This post What the Mainstream Doesn’t Get About Cryptocurrencies appeared first on Daily Reckoning.

I’ve been writing about cryptocurrencies and bitcoin for many years.

I am an interested observer, not an expert. As an observer, it seems to me that the mainstream — media, financial pundits, etc.– generally don’t grasp the dynamics driving bitcoin and the other cryptocurrencies.

What the mainstream does get is speculative frenzy. New technologies tend to spark speculative manias once the adoption rate exceeds a critical threshold, and opportunities to buy into the new technology become available to the general public.

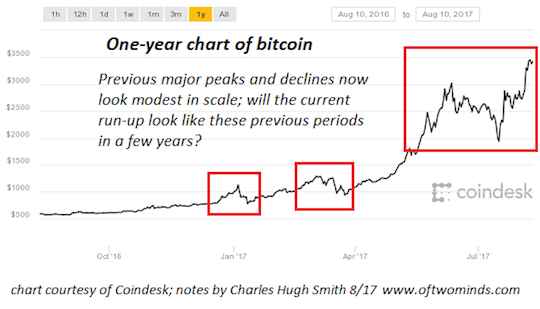

Just as radio and the Internet sparked speculative manias in their boost phase, cryptocurrencies have sparked their own speculative frenzy.

But where the mainstream goes wrong is assuming that’s all there is to bitcoin: a speculative mania.

The Establishment often dismisses transformative technologies as fads or gimmicks. Thus the infamous rejection of photocopy technology as only of interest to a dozen large corporations, personal computers belittled as being of limited utility (storing kitchen recipes), and so on. There’s also Paul Krugman’s famous obituary for the Internet in the late 1990s.

Skepticism is always a wise default position to start one’s inquiry. But if no knowledge is being acquired, skepticism quickly morphs into stubborn ignorance.

And cryptocurrencies are not the equivalent of Beanie Babies. Cryptocurrencies have utility value. They facilitate international payments for goods and services.

So the primary cryptocurrencies are not a scam. Advertising a flawless Beanie Baby and shipping a defective Beanie Baby is a scam. Advertising a mortgage-backed security as low-risk and delivering a guaranteed-to-default stew of toxic mortgages is a scam.

The primary cryptocurrencies (bitcoin, Ethereum and Dash) have transparent rules for emitting currency. The core characteristic of a scam is the asymmetry between what the seller knows (the product is garbage) and what the buyer knows (garsh, this mortgage-backed security is low-risk — look at the rating).

Both buyers and sellers of primary cryptocurrencies are in a WYSIWYG market: what you see is what you get. While a Beanie Baby scam might use cryptocurrencies as a means of exchange, this doesn’t make primary cryptocurrencies a scam, any more than using dollars to transact a scam makes the dollar itself a scam.

The mainstream also misses the core driver of bitcoin and cryptocurrencies: the current financial system is doomed.

Those who get on board alternative arrangements early will likely preserve more of their wealth than those who believe the current system is permanent. And some may earn great wealth as capital flees the sinking ship of central banking/credit for more secure climes.

The inevitable collapse of the Empire of Debt is off limits in the mainstream, for obvious reasons. The mainstream’s job, as it were, is to maintain the delusion that the exploitive Empire of Debt is permanent and the only possible financial system.

Most people sense that an Elite that lies when it gets serious cannot be trusted. As all the internal contradictions and excesses of the present financial system weaken its foundations, Elites must obfuscate, lie and manipulate via gamed statistics, …read more

Source:: Daily Reckoning feed

The post What the Mainstream Doesn’t Get About Cryptocurrencies appeared first on Junior Mining Analyst.