Source: Maurice Jackson for Streetwise Reports 08/21/2020

The CEO of Skyharbour Resources, Jordan Trimble, sits down with Maurice Jackson of Proven and Probable to discuss his company’s exploration and prospect generation activities in the uranium-rich Athabasca Basin, as well uranium’s supply and demand dynamics.

Maurice Jackson: Joining us for a conversation is the CEO of Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB), Jordan Trimble.

Pleasure to speak with you. Sir. Let’s get shareholders up to speed on several accretive moves that Skyharbour has been making since we last spoke in April. Before we begin, Mr. Trimble, provide us with a brief overview of Skyharbour Resources and the opportunity the company presents to the market.

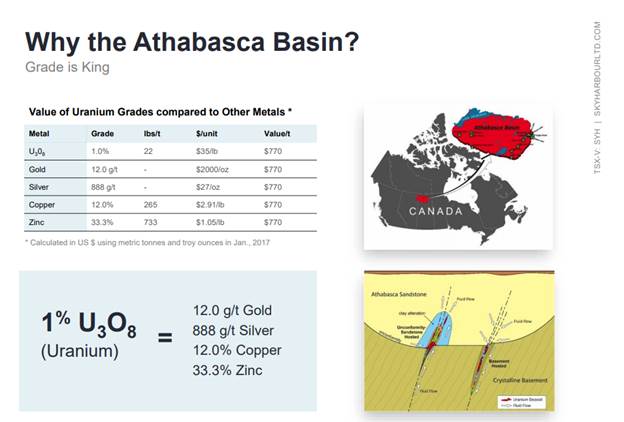

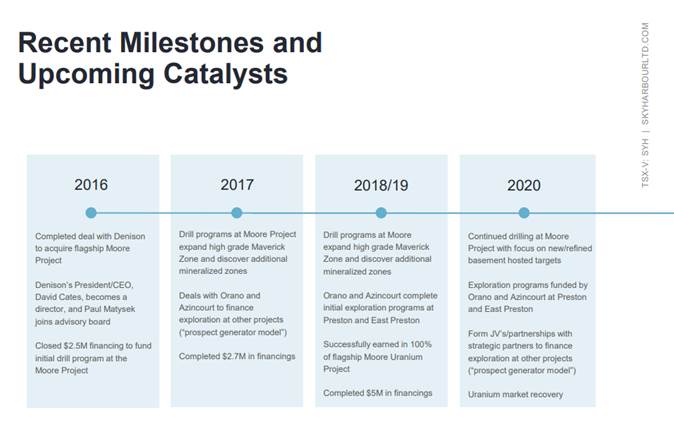

Jordan Trimble: Skyharbour Resources is a high-grade uranium exploration and early-stage development company with several projects scattered throughout the Athabasca Basin, the highest-grade depository of uranium in the world. We have projects on the infrastructure-rich east side of the basin, including our flagship Moore project, where we’re about to commence a summer drill program. And it’s been the focus of most of our exploration work over the last several years.

We’ve had high-grade results, including a 21% U308 over a 1.5 meters in historical drill holes. And we’re looking to add to that with the upcoming drill program, which will predominantly be focused at the Maverick quarter. And then, secondly, we do have a prospect generator component of the business.

