Source: Peter Krauth for Streetwise Reports 09/02/2020

Peter Krauth discusses the Fed’s inflation target and what that means for gold.

Make no mistake, higher gold prices are coming.

By pulling yet another arrow from its quiver, the Fed’s just helped move us closer that target.

The Fed wants inflation, so it’s going to get it. Problem is, we the people, will have to live with it.

Fed Chair Jerome Powell told us last week they will let inflation run higher than “normal” to make up for stubbornly “below average” inflation for some time.

It’s one more reason investors need to ensure they have exposure to real assets that provide protection from inflation.

Of course there’s raw land and real estate, collectibles and fine art. But these are typically illiquid, out of reach, or fully valued in many places the world over.

Meanwhile, precious metals are arguably much closer to inflation-adjusted all-time lows, as I’ll show you.

And that makes gold a must-own asset for years to come.

Overshooting Inflation, And Then Some

When Jerome Powell recently gave his Jackson Hole speech, he confirmed the trial balloon he’s been floating for some time.

Until now the Fed’s target was 2% inflation. If it went above, they’d cool it off by raising rates. But official rates have been so low for so long, and still that target has remained elusive.

To dial things up a notch, Powell has said the Fed will let inflation run above 2% for some time in order to make up for extended periods below that level. That’s the often mentioned “symmetrical” 2% target.

As a result, rates will stay near zero for some time yet to help achieve those results. With a pound of flesh ripped out of the economy from pandemic shutdowns, unemployment has reached historic highs. So the Fed needs to “do something.”

And we’re well on our way…

Already this past June alone, the U.S. printed more money than in the first 203 years of its history. Over $10 trillion in stimulus has been approved.

You can bet more is on the way. And that’s just in the U.S.

In the immediate wake of Powell’s announcement, bonds sold off, but gold and silver were only initially weaker. By the next day, gold and silver had pushed higher.

The dollar was unable to rally despite U.S. Treasuries markedly selling off.

But the biggest takeaway is clearly how gold and silver held up strongly even as bond yields rose.

It’s a massive signal for a weaker dollar over the longer term.

Gold’s Real Value

The U.S. Dollar Index broke down below its long-term support back in July.

That’s a strong bullish signal that the dollar will continue to weaken over the long term.

However, the very near-term picture is different.

As we can see, despite the downward leg since late July, both the RSI and MACD momentum indicators show positive divergence as they’ve been rising. That suggests a potential relief rally in the dollar over the next few days or weeks.

If that plays out, I’d expect gold and silver to suffer some limited short-term weakness. And that would likely be an excellent opportunity to buy.

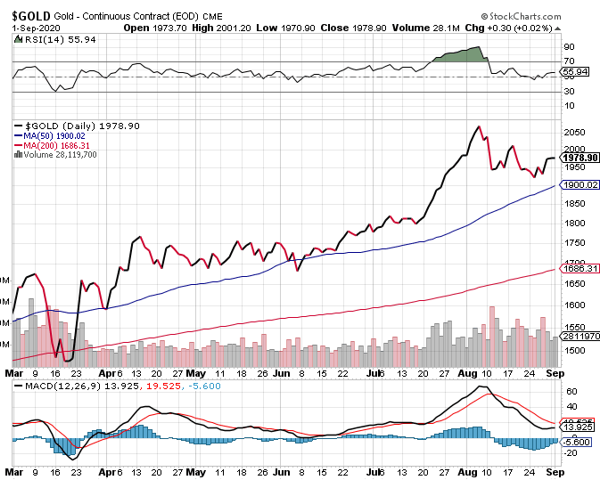

We can see that gold has struggled since hitting its all-time nominal high of $2,067 in early August.

So far, it’s formed a series of lower highs and lower lows, with spot gold ending August slightly down.

For the time being, gold still looks challenged from a technical perspective.

Still, I see much higher gold prices ahead once the current consolidation ends. Here’s why.

This chart shows the Shadowstats.com alternate inflation adjusted gold price. If inflation were calculated the way it was prior to 1980, it would be reported as having averaged about 8% annually since then.

Source: www.goldchartsrus.com

Here’s the thing. Gold’s 1980 peak in today’s dollars was actually an eye-watering $18,000. Yes, you read that correctly. $18,000 per ounce.

I’m not saying gold’s going there… but I’m also not saying it isn’t.

After all, a Fed still willing to keep rates near zero for an extended period, now overshooting inflation to compensate, and tens of trillions in stimulus dollars headed our way should eventually get the job done.

In this context, soaring gold doesn’t sound outlandish at all.

Own gold.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.