Source: The Critical Investor for Streetwise Reports 10/13/2017

The Critical Investor provides an update on Fiore Gold, which has just resumed trading after completing a business combination with GRP Minerals.

Pan Mine, Nevada

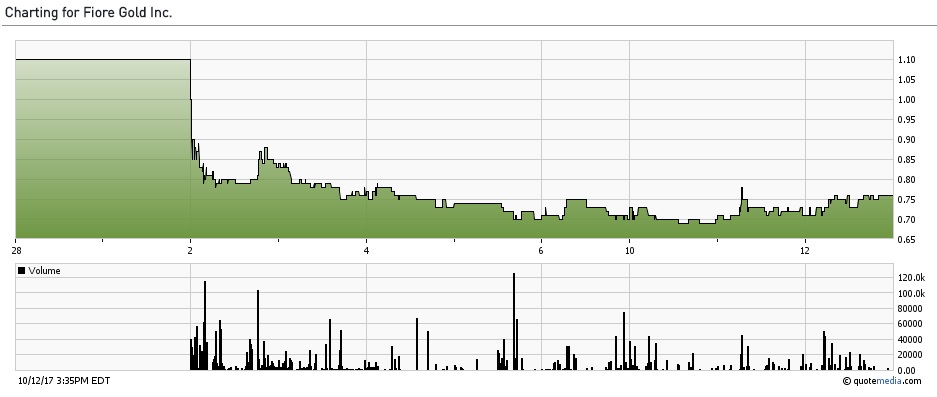

After a lengthy trading halt since June 12, Fiore Gold started trading on October 2, having completed the business combination with GRP Minerals. This took quite a bit of time, as it was a fairly complex venture for both companies, with a lot of paperwork. I view this deal as an accretive one, as a lot of tangible value through much more advanced assets was added, up to an estimated Net Asset Value of about C$120 million in my view, and a lot of realistic growth potential. Apparently, not everybody had the same long-term view for Fiore Gold as is needed in this case, the company now morphing into a long-term growth production story instead of an exploration story, and a sell-off started immediately after opening of the markets:

Share price; 10 day time frame

My suspicion is that there were some shareholders from both sides of the deal selling their shares, as the initial story changed significantly for both companies, possibly appealing to different kinds of investors, although the volume wasn’t really massive on the first day comparing to the last few days as the share price bottomed at C$0.70. As the share price closed at C$0.76 yesterday on healthy volume, it seems that the worst is behind us now. As I have calculated in an earlier article, I don’t think this selling is very much justified. According to my estimates, the Net Asset Value (NAV) comes in at around C$120 million, as there are:

- the current exploration assets, of which I estimate El Peñon at C$1M and Cerro Tostado at C$4M

- about C$25M in cash, zero debt

- the Pan Mine with a C$65M NPV and ramping up production

- the Gold Rock historical deposit and the exploration potential of both Pan and Gold Rock combined at C$20M

- Golden Eagle at C$5M, bringing the total NAV at C$120M.

The current market cap comes in at C$69.2M, so as the usual market cap to NAV ratio comes in at a very global 1.0-1.5, this would already indicate undervaluation. The valuation of a producer is usually much better represented by the market cap to operational cash flow ratio (which varies from about 8 to 12 in good jurisdictions at current gold prices/sentiment), so when looking at this metric we get confirmation for more upside when the Pan Mine is fully ramped up to commercial production next year.

The annual pro forma cash flow for Fiore Gold is calculated like this for a $1215/oz Au base case scenario: 40,000oz Au in 2018 x $1215- $685 = EBITDA US$21.2M – US$4.5M estimated depreciation etc – US$2.7M G&A = US$14M net income. Corporate taxes are about US$2M annually on average per the Feasibility Study. Operational CF is EBITDA – G&A – taxes = US$9.3M = C$11.625M. This does not take expensed exploration activities, currency fluctuations and changes in working capital into consideration. The corresponding estimated market cap would range from C$11.625 x 8 = C$93M to C$11.625 x 15 = C$174.4M, with a still conservative ratio of 10 resulting in an estimated market cap of C$116.25M, which would mean close to a double in a year from now.

