This post The One Safe Haven Left appeared first on Daily Reckoning.

The U.S. in the midst of partisan political turmoil. China is about to fight an all-out trade war with the U.S., Russia hunkering down for a new Cold War with the west, North Korea forcing a new world war, and emerging markets vulnerable to capital flight as confrontations escalate.

In the middle of all this, is there one investor safe haven left in the world?

The answer is, “yes.” It’s Europe.

I expect the euro to soar from $1.17 to $1.25 and higher in the months ahead.

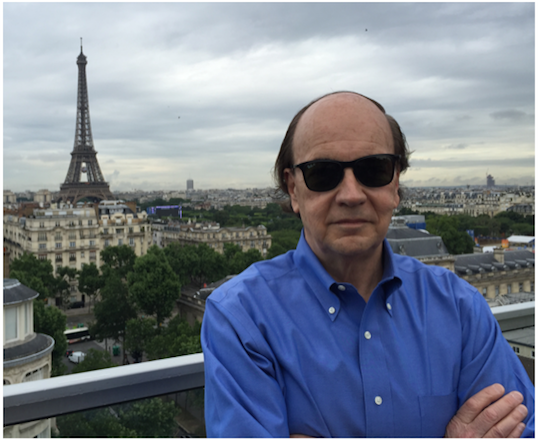

Your correspondent in Paris during a recent visit. Most Americans get their European news from sources in the U.S. or London such as The Economist or The Financial Times. These sources are biased against the euro and present a misleading picture. It’s critical to visit France, Germany, Italy, and other countries in Europe and meet with their officials to learn what’s really going on in the EU, and with the Euro.

The U.S. and UK media have bombarded U.S. investors with nothing but bad news on the euro and the EU since 2009. This began shortly after the global financial crisis of 2007–2008.

One of the aftershocks was the bankruptcy of the quasi-sovereign wealth fund DubaiWorld the day after Thanksgiving in November 2009. Even as Americans were recovering from the turkey dinners, the financial world was turned upside down by this black swan from the Middle East.

The contagion quickly spread from Dubai to Europe. A liquidity crisis arose. The sovereign bonds of the EU “periphery” of Greece, Italy, Ireland, Portugal and Spain (“GIIPS”) were called into question. A major bailout of the GIIPS countries was quickly organized.

This bailout involved money printing by the European Central Bank (ECB), conditional lending by the International Monetary Fund (IMF), and new lending and guarantees by the European Union (EU) based in Brussels and led by Germany. The ECB, IMF and EU became known as the Troika, and were responsible for a series of bailouts between 2010 and 2015.

At this point, early in the crisis, the critics of the euro came out in force. Led by Nobel Prize winners Paul Krugman and Joseph Stiglitz, and with support from many others including Nouriel Roubini, they screamed that the euro was doomed!

Their argument was that the GIIPS should quit the euro, go back to their original currencies such as the Greek drachma and Italian lira, immediately devalue to lower their labor costs, and grow their economies with cheap labor, cheap exports, and imported inflation.

In the estimation of Krugman, Stiglitz and the rest, the EU should split into a “northern tier” of strong economies such as Germany and the Netherlands. There would also be a “southern tier,” consisting of mostly GIIPS and possibly France. Only the northern tier would be eligible for a common currency.

In effect, the critics said the euro was certain to fail and the sooner it was buried in its grave, the better.

Everything about this forecast was wrong, …read more

Source:: Daily Reckoning feed

The post The One Safe Haven Left appeared first on Junior Mining Analyst.