By analyst

By Osprey Gold Development Ltd.

Osprey Gold is a MINING.com advertiser

Gold bugs are in a buying mood once again with the gold price knocking on the door of $1,300 an ounce. The yellow metal is up nearly 13% year to date on continuing global tensions – the terrorist attack in London being the latest example – along with a softening U.S. economy reflected recently in disappointing U.S. job numbers and a lower U.S. dollar.

Major gold companies have been cashing in on the rising gold price, with big players like Barrick (NYSE:ABX), Newmont (NYSE:NEM), AngloGold Ashanti (NYSE:AU) and Kinross (NYSE:KGC) all posting decent share price gains of late. The health of the sector overall can be seen in the Market Vectors Gold Miners ETF (NYSEARCA:GDX), which is up 13% in 2017.

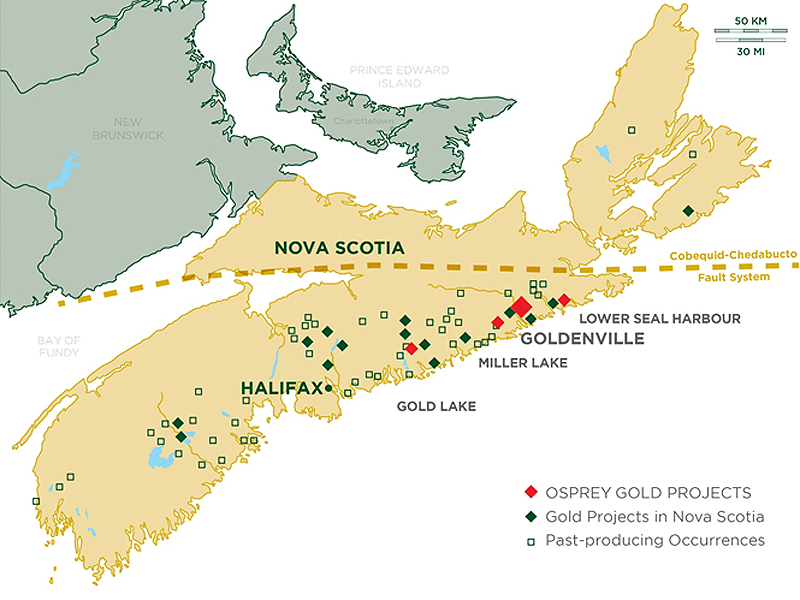

For exploration companies, it appears that gold fever is back and one of the most promising areas is in the safe Canadian jurisdiction of Nova Scotia. This is where Osprey Gold (TSXV:OS) is hoping to grow its resources in a past-producing gold mining area with an exciting drill program about to kick off this summer.

The story of Osprey, renamed from Gonzaga Resources in February, started with the acquisition of the Goldenville Gold Project – a 447,000-ounce monster of a deposit that is the largest historic gold mine in Nova Scotia’s Meguma Gold Belt, producing 212,000 ounces between 1862 and 1942. Along with Goldenville, Osprey also acquired three other properties – Lower Seal Harbor, Gold Lake and Miller Lake – that were previous high-grade gold mines.

Gold projects in Nova Scotia location map

Those may eventually be developed by Osprey, but the focus for now is on Goldenville. A first-phase drilling program is planned within the next few weeks, with the goal being to expand the known gold resource at Goldenville, which is currently pegged at 447,000 inferred ounces at 4.96 grams per tonne.

Nova Scotia has a history of gold mining that goes back to the 1830s; since then, the Atlantic Canadian province has produced some 1.1 million ounces, mostly from high-grade pockets of mineralization concentrated in quartz veins underground. Gold production in the province largely ceased in 1942.

Visible gold in quartz

While not much gold mining has occurred since the 1940s, interest in the region has been re-ignited lately with the accomplishments of Atlantic Gold (TSXV: AGB) which is about to become Nova Scotia’s latest gold producer, and the only permitted open pit gold project currently in construction throughout the whole country. Its first gold pour from its Touquoy property – part of Atlantic’s Moose River Consolidated project – is expected in the third quarter. Atlantic has seen a dramatic share price appreciation, going from 28 cents a share to $1.60 in just under a year and a half. That has Canada-focused gold investors wondering whether Osprey can do something similar.

According to renowned mining analyst Eric Coffin, who recently published a comprehensive report on Osprey in his HRA Advisories Hard Rock Analyst newsletter, the success of Osprey will depend on the composition of Goldenville’s shales and …read more

Source:: Infomine

The post Osprey Gold – Tremendous upside in Nova Scotia’s biggest mining district appeared first on Junior Mining Analyst.