By Zach Scheidt

This post Missed By The Media: Trump’s 75.7% Tax Cut appeared first on Daily Reckoning.

“Now boarding, flight 4890 to Baltimore”

The gate agent was announcing my Sunday flight back to Baltimore. But I wasn’t listening.

Instead, I was furiously scribbling calculations on a notepad. Had I really just found a way to cut taxes by 75.7 percent?

I double checked all my figures. Then I used the super-slow airport wifi to make sure my sources were correct. And then…

Everything added up. The tax loophole was completely legit. It had the potential to save hundreds of thousands in tax payments. And so far, no one had even noticed!

“Flight 4890, This is your final boarding call”

Oh crap! I was about to miss my flight!

I shoved my notes into my carry-on and sprinted over to the gate. Just in time, I boarded the flight, armed with a new opportunity to save you thousands of dollars.

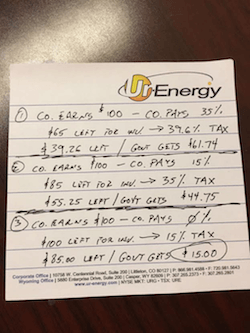

Here’s a quick snapshot yesterday’s notes from Hartsfield-Jackson Atlanta International Airport:

Don’t worry, I’ll translate my poor handwriting for you. But first, let me explain how I stumbled across this surprising loophole.

A Surprising Twist to Trump’s Tax Proposal

For the last week or so, there has been a lot of buzz around President Trump’s tax proposal. The new tax plan should help boost business profits by lowering corporate tax from a current rate of 35 percent to just 15 percent.

That shift has the potential to boost investor returns as stock prices rise and dividend payments increase. In short, the more money corporations save on taxes, the more cash is left for investors like you and me.

In addition to the lower tax rate, there are a couple other provisions that will benefit taxpayers.

First, tax rates for individuals will be simplified to just three tiers. The top rate for individuals will be 35% instead of the current 39.6% rate. Lower tax brackets for individuals will be set at 10% and 25%. 1

One final provision is that the personal tax rate for pass through businesses will be set at just 15%. And here’s where the loophole comes into play.

I’m actually a bit embarrassed that I missed this earlier. Last week when I saw the “pass through” provision, I assumed this was just for individuals who owned their own businesses (such as a personal LLC or sole proprietor business).

But as I sat in the terminal waiting for my flight, I realized that there is a huge class of exceptional investment opportunities that fall under this “pass through” business category. And by investing in these businesses, taxpayers will be able to cut out 75.7 percent of the taxes that would normally be paid to Uncle Sam.

Here’s How it Works…

The “pass through” clause in Trump’s tax proposal includes companies organized as Master Limited Partnerships (or MLPs). MLPs are a special class of businesses that are focused on energy infrastructure. In short, these companies generate profit through the production, transportation or refining of energy sources such as oil and natural gas.

To encourage investment in …read more

Source:: Daily Reckoning feed

The post Missed By The Media: Trump’s 75.7% Tax Cut appeared first on Junior Mining Analyst.