By Brian Maher

This post Where the S&P Will Be on March 31, 2018 appeared first on Daily Reckoning.

Where will the S&P be in six months?

Today we don the prophet’s motley… snatch a glimpse of the future… and reveal exactly where the S&P will close on March 31, 2018.

Sam Eisenstadt was the director of research at leading investment research firm Value Line.

He retired in 2009 after 63 years with the firm.

But Eisenstadt still toils over a complex forecasting model that spits out six-month economic predictions.

Now… we trust most forecasting tools precisely as much as we’d trust a dog with our dinner.

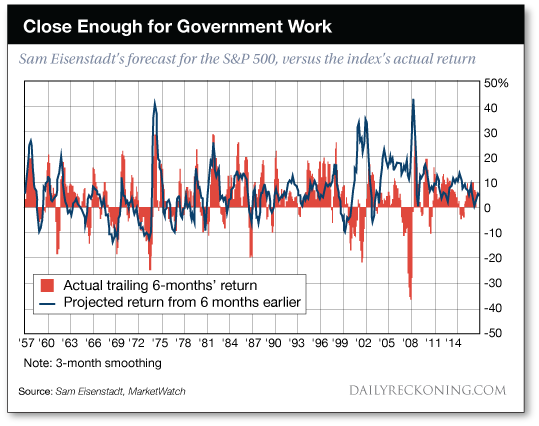

But MarketWatch’s Mark Hulbert says Eisenstadt’s model ranked first in risk-adjusted performance over the three decades Hulbert tracked competing models.

Between the scale of zero and one — dead wrong and dead on — it scores 0.31.

We admit, 0.31 is not nearly as certain as death… much less taxes.

But note how closely Eisenstadt’s model tracks the S&P’s actual record since 1957:

You’ll notice two significant warts on the record. But perfection is not to be found on this side of eternity.

And of all forecasting models, few come closer to the Kingdom of Heaven.

Hulbert:

Though you might be disappointed that [it] isn’t higher, you should know that most of the models that get attention on Wall Street and in the financial press have [records] that are far lower — if they’re not actually zero.

Eisenstadt’s model shows that low interest rates and positive market momentum indicate the most promising futures.

What do today’s conditions portend for the next six months?

Despite the Federal Reserve’s recent hikes, interest rates remain historically low.

And market momentum?

The Dow has notched 63 record highs since Trump’s November election.

The S&P tallied its sixth consecutive record close last Thursday — its longest streak in over 20 years.

All in all… it’s clear, sun-drenched skies as far as eyes can see.

So where exactly will the S&P end trading on March 31, 2018?

Perhaps here you suspect we’re luring you into an ambush (it’s just like us to do it too).

After all, is not war with North Korea a live possibility?

Trump’s tax cuts may well perish in the crib.

Janet Yellen’s term expires in February. Will her successor toss markets a screwball?

All these in mind, again, where will the S&P close on March 31, 2018?

Eisenstadt’s crystal ball shows that on March 31, 2018, the S&P will close…

Somewhere between 2,620 and 2,640.

That is, 2.7–3.5% higher than today.

Will it happen?

The answer is on the knees of the gods… far beyond our slender understanding.

But we’ve recently discussed the possibility of a market “melt-up.”

In this melt-up, stocks reach fever-heat during the glorious terminal phase of bull markets.

Some of history’s worst collapses have been preceded by melt-ups…

In the 18 months prior to the Crash of ’29, for example, the stock market nearly doubled.

The Nasdaq spiked 200% in the 18 months before the dot-com mania peaked in 2000.

Is the market in the larval stages of its own melt-up?

Jeffrey Saut, chief investment strategist at Raymond James, says yes. The S&P “now appears to …read more

Source:: Daily Reckoning feed

The post Where the S&P Will Be on March 31, 2018 appeared first on Junior Mining Analyst.