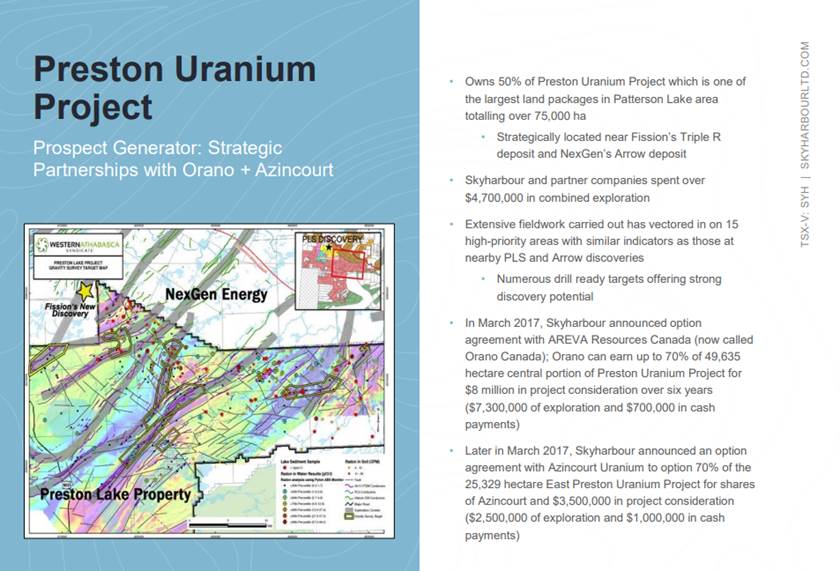

So with our large portfolio of properties, we look to bring in option partners and strategic partners to come in and advance our other projects while we focus our efforts on our flagship Moore Project. And we’ve consummated two deals and have two partner companies, one of which is France’s largest uranium mining company, Orano, that is currently working at our Preston project, and another company, Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC), which is actively exploring our East Preston project. And we should hopefully have some news out on additional partner companies coming in on some of our other projects in the coming months.

Maurice Jackson: I referenced the accretive moves that you’ve been making to increase shareholder value. And we’ve also just referenced the impressive property bank. It’s loaded with potential. You have projects in the Athabasca, which holds the highest-grade uranium in the world. Take us to the East Preston and get us up to speed on the developments there.

Jordan Trimble: Azincourt is our partner company on the East Preston. It has been advancing that project over the last several years as a part of a 70% earn-in that it has. And just to recap that earn-in option: it’s almost complete. Azincourt has a summer program that it will carry out. It will start in the next few weeks here to complete the exploration expenditures at the project. We did extend the earn-in for this project by a year.

And in return, we received 2.5 million shares, and Azincourt also has to make a $200,000 cash payment. Therefore, we do generate some revenue from that with option payments coming in. Azincourt’s plan is some geophysics and some fieldwork this summer, and that will help define drill targets and further refine drill targets or drilling later this year, early next year.

And then as a segue, we have Orano, a strategic partner, working at our Preston project, which is adjacent to East Preston. This is over on the west side of the Athabasca Basin near Fission and NexGen. Orano, earlier this year, finished a large geophysical and field program and is just waiting to get the final report there with some guidance for upcoming work programs later this year and into the new year. And that earn-in option is 70% earn-in. And then to complete that, Orano has to spend $8 million over six years, the bulk of which is in exploration expenditures.

Maurice Jackson: I like the modest way that you just conveyed the success of your business acumen. Readers should note you were able to get shares and capital without diluted Skyharbour’s shareholders. Impressive. That’s important for a shareholder to note and you just skimmed over it like it was nothing.

Jordan Trimble: Thank you. It’s important given the size of the property package that we have well over half a million acres of ground in six drill-ready projects, again, scattered throughout the Athabasca Basin. We’re one of the few junior companies that have an NI 43-101 compliant resource, but our efforts and focus remain at our flagship Moore project. That’s where we have, we believe, the best prospectivity, the best geology, and the best potential for additional high-grade discoveries to be made.

And so it serves us well to have partner companies come in. It also allows us to leverage other technical teams and geologists, which is always key. It brings some new ideas to the table. And, as I mentioned, we’ve been working on bringing in additional partner companies on some of our other 100%-owned properties in the basin.

Maurice Jackson: We’re going to get to the flagship Moore Uranium Project shortly, but sticking with the East Preston, there was some geophysical target work being conducted. Do we have any updates? And when will results be released?

Jordan Trimble: We are expecting the program to commence, as I mentioned, fairly soon. It probably shouldn’t take too long. I believe the budget’s about $150,000 to $200,000. And what we’re looking for, what Azincourt is looking for there, are additional drill targets on some of the conductive corridors that it can go and drill once the ground’s frozen later this year and early next year.

Maurice Jackson: All right, let’s visit the flagship Moore Uranium Project. You’ve had some activity there recently, in particular on the Maverick East Zone. What can you share with us, sir?

