Copper once again cleared the psychologically important $3 a pound level on Thursday on the back of falling inventories, booming Chinese demand and pandemic hit supply from South America, the US and Africa.

Copper for delivery in December trading on the Comex in New York exchanged hands for $3.0120 a pound ($6,605 a tonne) in morning trade, bringing gains for 2020 to more than 8% and a mouthwatering 52% since the covid-19 lows struck in March.

“China is importing more refined metal from nearly every country suggesting a structural shift not a temporary change”

Jonathan Barnes – Roskill

A new report from Roskill suggests the rally in copper – which has surprised many with its speed – has further to go.

Jonathan Barnes, associate consultant for copper at the London-based metal and minerals research firm, says while the effects of covid-19 could decrease world consumption of the metal by 3%–4% this year, the drop in mine output and scrap flows has been greater.

Signs of panic buying

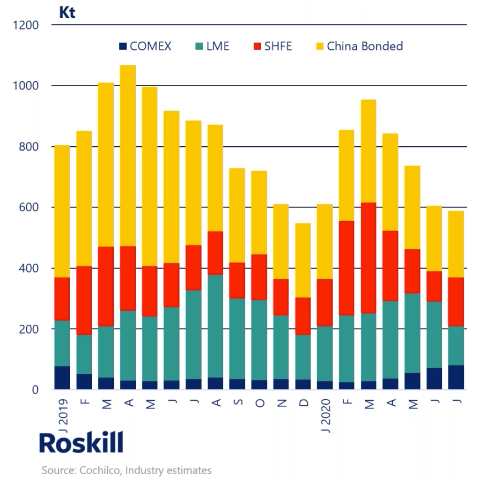

The effect of this is most visible in the fall in stocks around the world.

Total visible stocks globally, which include those on exchanges and bonded warehouses in China fell by 40% from March to end-July to below 600,000 tonnes. Inventories in LME warehouses are at 13-year lows.

China is responsible for more than half the world’s copper consumption and the country is sucking up copper at record-setting rates.

“China is importing more refined metal from nearly every country suggesting a structural shift not a temporary change,” says Barnes.

“If you are looking for signs of panic buying, you can find evidence of that in China – total Chinese stocks represent less than two weeks’ consumption at current rates of use.”

In the rest of the world, where demand has dropped by much more relative to China, stocks represent only one week of consumption.

Secondary shortfalls

The lack of available scrap – imports are down 50% in the first half – after Beijing delayed new importing rules, has forced the Chinese buyers to replace secondary sources with cathode, further driving down visible inventories.

Roskill estimates a roughly 300,000 tonne shortfall in imports of secondary materials – scrap, ingots and granules – into China in January to July.

Barnes believes global scrap flows may not normalize until the first quarter of next year, but would depend on new rules in China.

Barnes says Roskill’s sources have not been able to confirm that China’s State Reserve Bureau has been buying up strategic stocks of copper, “but if they were, they probably would have done so earlier, when prices were much lower.”

Two-year restocking cycle

Disruptions to mine supply could be between 750,000 to 1 million tonnes in 2020, with eight out of the 10 largest miners recording lower output during the first half of the year.

China’s concentrate imports are down year on year while sourcing anodes and blister from the central Africa copper belt is also hitting roadblocks.

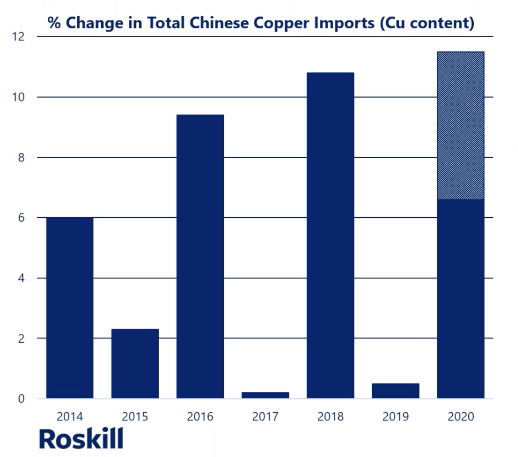

Barnes says China’s two-year restocking cycle is rising in amplitude as the country’s dominance in the copper market increases and he expects an 11.5% rise for the full year in copper imports.

The country has a structural copper market deficit and it restocks whenever LME prices appear attractive. Moreover, says Barnes, China can take a long term view and use tomorrow what it does not need today.

Roskill expects trade data to show another bumper August for imports, despite being a seasonally muted month for shipments.

Parallels to post-GFC

Barnes says the copper price will likely rise further towards the end of 2020, and that the current environment has strong parallels to the rebound in the copper price after the global financial crisis.

Copper hit a low of $1.32 a pound in January 2009, then surged to $3.55 by April the next year on its way to an all-time peak of $4.58 (more than $10,000 per tonne) in February 2011.