By Jody Chudley

This post 5 Critical Takeaways From Buffett In Omaha (You’ll Be Disturbed By #4…) appeared first on Daily Reckoning.

The first Saturday in May it happens.

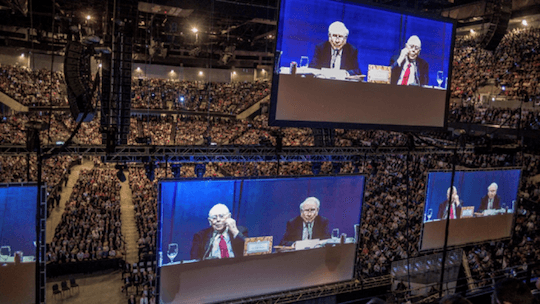

Forty-thousand or so people book a hotel room, pack their bags, jump on a plane and come to the vacation hot-spot that is Omaha, Nebraska.

I know, it sounds crazy doesn’t it? Nobody vacations in Omaha…

The reason that they all do this is even more bizarre.

All of these people do it to sit quietly and listen to a 93 year old and an 86 year old share their thoughts and opinions!

I think it is safe to say that there is nothing else like this on our fine planet.

These two very senior citizens are not your average retirement home residents.

They are Warren Buffett and his longtime partner in crime Charlie Munger.

Together they have turned Berkshire Hathaway from being a near worthless textile mill in the late 1960s into a conglomerate with a $410 billion market cap today.1

The event that brings so many people to Omaha is Berkshire’s annual shareholder meeting. In addition to the 40,000 in attendance there are more watching the livestream on the internet.

It is the wisdom that these men share at the meeting each year that brings all these people together. It is the wisdom of these two men that make all these people do something very unusual.

They all just sit there and listen.

Here are the key things that 40,000 plus listeners learned this year.

Need to Know #1 – $9.5 Billion Reasons Buffett Should Love President Trump

As he has gotten older Buffett has gotten somewhat more political. He was a very vocal supporter for President Obama in both of his victories and this time around he was publicly in the corner of Hillary Clinton.

While Buffett bet on the wrong horse in the election, I would have a hard time saying that he didn’t win.

And win big at that.

President Trump’s plan to reduce the corporate tax rate to 15 percent will be a huge benefit for Berkshire Hathaway and Buffett personally. Thanks to Buffett’s incredible long term investments in companies like Coca-Cola, American Express and Wells Fargo, Berkshire sits on over $95 billion in unrealized capital gains.2

According to Buffett, if the corporate tax rate were to drop by 10 percent Berkshire’s value would immediately increase by $9.5 billion thanks to the reduced future tax owing on all of those unrealized gains.

Even for Berkshire that is a huge amount of money.

On top of that will be another multi-billion bump in cash flows that come with a reduced annual tax burden.

Not a bad consolation prize for when your candidate doesn’t win!

Need to Know #2 – Self-Driving Vehicles Will Permanently Damage These Businesses

Investing is all about predicting the future. The better that you are figuring out what is going to happen the better you will be as an investor.

Buffett has excelled because he has focused on companies with giant competitive moats around them. Powerful brand names like Coca-Cola which generate much more predictable …read more

Source:: Daily Reckoning feed

The post 5 Critical Takeaways From Buffett In Omaha (You’ll Be Disturbed By #4…) appeared first on Junior Mining Analyst.