out in 2011. A nasty six-year bear market sliced its spot price in half. But as we revealed earlier this year, Copper’s prospects have changed dramatically. The post-election rally back in November was the spark that helped copper snap its nasty downtrend. After seven months of choppy consolidation, copper jumped back near its March highs by the summer, signaling to us that it was ready to make a play at a huge breakout.

Now Dr. Copper is back on the move – and we’ve already reserved our seats on the bandwagon. I don’t know if copper is just getting started on another decade-long bull run or if it’s just enjoying a short-term rally. Either way, we’re willing to ride the new trend to gains.

You had a shot to grab onto shares of Freeport-McMoRan Inc. (NYSE: FCX) …read more

Source:: Daily Reckoning feed

The post Why Copper is the Best Metals Trade Right Now appeared first on Junior Mining Analyst.