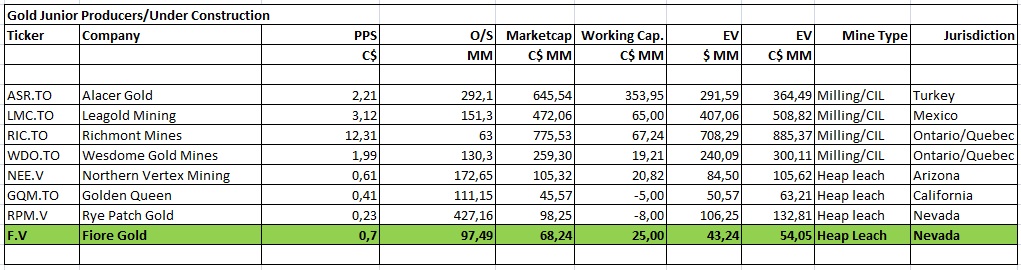

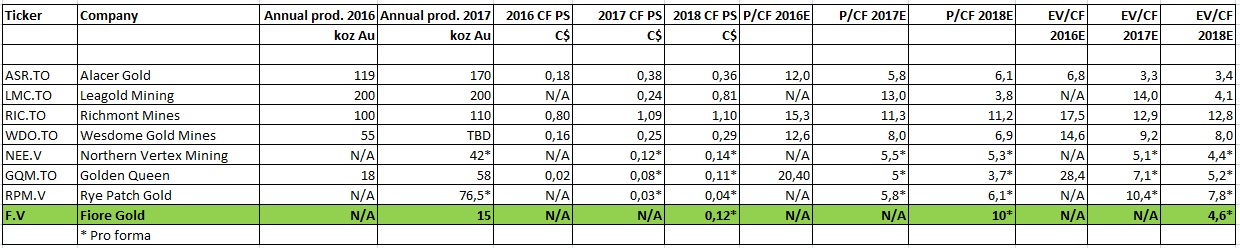

When Fiore Gold is compared to a few other junior gold producers (some data coming from Haywood’s weekly update the Weekly Dig) it can be seen that Fiore Gold is pro forma (as a ramping up producer) valued on EV/CF ratios comparable to the more adventurous jurisdictions like Turkey or Mexico. Another subject is the relatively very small market cap and EV of Fiore Gold, its peers provide a convenient outlook on future market caps based on the intended scenario for a 150,000oz Au per annum producer:

And part II:

It was actually difficult to find comparable producers/advanced developers as all heap leach operations in full production that I know are part of a large producer with multiple projects, so I resorted to smaller tier producers and heap leach start-ups, which have low values on CF multiples as they aren’t in full production yet so the markets are hesitant, or have teething issues to work through. The P/CF multiples are actually quite varying in this table, but on average when looking at many other producers, a P/CF ratio of 8-12 is industry standard for now. Richmont actually has a high number because of the friendly Alamos Gold takeover, btw, so my table isn’t a very good representation, unfortunately. Keep in mind that all companies have their own, very specific stories and valuations, so any peer comparison has its risks, but it illustrates an overview, and at least a quick impression of what’s out there.

Regarding market cap outlook, Fiore Gold itself aims even higher at the likes of Guyana Goldfields or McEwen Mining with market caps recently hovering around the C$1billin tag, with comparable production figures.

Here is a quick recap of the corporate strategy of Fiore Gold, per the news release of September 29th:

“Fiore’s goal is to build on the existing operations at the Pan Mine in Nevada to become a 150,000 ounce/year gold producer. To achieve this, the company intends to:

According to this news release, everything is going exactly according to plan, which isn’t an easy feat, as heap leach operations are notorious for delays and problems during ramping up. It really confirms the quality of the people running the show, in my view. As mentioned in my last article on Fiore, the company has overhauled the entire heap, restacked it, improved solutions management and has blended existing clay ore from the South Pit with new rock ore from the North Pit. As a consequence, problems with low permeability and ponding of cyanide solution experienced by the previous operators have not recurred.

