Precious Metals Warrants Learning Center

A. Overview

B. Basic Definition of a Warrant

C. Background and History of Warrants

D. The Most Important Decision (company)

E. Why Investors Should Consider Warrants – Leverage

F. Are You an ‘Investor’ or a ‘Speculator’

G. Portfolio Allocation for warrants

H. Other professionals talking about warrants (Adam Hamilton, Frank Holmes, Martin Weiss)

A. Overview

Before an investor considers purchasing a warrant, he must like the company.

An investor who is interested in purchasing warrants must initially analyze the company. For a warrant to be interesting, the results of the analysis of the company must indicate that the company offers potential growth in earnings and is financially sound. If the investor likes the company and is convinced that the company offers potential, then the investor should consider the warrants.

The investor should then analyze the warrant. If the warrant has 2 or more years before it expires (our personal suggestion) and offers the investor potential leverage, then the warrant offers the investor more potential capital gains than the common stock. The investor should then purchase the warrant in preference to purchasing the common stock.

It is essential for the investor to realize that when he considers a warrant for purchase, he must analyze (select) the company. If the investor does not believe that the company offers potential growth and/or that we are not in a bull market in the natural resource sector, then there is no reason to be interested in a company’s warrant.

There is no reason to believe to that the price of a warrant is going to rise without an increase in the price of the common stock that the warrant is an option to buy. The investor purchases the warrant instead of the company stock of the company because he anticipates that the price of the warrant will rise more rapidly than the price of the common stock. The warrant then offers the investor a greater return than the common stock, that is, the warrant offers leverage. But such potential leverage requires that the price of the common stock will rise, and hence the company itself must have potential for growth.

B. Basic Definition of a Warrant

A warrant is a security (like an option) giving the holder the right, but not the obligation, to purchase the underlying stock at a specific price, within a specified time period. In essence, a warrant is very similar to a long-term call option.

Warrants are usually issued by a company in connection with a private placement or a financing arrangement. Many of the warrants will remain privately held and will never trade in the open marketplace. Our service only covers warrants which are tradable on the exchanges either in the United States or Canada.

As an individual investor, your objective is usually to only trade the warrant, not to exercise the warrant and the warrants trade freely, just like the common stock.

Currently there are many warrants trading with expiration dates out to the year 2012 and though warrants expiring within, say, two years, may possess great upside leverage, also pose a greater risk. It is widely recommended for most investors to focus on Warrants with at least two years left before expiration date.

Example of a warrant:

Northern Orion wt A

Exercise Price – C$6.00

Expiration Date – 17-Feb-2010

Current price of warrant – C$1.83

Current price of common – C$6.43

Using the above data, if you purchase one wt at a price of C$1.83 you now have the right to purchase one common share at C$6.00 until 17-Feb-2010. This is the exact principle of call options and LEAPS.

The warrant intrinsic value is said to be C$.43 (current price of common C$6.43 – exercise price, C$6.00). The additional premium of C$1.43 (current price of wt, C$1.83 – intrinsic value, C$.43) is the time value premium placed on the warrants by the markets.

Summary

An investor may purchase a warrant which is the option (the right) to purchase the common stock of a company. He may prefer to purchase the warrant instead of the common stock because the warrant offers more potential gain, that is the warrant offers the investor leverage.

C. Background and History of Warrants

Warrants have literally been available for investors for many decades but yet are very under appreciated and overlooked by most investors.

In the 1960’s and 1970’s there was a service called, ‘The RHM Warrant Survey’ to which many investors subscribed and which was available only in hard copy. To the best of our knowledge, this service stopped in the late ‘70’s or early 80’s and very little information has been available since to investors.

In the very popular and highly recommended book, The Coming Collapse Of The Dollar And How To Profit From It by James Turk and John Rubino, they discuss options and LEAPS as a possible avenue for investing in the mining stocks. They did not discuss our third possibility, warrants, which we feel is more “investor friendly”. Why? Because of the all-important element of TIME. How many times have your options expired worthless but yet within a few months or so your stock goes up; you just ran out of TIME. (James Turk is now one of the many professionals who are subscribers to our service).

D. The Most Important Decision (the company)

As with any investment decision, whether you are considering the purchase of common shares of a company or perhaps, warrants, call options or leaps you must consider the company fundamentals and whether you believe the shares of the company will rise in the future, right? Sounds elementary, but if the price of the common shares of the company does not increase in value neither will the value of the warrants, options, or leaps.

