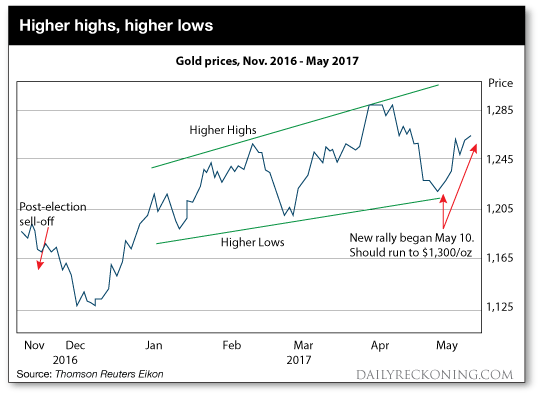

The current rally in gold began on December 15, 2016 at $1,128/oz. For over 5 months, gold has Adhered to a pattern in which each new high price is above the one before (“higher highs”), and each drawdown settles at a price above the one before (“higher lows”), If this pattern persists, the next high will be above $1,300/oz. Gold could rally further from there based on Fed policy.

The question for investors today is: Where does the gold market go from here?

We’re seeing a persistent excess of demand over new supply. China and Russia alone are buying more than 100% of annual output each year. That’s on top of normal demand by individuals and the jewelry industry. This means that demand has to be satisfied from existing stocks in vaults.

But western central banks have all but stopped selling in recent years. The last large sales were by Switzerland in the early 2000s and the IMF in 2010.

Private holders are keeping their gold also. On a recent visit to Switzerland, I was informed that secure logistics operators could not build new vaults fast enough and were taking over nuclear-bomb proof mountain bunkers from the Swiss Army to handle the demand for private storage.

With gold sellers disappearing and large demand continuing, the price will have to go up to clear markets — regardless of how much “paper gold” is dumped.

Geopolitics is another powerful factor. The crises in North Korea, Syria, Iran, the South China Sea, and Venezuela are not getting better; they’re getting worse. The headlines may fade in any given week, but geopolitical shocks will return when least expected and send gold soaring in a flight to safety.

Fed policy tightening is normally a headwind for gold. But, the last two times the Fed raised rates — December 14, 2016 and March 15, 2017 — gold rallied as if on cue. Gold is the most forward-looking of any major market. It may be the case that the gold market sees the Fed is tightening into weakness and will eventually over-tighten and cause a recession.

At that point, the Fed will pivot back to easing through forward guidance. That will result in more inflation and a weaker dollar, which is the perfect environment for gold. Look for another Fed rate hike on June 14, and another gold spike to go along with it.

In short, all signs point to higher gold prices in the months ahead. I look for a short-term rally to $1,300 in the next month, and then a more powerful surge toward $1,400 later this year based on Fed ease, geopolitical tensions, and a weaker dollar.

The gold rally that began on December 15, 2016 looks like one that will finally break the bear pattern of lower highs and lower lows, and turn it into the bullish pattern of higher highs and higher lows.

Regards,

This post Gold’s Next Spike appeared first on Daily Reckoning.

[Ed. Note: Jim Rickards’ latest New York Times bestseller, The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis, is out now. Learn how to get your free copy – click HERE. This vital book transcends geopolitics and rhetoric from the Fed to prepare you for what you should be watching now.]

Is the latest gold rally for real?

Investors can be forgiven for asking that question. Gold reached an all-time high dollar price of $1,898 per ounce on September 5, 2011. Then it began a relentless four-year, 43% plunge that took it to $1,058 on November 27, 2015.

Of course, gold did not go down in a straight line. There were numerous strong rallies along the way.

Gold rallied 13%, from $1,571 in June 2012 to $1,780 in October 2012. Then gold rallied 15%, from $1,202 in December 2013 to $1,381 on March 2014. Gold rallied 22.5% again, from $1,058 in November 2015 to $1,366 in July 2016, just after the Brexit vote in the UK.

If you were fortunate enough to buy each dip and sell at each high, lucky you. I don’t know anyone who actually did that. More common behavior is to buy near the interim tops on euphoria, and sell at the interim lows on depression. That’s a great way to lose money, but unfortunately it’s exactly how many investors behave.

With that said, no one can blame investors for being discouraged and skeptical about the price action in gold. Every rally since late-2011 was followed by a sickening plunge.

Perhaps the worst plunge was the dizzying 24% plunge, from $1,607 to $1,223 per ounce, in a brief 15-week span between March 22 and July 5, 2013. That period included the notorious “April Massacre” when gold fell over 5% in just two trading days.

Each time gold experienced one of these major reversals, investors were quick to claim price manipulation by dark forces, usually central banks, using highly-leveraged “paper gold” dumps on the commodity futures exchanges.

Actually there is strong statistical and forensic evidence to support the gold price manipulation claims, as I explain in my 2016 book, The New Case for Gold. China has a keen interest in keeping gold prices low because it is on a multi-year, multi-thousand ton buying spree. If you were buying 3,000 tons in a thin market, you’d want low prices too.

Of course, all of that will change when China reaches its gold reserve target of 10,000 tons — surpassing the United States. At that point, it will be in China’s interest to become more transparent and let the price of gold soar, which is another way of saying the value of the dollar is in free-fall.

China’s endgame may still be a few years away. Meanwhile, there are other more prosaic explanations for the long decline in gold prices from 2011 to 2015.

The best explanation I’ve heard came from legendary commodities investor Jim Rogers. He personally believes that gold will end …read more

Source:: Daily Reckoning feed

The post Gold’s Next Spike appeared first on Junior Mining Analyst.