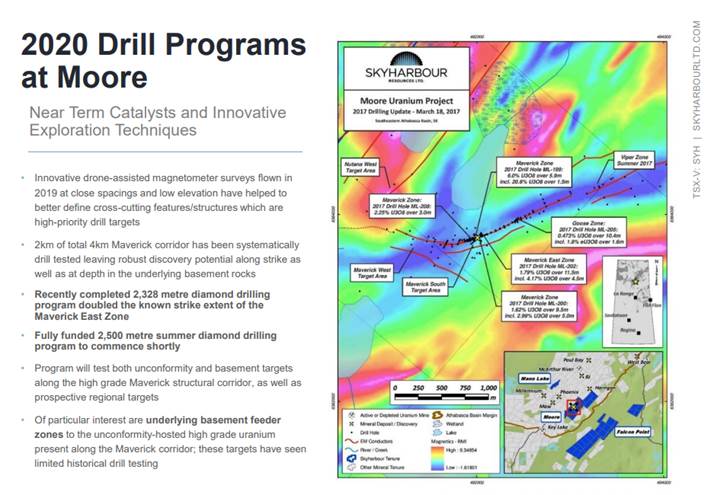

Jordan Trimble: We announced our results from our winter drill program earlier this year. And we were successful in doubling the strike and extent of our East Maverick zone and the basement rocks. You’ll recall from previous interviews, that’s been a focus for us. We have high-grade pods or lenses at the unconformity in the sandstone, and a little bit of mineralization. That’s been discovered previously in the basement rocks, but below the unconformity, but there hasn’t been a lot of exploration and drilling into the underlying basement rocks at this project.

And that’s intriguing to us in that’s where a lot of the recent notable high-grade discoveries in the Athabasca Basin have been found. And so we know that there’s high-grade mineralization at the unconformity or just above. We will continue to look for additional high-grade pods in the sandstone and at the unconformity. But we believe within the feeder zones in the basement rock, there’s a lot more mineralization that’s yet to be discovered.

And so that’s where we’ve been focusing our efforts. We announced the results a couple of months ago now, and we have plans for a 2,500-meter drill program, which will start up toward the end of August. And the focus there will continue to be on this main Maverick corridor. It’s about a 4.5-kilometer long conductive corridor. We have several high-grade zones along with it. But only about half of it’s been systematically drilled.

So we’re going to go back in. We’re going to continue drilling at depth into the basement rocks at the Maverick and East Maverick zones, but we’re also planning to test a zone about 1.5 kilometers along strike up to the northeast called the Viper zone. And there’s been some historical drilling there, some good high-grade results, but not a lot of follow-up work. So we’re excited to get back and drill test that target as well as several others.

It’s a big property, just over 35,000 hectares. There are lots of regional targets. And it’s great because it’s proximal to infrastructure. We’re about 15 kilometers due east of Denison Mines’ flagship project, the Wheeler project; Denison is our largest strategic shareholder. So it’s ideally located on the infrastructure side of the Athabasca Basin.

And we think there is, as I mentioned, a lot more mineralization that we can discover with more drilling. We’ve done a fair bit of work geophysics and some more groundwork in geological modeling over the last couple of years to refine these basement host targets. And we are working toward a maiden resource estimate, which we’re hoping to have out toward the end of the year.

Maurice Jackson: To summarize the strike zone has been doubled. You’ve got basement rock, and you’ve got unconformity. Talk to us about the unconformity, and why that’s important to the value proposition before us.

Jordan Trimble: Not to get into too much technical or geological lingo, but in the Athabasca Basin, it’s a sedimentary basin. You have the sandstone above. It’s like a big bowl. And then you have the contact with the underlying basement rocks and that’s called the unconformity. You find a lot of high-grade mineralization and uranium at the unconformity. You can have it in the sandstone above, which is interesting because some new mining methods are being proposed for deposits in the basin that would take advantage of this like ISR and SABRE, but there’s higher-grade mineralization that can also be discovered in the underlying basement rocks.

