Vale (NYSE: VALE) is preparing to potentially shut down its nickel and cobalt operations on the Pacific island of New Caledonia after failing to reach an agreement on the assets sale with Australia’s New Century Resources (ASX: NCZ).

The Melbourne-based zinc producer first announce its intention to acquire a 95% stake of Vale Nouvelle Calédonie (VNC), the operator of the troubled Goro nickel-cobalt mine, in May. A final decision on the transaction was expected in July, but was later deferred to September.

New Century said in a separate statement that its business analysis had concluded there was “strong potential” for sustainable long-term operations at Goro. Negotiations with various stakeholders, however, did not lead to a worthwhile venture, it said.

Vale, the world’s largest nickel and iron ore producer, noted it continued to explore alternatives for the assets, all of which include the company’s exit. It also said it had already begun taking steps for a potential shutdown.

VCN, the world’s No. 1 nickel operation, has proven a financial burden for Vale since it began operations two years behind schedule in 2010.

Mounting issues, including a $1.6 billion-write down related to the ailing mines, pushed the mining giant to announce its intention to exit New Caledonia in December.

Vale cut in April its 2020 nickel production guidance to 200,000 – 210-000 tonnes per year from 240,000 tpy to account for the anticipated loss of VNC’s 60,000-tpy output.

Shortly after, the miner revealed it had received non-binding offers for VNC, which includes the Goro mine, a processing plant and the port of Prony.

Goro’s potential

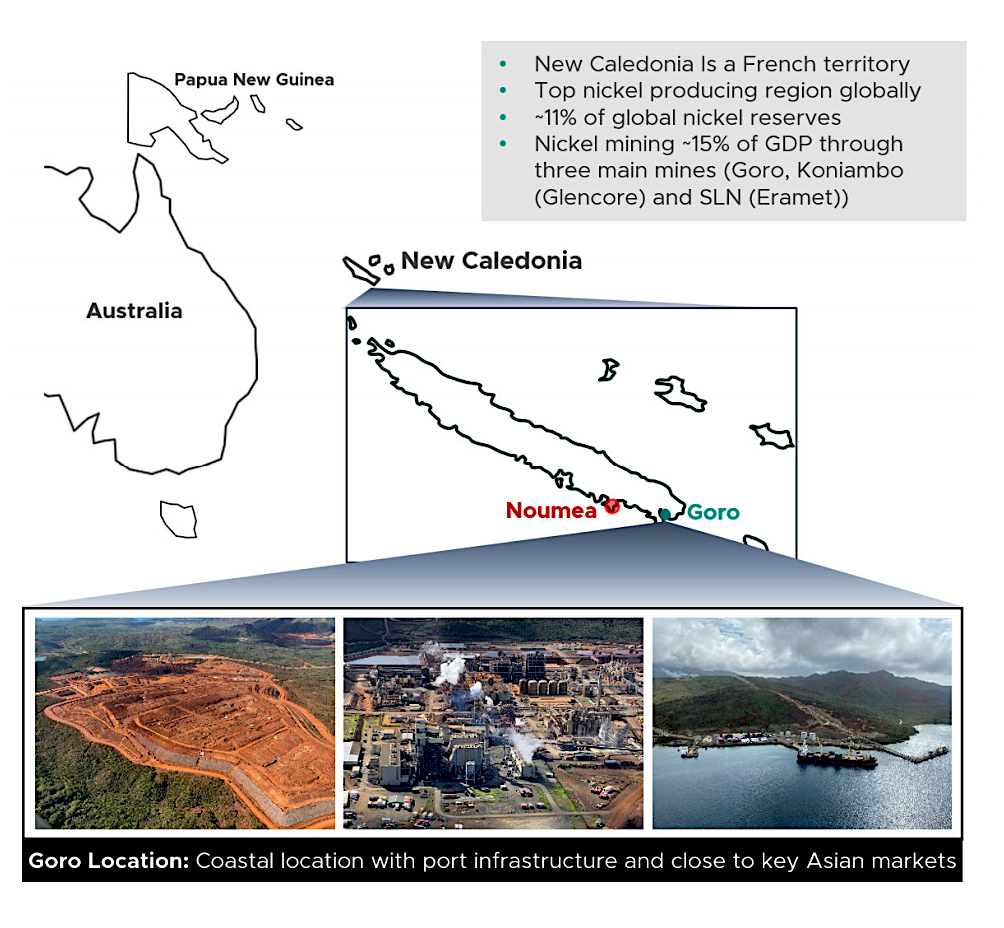

The Goro operation includes a mine, processing facility and port, located on New Caledonia, a French territory which is a top nickel producing region globally.

Prices for the silvery-white metal has been hovering at their highest level in eight and a half months, around $10.25 a tonne in the past few weeks. The surge was partly triggered by a sharp production decrease in the Philippines, the world’s biggest exporter of the material.

Analysts estimate the nickel market could face a shortage as soon as 2023. A recent announcement by Tesla boss Elon Musk aimed at locking supply of the metal used in the batteries that power its electric vehicles (EVs), seemed to confirm shortfall fears.

Musk promised a millionaire contract to any company able to provide Tesla with sustainable nickel, which helps cram more energy into cheaper and smaller battery packs, allowing EVs to charge faster and travel farther between plug-ins.

While Goro has the capacity to produce 60,000 tpy of nickel in the form of nickel oxide, it has never performed to full capacity due to design flaws and operational commissioning issues.

Las year, the mine churned out just 23,400 tonnes of nickel, slightly over a third of its annual capacity.

Had the transaction gone through, it would have become a major supplier of nickel and cobalt sourced from outside the Democratic Republic of Congo. The African country is currently the world’s biggest supplier of cobalt for the EV sector.