Pan Mine; leach pads

Other things Fiore did were:

Management already worked on a way to save initial/sustaining capital, as it is looking to defer on crushers (cost $16.8M), and instead focuses on a larger mining operation as the Pan Mine goes from a foreseen nameplate capacity of 10,000tpd to 14,000tpd:

“In the fourth quarter, the mining team will be focused on assessing the equipment and manpower needed to achieve a sustained 14,000 tpd ore and associated waste stripping throughout 2018. Fiore is targeting a steady-state mining rate of 14,000 tons ore per day (tpd) by January 2018, with projected gold production of 35-40,000 ounces in 2018. The planned 2018 mining rate of 14,000 tpd of ore is higher than 10,000 tpd rate assumed in the 2017 SRK Technical Report. The estimate of 35-40,000 ounces of gold production for 2018 is based on this higher mining rate, and the 60% gold recovery value used in the technical report for run of mine ore. In conjunction with the increase in mining rates, construction of the Phase II Leach Pad expansion is currently underway with completion targeted by year-end. “

Recoveries just based on run-of-mine methods come in lower (in this case estimated at 60% by SRK) compared to methods using crushers (72%), hence the increased production. I have no doubt that the trade-off was positive, as a lot of energy would be saved as well by deferring the crushers. As the throughput increase outscores the loss in recovery, I expect a higher production figure than possible according to the FS. Fiore does have to expand its reserves to maintain (and preferably increase) the Pan life of mine (LOM), but there appears to be enough exploration potential for this. The company acknowledges this too, and has drilling scheduled for Q1 2018:

“Exploration work aimed at increasing the resource and reserve base at Pan is ongoing, with a number of drill targets identified proximal to both the North and South Pits. Drilling is expected to commence in early 2018 in order to minimize delays and increased costs associated with winter drilling.”

Regarding the second most important project Gold Rock, which is fully permitted for exploration drilling, Fiore will be working towards a resource update in H2 2018 after a first full season of drilling.

The company is concluding the Federal permitting process for a complete operation, and this permitting process was begun approximately four years previously under Midway Gold, and a decision on the Environmental Impact Statement for the project is anticipated in Q1 2018. As soon as this permit would be granted, Fiore can move forward with the Nevada state permits.

The potential economics might be better for Gold Rock compared to Pan, as historical grade and potential size are very promising, and CEO Tim Warman pointed this out to me, telling that Kinross came in for a 9.9% stake, mainly for the exploration potential at Gold Rock.

As a reminder, both Pan and Gold Rock have considerable exploration upside, which could extend both mine life and annual production. Key to the strategy is acquiring another near-production deposit of 800,000 to 1 million ounces Au, capable of producing at least another 50,000 oz Au annually. That would bring total annual production to at least 150,000 oz Au in 2020-2021.

In the meantime, the company also continues exploring its former flagship assets in Chile.

Diamond drilling generated verification results on Cerro Tostado, although nothing special yet: 1m @501 g/t Ag and 2.7m@ 381 g/t Ag, coming in below earlier SQM reverse circulation (RC) results (2m @943 g/t Ag, 3m@ 685 g/t Ag and 2m@ 413 g/t Ag). CEO Tim Warman is optimistic about his chances:

“By drilling these initial oriented diamond core holes we’ve been able to confirm the north-south striking, steeply dipping nature of these high-grade silver zones. We’re also pleased to have intercepted a second mineralized zone beneath the alluvial cover to the east of the main Cerro Tostado hill. Planning is underway for the next phase of drilling to test these structures along strike.”

To be honest, I don’t expect too much here considering these and past results, and consider this a little exploration wild card on a solid production story.

Conclusion

Fiore Gold had to deal with some selling first when it recommenced trading as objectives had changed for both GRP and Fiore investors, and as such, provides an opportunity to get in low on an undervalued production growth story, in my view. The combination of (potential) low-cost assets like Pan and Gold Rock, being cashed up, M&A around the corner, strong management, advisors and, last but not least, strong financial backing by the likes of founder Frank Giustra, who is too proud to have a company named after his mother going nowhere as this last intervention (RTO of GRP) proved, is an attractive one in my opinion. I’m willing to be patient here, as the projected upside is significant.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor. The author holds a long position in this stock. Fiore Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fioreexploration.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Pan Mine; waste dumps

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long term commodity pricing/market sentiments, and often looking for long term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Want to read more Gold Report articles like this? Sign up at www.streetwisereports.com/get-news for our free e-newsletter, and you’ll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Guyana Goldfields. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images and charts provided by The Critical Investor.