And a couple of notable deposits include NexGen’s, as well as Fission’s and the Griffin deposit at Denison’s Wheeler project. These are basement hosted deposits that have been recently discovered. So, you have a couple of different deposit models and on our project, as I mentioned, a lot of the historical drilling and work, and a lot of the drilling that we’ve done over the last three years, has been focused on mineralization at or above the unconformity. So we’re now just taking a look a little bit deeper at about 300 to 400 meters vertical depth and looking for higher-grade mineralization structures in the basement rocks.

Maurice Jackson: Leaving the property bank and turning our focus to the uranium sector. Jordan, what has your attention, and why?

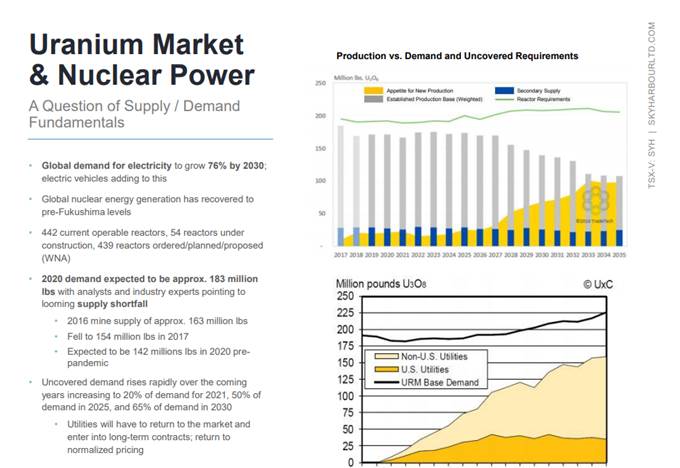

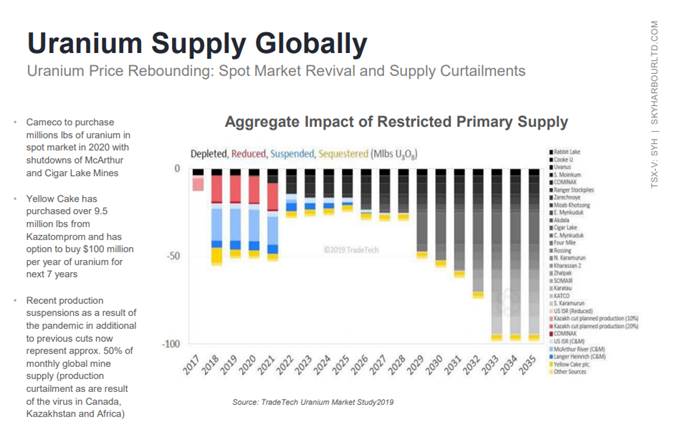

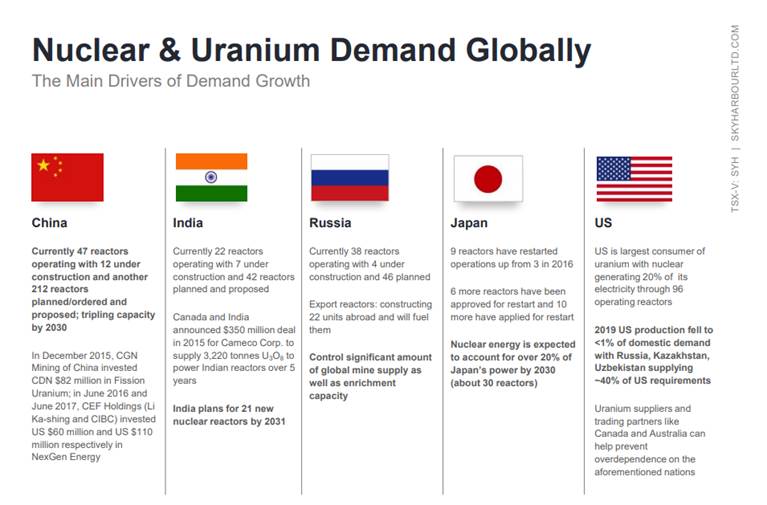

Jordan Trimble: Well, a lot’s happened in the last four or five months. We’ve covered a little bit of it in April when we spoke. There’s been a major, major supply-side response that’s played out in and a rebalancing of the market. We now see a pretty significant supply deficit forming. You have about 180 to 190 million pounds of annual demand, which has been relatively unaffected by the pandemic. Nuclear power is one of the last sources of electricity generation that will be impacted because of the pandemic.

