Zinc prices will edge higher over the remainder of 2020, continuing a strong rebound from the lows posted during the initial covid-19 outbreak, according to Fitch Solutions’ latest industry report.

Zinc prices fell by 17.3% over the first three months of 2020, but have since recovered to post new highs for the year.

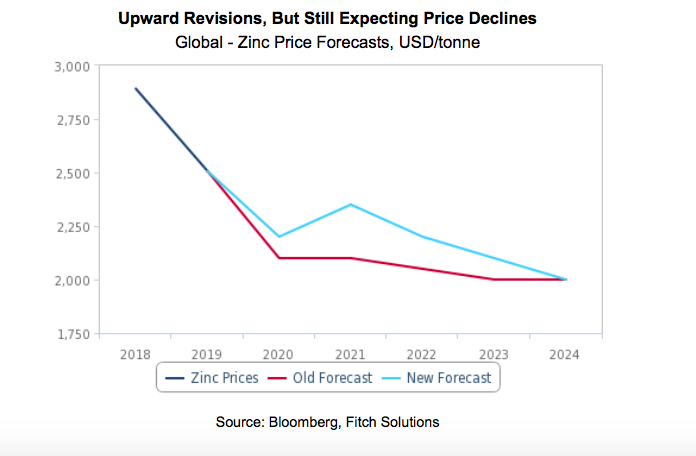

Three-month zinc price averaged $2,121/tonne over the first eight months of 2020 and Fitch has revised its forecast for 2020 as a whole, up from $2,100/tonne to $2,200/tonne.

Fitch says this implies prices will rise to around $2,600/tonne by the end of the year.

Fitch forecasts global zinc consumption growth to slow from an average of 2.2% y-o-y over 2010-2019 to an average of 1.1% y-o-y over 2020-2029

Fitch has turned more positive on zinc prices over the near term due to a stronger-than-expected rebound in economic activity in China since Q12020.

The analysts maintain revised 2020 real GDP growth forecast of 2.2% (from 1.1% previously), with high frequency data affirming Fitch’s view for economic activity to recover more quickly than anticipated.

Fitch expects a V-shaped recovery for China, as Beijing is likely to increase policy support if the recovery loses steam. China accounted for just less than half of global zinc consumption in 2019.

Longer term downtrend

Government economic stimulus in China will continue to underpin

a strong rebound in steel production and zinc demand that will persist into 2021, Fitch forecasts.

Economic stimulus measures announced at the China National People’s Congress meeting in May amounted to around 7.5% of annual GDP. While smaller than both the 12.5% of GDP package implemented during the Global Financial Crisis and the spending implemented by several other countries including the US and Singapore (around 20% of GDP), Fitch says these measures should boost demand for steel from key sectors such as construction and manufacturing over the remainder of 2020 and into 2021.

Fitch expects a long-term structural downtrend in zinc prices, forecasted to begin in 2021.

Although Fitch revised up its price forecasts, the market analyst expects prices to peak in 2020-21 and for market oversupply to drag prices down thereafter. This structural decline will be driven by sluggish growth in global steel production, as galvanising steel is the primary use of zinc.

Fitch forecasts that after a rebound in 2021, annual steel production growth will steadily slow down in the coming years due to declining capacity increases in China and Europe. In China, escalating environmental restrictions on producers and weakening demand growth from the construction sector will cap steel production growth rates, Fitch says, while European producers will cut production in the face of low steel prices.

Given this weakening backdrop, Fitch forecasts global zinc consumption growth to slow from an average of 2.2% y-o-y over 2010-2019 to an average of 1.1% y-o-y over 2020-2029. The slowdown in consumption growth will keep the market in surplus over the coming years, Fitch says.