Source: Lior Gantz for Streetwise Reports 07/31/2017

Lior Gantz, founder of Wealth Research Group, believes Warren Buffett has left untold profits on the table by not investing in gold and cryptocurrencies.

I have so much respect for Warren Buffett. In fact, it’s well beyond respect—it is a complete admiration for his dedication to sticking with his philosophy and making ridiculous amounts of money for his shareholders.

I have been studying Buffett’s approach and success since the age of 16, when a neighbor of mine who was a stock broker then and my babysitter prior to that when he was a teen himself, told me to start reading up on the Oracle of Omaha. Even I can’t shake the feeling that Buffett is losing his magic touch.

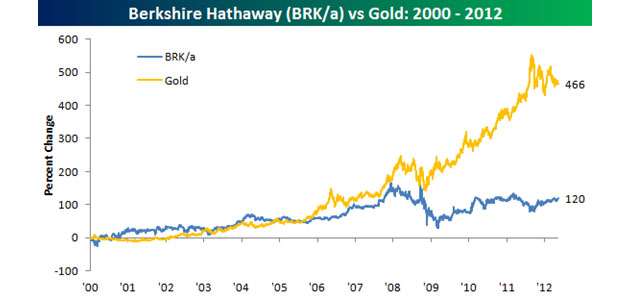

During the length of the bull market for commodities, from 2000–2012, Buffett’s persistence to sticking with his mandate of avoiding natural resource businesses cost him big-time.

Years prior, even his close and tight relationship with mega-successful entrepreneur Bill Gates, which started in 1991, hadn’t convinced him to own even a single share of Microsoft.

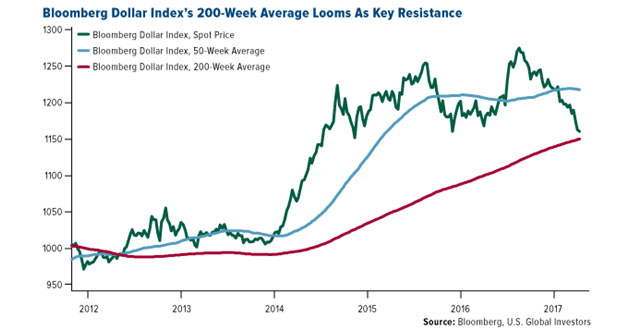

That had to be a mistake that cost Warren tens of billions in lost profits. Warren’s strategy revolves around Wealth Stocks, but Wealth Research Group has backtested Berkshire Hathaway’s performance, and the fact is that Berkshire’s massive cash hoard, which is in the tens of billions of dollars, must be partly converted into gold and silver because the USD is practically entering a bear market.

Buffett is an expert at identifying the value of a brand name, like Coca Cola, American Express or Procter & Gamble, and he loves these companies because they don’t have to constantly spend marketing dollars to attract customers. But what about gold?

That’s the most universally accepted form of money to ever exist. Give a man a gold bar and he’ll instantly recognize the value of it. Can you say the same thing about nickel, lead, or other metals?

Gold reigns supreme as the emperor of elements, and that’s exactly why mining it brings with it the opportunity for ridiculous gains.

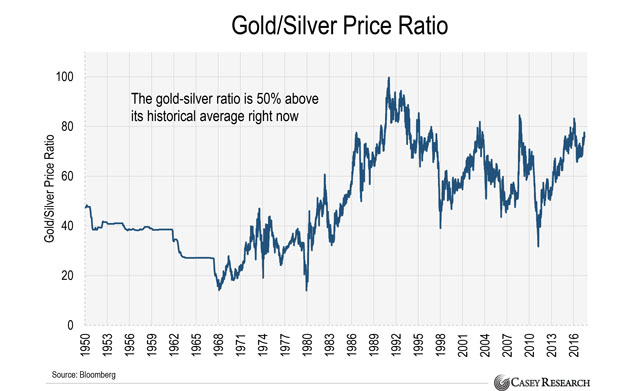

As it stands today, the gold-to-silver ratio is again approaching 80:1, and whenever it reaches that extreme, we’ve seen the ratio reverse course and mining shares explode to the upside.

But Buffett’s ignorance of the dangers of fiat currencies goes beyond his refusal to convert some fiat into gold, which would have pocketed him serious gains with zero hassle. He has now taken a stand against cryptocurrencies.

Here’s the problem with that: cryptocurrencies are the future of transactions.

Wealth Research Group has been covering the most important developments and our highest-conviction opportunities.

They represent an important allocation of my personal portfolio model, especially with regards to my ultimate safe havens list.

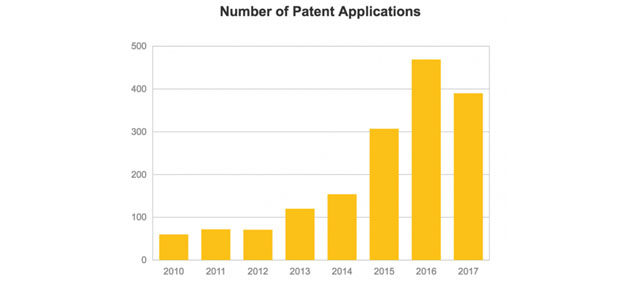

Even Buffett has to admit that the amount of patents being applied for within the blockchain industry is creating a competitive advantage like no other for this industry, and it goes beyond Bitcoin alone.

I don’t plan to miss the monster profits that lie ahead, and the Wealth Research Group newsletter will be publishing specific ideas on how to position for maximum gains.

The August 1 Bitcoin fork will only validate the industry’s importance, but it’s only in its infancy stage.

The runway is clear for businesses to hyper-grow and prosper.

Lior Gantz, the founder of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by Wealth Research Group