It’s not easy shutting down a large nuclear reactor; intermittent sources of electricity would be the first to go. So the demand side, I think will continue to be relatively stable. You may see a small decrease just due to lower economic activity and output. But on the supply side, we’ve seen major supply disruption with the pandemic.

We’re now looking at a potential primary mine supply of about 110 to 120 million pounds. Now this will all depend on additional news coming out of Kazakhstan. That’s something to keep an eye out for. Kazakhstan, being the largest producer of uranium globally, usually accounts for about 40% of primary mine supply. Unfortunately, the country’s been hit quite hard by the virus. We’ve seen an initial announcement back in April on the supply curtailment from Kazakhstan. We’re going to probably get some more guidance from them in the coming weeks here, but I’ve been hearing that it hasn’t been good.

They likely won’t be able to ramp up to their pre-pandemic production levels for a while. And it’s not just the production curtailment that they’ve announced and that we’ve seen, but it’s also going forward because these are ISR operations, their wellhead development, their drilling has been incapacitated over the last several months. So that will affect their ability to ramp production back up.

So I think you’re going to see an extended timeline. You’re going to see lower production profile out of Kazakhstan for a long period of time. And I think that that has yet to work its way into the market. We’ve already heard from Kazatomprom that they may, and I’ve heard more recently, they are buying material in the spot market to make up for the lost production.

We know that many producers have had to do that over the last several years, including Cameco, a major source of spot market demand over the last several years. And we will continue to see that. And I think there’s a couple of key points just to summarize all of this. And Cameco mentioned this in its recent quarterly call, that the industry is heavily reliant on supply that’s highly concentrated, both geographically and geologically, and that the risks to supply are far greater than the risks to demand.

And that’s something keep in mind for this industry, and for this commodity going forward, that any supply disruption you do see it work its way into the market relatively quickly, and it can have a major impact. And, with the pandemic, we’ve seen that in this space. And April, when we last spoke, was one of the busiest months in the spot market. The spot market volume, I think amounted to about 25 million pounds, which is one of the largest in history, and cleaned out the market. We saw the price jump up from the mid-$20s to, briefly, the mid-$30s. It’s settled in back around $33 a pound. And it’s built a nice base here. Seasonally, the summer is a bit slower. So it’s not surprising to see the price settle in there, but I do expect that come the fall, we could see another month much as we saw in April, and we could see the next leg up.

There’s a mismatch between deliveries and production and supply toward the end of the year. Investors could see producers that are having to buy in the market to meet their deliveries like Cameco and others that have had to curtail production. You could see them buying more aggressively toward the end of the year to make sure that they don’t default on any contract deliveries, which they can’t do. So keep an eye out for that.

One of the other things more focused in the U.S. is the RSA, the Russian Suspension Agreement extension. We could see, again, this 20% cap on uranium imports from Russia to the U.S. extended out. That would be quite positive for Canadian, American and Australian companies. The U.S., which again is still the largest consumer of uranium globally, with its nuclear fleet having to source material, continue to source material from allies like Canada and Australia and domestically.

The bottom line is there are several key upcoming catalysts and this major supply deficit that we’ve now seen formed because of the supply disruption due to the pandemic and due to low prices. You’ve got to remember there was a lot of production that went offline over the last several years simply due to the low uranium price. And we’re still nowhere near the average all-in global cost of production. So I do see there is more room to move for this commodity.

Maurice Jackson: If readers want to take a look at Mr. Trimble’s pedigree, take a look at our interview back in October. You referenced that there was going to be a move in the spot price. It was $24 at the time. The uranium spot price has risen to the mid-$30s here. You were spot on. I’ve got to commend you on that. That’s more than a 25% move there. And you made that call right here on Proven and Probable.