Thus, the single most important decision for you, as an investor, is to select which specific natural resource companies are of interest to you.

You may accomplish this task in many ways including:

- Follow the recommendations of other analysts and/or newsletters

- Personal research

Review the list of all of the companies which currently have warrants trading. This list is furnished in our ‘Warrant Summary’ and now contains 85 companies, many of which you may recognize.

After you have a list of companies (whether it is one company or ten companies) of interest to you then it is time to focus on those companies:

Companies with warrants:

- Remaining life of the warrant (furnished in our database)

- Current valuation of the warrant (furnished in our database)

- Future leverage potential (furnished in our database)

Making the decision to purchase

The decision to purchase any warrant (s) will be solely yours based upon the above process and your time horizon as an investor, short-term or long-term.

E. Why Investors Should Consider Warrants — Leverage

We would again like to share with you some comments from the July 2007 Issue of Zeal Intelligence from editor, Adam Hamilton, CPA, which we are providing in its entirety with his permission.

“Since warrants are cheaper than owning stock outright, you can use warrants to increase leverage or decrease risk. To get more leverage, take capital you are going to use to buy a long-term stock position and instead buy warrants, which let you ‘control’ the profits on many more shares. To lower risk, use less capital than it would take to buy stock to buy warrants on the same number of shares. Like any options if you are wrong you will take a loss of up to 100%, but within a secular bull it is hard to be wrong over such a long period of time. The odds of winning for warrants are vastly higher than in standard options due to this abundant time.”

Warrants are a unique trading tool that is highly underappreciated and potentially incredibly profitable.

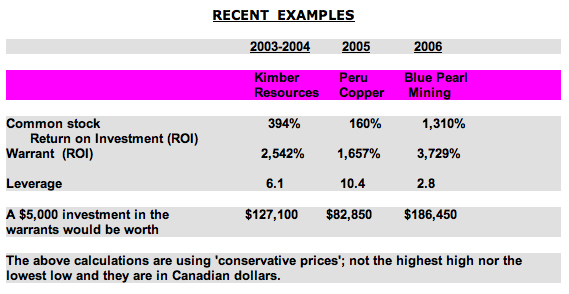

The above calculations are using ‘conservative prices’; not the highest high nor the lowest low and they are in Canadian dollars.

The above calculations are using ‘conservative prices’; not the highest high nor the lowest low and they are in Canadian dollars.

Additional Information:

For those investors craving more information, let’s say leverage, or at least potential leverage, is the prime reason an investor would be interested in warrants. The owner of the warrant receives none of the benefits of ownership of the common stock of a company. He cannot vote, and he does not receive any cash dividends. Why would an investor want to buy an option (warrant) to buy something instead of buying the thing itself?

The essence of the answer is that the anticipated gain on the warrant must be greater than the anticipated gain on the common stock. This more rapid growth in the value of the warrant relative to the common stock is called leverage.

The advantage that a warrant offers the investor is leverage, that is, a greater gain than would be possible with an equal investment in the common stock. Without this possibly of such leverage the investor would buy the common stock.

Pricing of warrants

No one would purchase and exercise a warrant when we can buy the common stock for a price that is less than the exercise price of the warrant.

Minimum price of a warrant

What will be the minimum price that an investor may be able to pay for a warrant? The answer is the theoretical value of the warrant, the warrant’s intrinsic value as an option. This intrinsic value is the price of the common stock minus the per share exercise price of the warrant. If the common stock is selling for a price greater than the per share exercise price of the warrant, the warrant has some positive theoretical value. If the common stock is sell for a price that is less than the per share exercise price of the warrant, the warrant has no real value as an option.

The theoretical value of a warrant considers only the intrinsic value of the warrant as an option. It does not consider the possibility of leverage that the warrant may offer the investor. It is this possibility of leverage as well as the theoretical value of the warrant that influences the market price of the warrant.

Since the investor gets both the theoretical value of the option and the potential leverage that the option offers, the market price of a warrant usually exceeds its theoretical value.

Let’s show you this in an example:

If a warrant were the option to buy common stock for $20 a share and the shares were currently selling for $30, then the theoretical value (intrinsic value) of the warrant is $10. Why is $10 the lowest possible price for this warrant? The answer is that if the market price of the warrant were less than $10, there would exist an opportunity to arbitrage, and the act of arbitrage would drive the price of the warrant to its theoretical value.

The professional arbitragers will guarantee that the market price of a warrant cannot remain for any length of time below its theoretical value.

