Tom Beck of Portfolio Wealth Global shares his strategy for investing in commodities.

For close to five years, investors, experts and analysts have been predicting that commodities, as a group, are going nowhere.

Still, millions of respected, intelligent investors seek to invest in minerals and resources because of one important reason: one solid position can fund a decade worth of retirement.

Warren Buffett, whom I personally regard as the absolute best investor the world has ever known, was even duped into buying oil stocks because he fell into the “Peak Oil” theory, which was popular prior to the invention of “fracking.”

This reminds me of the famous 1890 London Futurist experiment, where the most highly regarded scientists of Oxford were asked to envision London 40 years into the future, and the prediction was sealed until 1930, when it was finally opened and read.

Their theory was that London would be impossible to live in because of horse manure and diseases caused by sanitation.

They couldn’t possibly forecast that within the decade after their brainstorming, the automobile would be invented.

Today, London is the most expensive and sought-after location of the ultra-rich, as well as a tourist hub.

The bottom line is that commodities are unpredictable, and they often move inversely to fundamentals, research and common sense.

Even worse, when they do change from bust to boom and vice versa, the discipline it takes to notice the trend change and the precision involved with investing and timing it is sheer luck.

In 2016, Portfolio Wealth Global, the highest-ranked free financial publication of the year, profiled just three mining companies.

I believe it was a combination of timing, months of research and, ultimately, ridiculously undervalued stocks that allowed you to profit from two trades that gained 103.4% on average, and from one stock that gained 312%.

Here are the facts that Wall Street never shares with you, but would save you millions of dollars and countless hours of needless reading through the course of a lifetime:

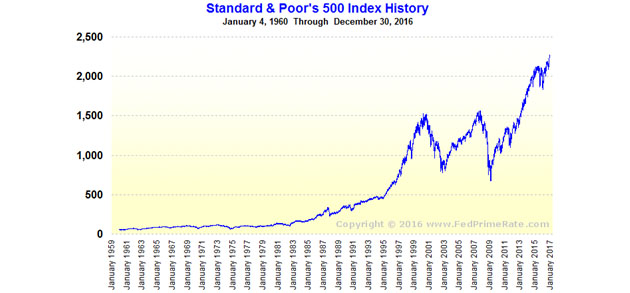

1. The S&P 500 returns an average of 7% per annum in a 30-year span.

This translates to making 750% every three decades.

If you start out with $50,000, you’ll have roughly $400,000 about three decades later.

The lesson here is that in order to generate serious returns that will kick in before the time you’re 60, you’ll have to outperform the S&P 500.

2. Wall Street analysts do not focus on the one sector that allows 750% returns in a few months or a few short years: junior mining.

To tackle these two facts, you should adapt a contrarian outlook on the markets.

A. Instead of investing in the S&P 500, which is a basket that will always include mediocre, struggling companies, find Wealth Stocks.

These are companies that grow, historically, at 9%–12% and are undervalued.

This is the ultimate company that we’ve found.

B. Instead of chasing the sudden and erratic boom and bust cycles of the commodity prices, take an approach that will make you much more balanced, take much of the uncertainty out of your portfolio, and allow you to potentially make those big returns that commodity investors desperately crave for.

My strategy is simple:

1. Only risk what you can afford to lose.

2. Only invest in exploration-stage companies where the geological team is made up of proven experts and the management is world class.

That way, no matter what is going on in the commodities market, this stock will make money if a discovery is made.

I like that approach because if I did my homework, there’s a real chance of making an extraordinary investment.

There’s a clear example of this type of situation forming in the cobalt market.

This is the stock I am thinking of.

Tom Beck is senior editor of Portfolio Wealth Global. Known as one of the first millennial millionaires in the United States, Beck is a relentless idea machine. After retiring two years ago at age 33, he’s officially come out of retirement to head up Portfolio Wealth Global. He brings a vision of setting a new record for millionaires with his seven-year plan to accelerate any subscribers’ net worth who will commit to the income lifestyle. Beck delivers new ideas on the marketplace that were once only available to the rich. Traveling the world, he’s invested in over a dozen countries, including real estate.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Tom Beck and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

Charts provided by the author.