Jordan Trimble: I think it’s just the first leg up. I think you could see a much higher of a price come to fruition over the next, call it 6 to 12 months, especially as we see this supply-side response work its way into the market. And again, as I said, we’ll see what happens in Kazakhstan. I think that’s key to watch what unfolds there. If they can’t ramp back up quickly, much like Cameco has had to do in the last few years, they’ll be a buyer in the spot market.

And then last but not least, a utility interest. We’ve seen several RFPs recently, and utility interest peeking or poking its head up a bit. And that’s key because utility contracting typically, and historically, is what drives the price. And we haven’t seen much of that over the last several years.

I think in the next 6 to 12 months, you’ll see these utilities enter into new long-term contracts at much higher prices. We know that the mining companies aren’t willing to budge on a price given that there’s been a low spot price. We’ve had a bit of a stalemate over the last several years with purchasing managers at utility companies and the uranium mining companies. But I think the miners are holding the hammer here. And eventually, we will see some major contracts announced and at much higher prices, which will be positive for the sector going forward.

Maurice Jackson: And what kind of contract prices are you seeing right now?

Jordan Trimble: Well, several recent contracts you do have the long-term contract price. It’s in the low to mid-$30s, but there are several contracts as well that they don’t disclose the price on. And so there’s been a handful of those that we can only speculate on what the price is. But my guess is you’re going to start seeing several contracts signed at a pretty significant premium to where the current spot and term price is. We know that the mining companies have been reluctant to sign anything less than $40 a pound. So I would expect over the coming months, especially as these utilities need to shore up supply, they need to restock inventories, you’ll see them pay higher prices.

Maurice Jackson: Those are some very encouraging numbers, in particular, if you’re a shareholder of Skyharbour Resources. Sir, in closing, multilayered question: what is the next unanswered question for Skyharbour Resources? When can we expect a response and what determines success?

Jordan Trimble: The big thing for us over the next three to four months is the drill program at our flagship Moore project results, which will likely be coming out in October and November and our partner companies, Azincourt, Orano, and potentially new partners coming in. Their exploration programs over the next several months and the resulting news flow from those programs. And then as we just covered, we’ll see what the uranium price does. But as we’ve talked about previously, there are not many pure-play uranium companies left. So Skyharbour does offer investors exposure to a commodity that I think is in the early innings of a bull market.

Maurice Jackson: In closing, no, actually let me do this. Three, two, one. I’m on record for sharing this with a number of my subscribers. You know, there’s a change occurring in the natural resource space as a number of the CEOs here are in their last portion of their tenure in their careers. And we now have to look to the future and the future is: who is going to be the new, young CEO that has the promise, that has the potential. And I believe we’re listening to one right here in Mr. Jordan Trimble. I have shared that with a number of my subscribers. Sir, I think your outlook here in this industry is going to be a very rewarding one, and in particular, for those that have the courage and conviction to move forward with you. And we certainly are. We’re proud shareholders. Mr. Trimble, if investors want to get more information about Skyharbour Resources, please share the contact details.

Jordan Trimble: I appreciate that. And the best way to get some more information on the company is to go to the website, skyharbourltd.com. I’m very accessible. All of our contact info is on the website. So happy to chat with anyone on the company.

Maurice Jackson: Mr. Trimble, it’s always a pleasure to have you and Skyharbour Resources on our program. Wishing you the absolute best, sir.

And as a reminder, I’m the proud licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio, from physical delivery, offshore depositories, precious metal IRAs and private blockchain, distributed ledger technology.

Call me directly at 855-505-1900 or you may email maurice@milesfranklin.com. Finally, we invite you to subscribe to www.provenandprobable.com.

Jordan Trimble of Skyharbour Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Skyharbour Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Skyharbour Rresources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Azincourt Energy. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources and Azincourt Energy, companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

( Companies Mentioned: AAZ:TSX.V; AZURF:OTC,

SYH:TSX.V; SYHBF:OTCQB,

)