Summary:

An investor may purchase a warrant which is the option (the right) to purchase the common stock of a company. He may prefer to purchase the warrant instead of the common stock because the warrant offers more potential gain, that is, the warrant offers the investor leverage.

Premium

What effect does the premium have on the potential leverage that the warrant offers?

The higher the premium you have to pay for the warrant thus decreases the potential leverage that the warrant offers.

Hypothetical example

Assuming the market price of the common stock is $25 and an exercise price of $20, the theoretical value (intrinsic value) of the warrant is $5, but the market price of warrant is $14. The investor must pay $14 to purchase the warrant and thus he is paying a premium of $9 over the intrinsic value of the warrant.

Investors goals are to find the warrants which exhibit a reasonable premium and thus provide the highest leverage potential possible. In our warrant database, we do these calculations for you in a simple format easy to understand.

As long as the leverage factor is greater than 1 to 1, the price of the warrant will rise more rapidly than the price of the common stock. While the existence of the premium decreases the leverage, it need not eliminate it.

An investor, who is considering purchasing a warrant, must ask himself what price increase can he expect in the warrant if the price of the common stock rises. We provide you this detail in our warrant database.

For the warrant to be attractive, the anticipated percentage increase in the price of the warrant must exceed the anticipated percentage increase in the price of the common stock.

Simply put, the warrant must offer the investor leverage.

F. Are You an Investor or Speculator

We encourage you to determine your investment philosophy as to whether you are an ‘investor’ or ‘speculator’. Basically this involves your investment time horizon (in days, months or years) and your level of risk. As to risk, we are of the opinion that long-term warrants which we would define as having a remaining life of two years or more, have no more risk that purchasing the common shares of the same company and thus we classify long-term warrants as investments.

There is no reason why a person who considers himself to be a conservative investor should not consider long-term warrants as a viable means to his investment goals.

Short-Term and Aggressive Investors

Warrants offer incredible opportunities for those investors seeking short-term gains by focusing on those warrants expiring within 12 months. The average investor must be cautioned to the additional risk involved in the short-term warrants but incredible gains have been made by many investors in warrants of Peru Copper, Northgate Minerals and Blue Pearl. Click on each of the links above to see the charts of the incredible gains exhibited by these warrant. Perhaps YOU can pick the next winner out of our Warrant Database!

Option investors should consider the possibilities of including warrants in their investment strategies along with call and put options and LEAPS. More opportunities, more possibilities, more flexibility = greater potential profits.

Long-Term Investors

For those investors with a longer term horizon of the precious metals and energy markets there are many warrants trading which have a remaining life until expiration of 3 years, 4 years and more.

You determine your favorite mining stock which has warrants trading will a long-term life and thus establish a long-term position and do not concern yourself with the daily, weekly or even monthly movements in the markets. Relax, enjoy the ride, and sleep well at night knowing you are positioned with the long-term trend.

In each of the last several years at least one warrant has performed incredibly well.

G. Portfolio Allocation

As with any investment you must decide how much of your portfolio to allocate to different sectors, different shares, ETF’s, mutual funds, gold bullion, etc.

Even though we view ‘long-term warrants’ as investments (as opposed to speculation), we find an allocation of 10% to 20% maximum of your portfolio as a reasonable allocation of your total dollars to this investment vehicle.

H. Other Professionals Talking About Warrants

Adam Hamilton, CPA

Great newsletter, Zeal Intelligence

In his July 2007 issue he gave great coverage to options, LEAPS and warrants and in particular has given us at Precious Metals Warrants and Dudley Baker a wonderful endorsement. Adam calls Dudley, “the world’s premier commodities-stock warrants guru”.

Frank Holmes

Chairman of U.S. Global Investors. We have had the opportunity to meet with Frank and his investment team in San Antonio, Texas or several occasions and would like to furnish you with some of their thoughts on warrants which appeared on their website:

“Anticipate Before You Participate: Part 2”

We have used long-term warrants combined with higher cash levels to maintain a highly liquid portfolio and at the same time participate in a rising market and still be able to buy attractive securities during corrections.

As we said earlier, we are active money managers. We will at times have a large defensive cash position combined with exchange-listed warrant positions as a way to manage risks and volatility and to capture opportunities.

Martin Weiss

We had the opportunity to visit with Martin Weiss, editor of SafeMoney. (See MartinWeiss.com and MoneyandMarkets.com.) while attending an investment conference in Las Vegas in May 2006 and had a great discussion on the benefit of warrants, the markets and the opportunities for warrants in investors’ portfolios.