Copper rose above $3 a pound for the first time in more than two years on Wednesday, boosted by a weaker dollar, low stocks and falling output.

Most actively traded copper futures for delivery in September added 1.5%, to $3.0190 a pound, surpassing the $3 level of June 2018.

Copper is now up about 8% for the year and 25% in the past three months.

China’s refined copper output in July fell 5.3% from the previous month to 814,000 tonnes, according to official data.

Meanwhile, the U.S. dollar hovered around a 27-month low on uncertainties about an economic recovery and the U.S. fiscal stimulus package.

A weaker U.S. dollar makes LME metals priced in the greenback cheaper for holders of other currencies.

Rio Tinto announced on Wednesday that has cut its refined copper outlook for the year to 135,000-175,000 tonnes from 165,000-205,000 tonnes.

“You have the perfect cocktail of price supporting factors with pick up in demand, supply issues, and expectations for a weaker dollar,” Saxo Bank analyst Ole Hansen told Reuters.

Chinese stimulus

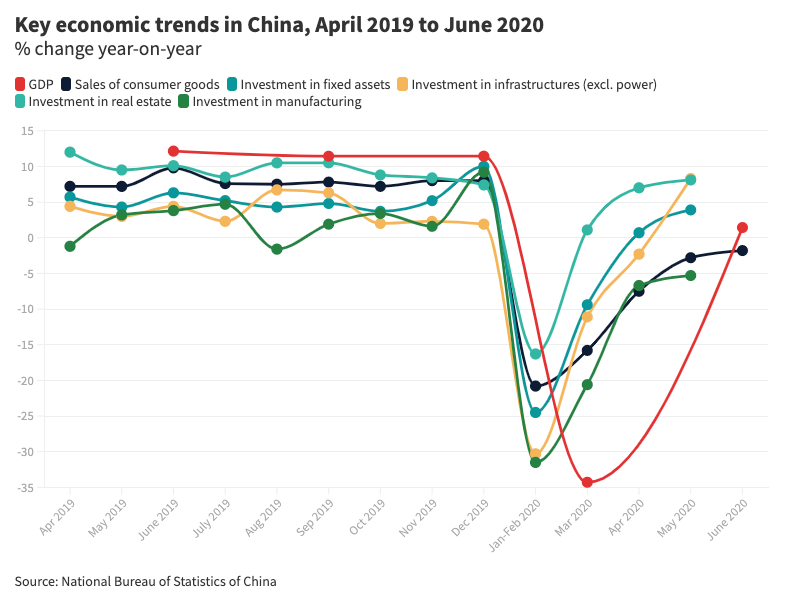

Copper prices have also been lifted by top consumer China, where unprecedented stimulus measures have increased demand for the metal widely used construction, transportation, industry and electrical grids.

Since the outbreak of the pandemic, Beijing has issued 4.75 trillion yuan ($683 billion) in local and national debt with a focus on encouraging infrastructure projects, according to China Dialogue.

As of the end of June, 63% of funds from local government special bonds had gone to infrastructure investments, primarily in transportation, civic infrastructure and industrial parks, according to figures from GF Securities.

China’s finance ministry has said that 700 billion of the 1 trillion yuan in national special bonds can be used as capital for infrastructure construction (the remainder is to be used for general pandemic-related spending).

Soaring imports

Customs data released last week showed China’s unwrought copper imports (anodes and cathodes) in July rose a stunning 81% from the same month last year to 762,211 tonnes and a full 16% above the previous monthly record set in June.

For the first seven months of 2020, imports are running at 21.7 million tonnes annualized, compared to 2019’s record-breaking tally of 22 million tonnes.

Over the first seven months of the year, imports totalled 3.6m tonnes, on track to easily beat 2018’s annual record of 5.3m tonnes.

July imports of copper concentrate rose by more than 12% from June’s 9-month low to 1.795m tonnes, but still down 13.5% from July last year, due to disruptions at mines in Peru, China’s top supplier.

(With files from Reuters)