Europe has now overtaken China – not long ago responsible for every other electric car sold worldwide – as the globe’s largest EV market.

Over the first seven months of the year, Europe’s electric vehicle sales (including plug-in hybrids) outpaced that of China reaching the half million mark thanks to record-breaking monthly sales of 53,000 units on the continent in July.

More remarkable considering Chinese so-called New Energy Vehicle (NEV) sales data also include fuel cell and commercial vehicles. July was also the first month of annualized positive growth in China with sales approaching 84,000 units – 48% year on year growth.

China still leads the charge in full battery electric vehicles however. According to Schmidt, a market researcher, for the year to end-July of this year, 269,000 BEV were sold in Western Europe compared to 373,000 in China.

More remarkable considering Chinese New Energy Vehicle sales data also include fuel cell and commercial vehicles

Recovery accelerates

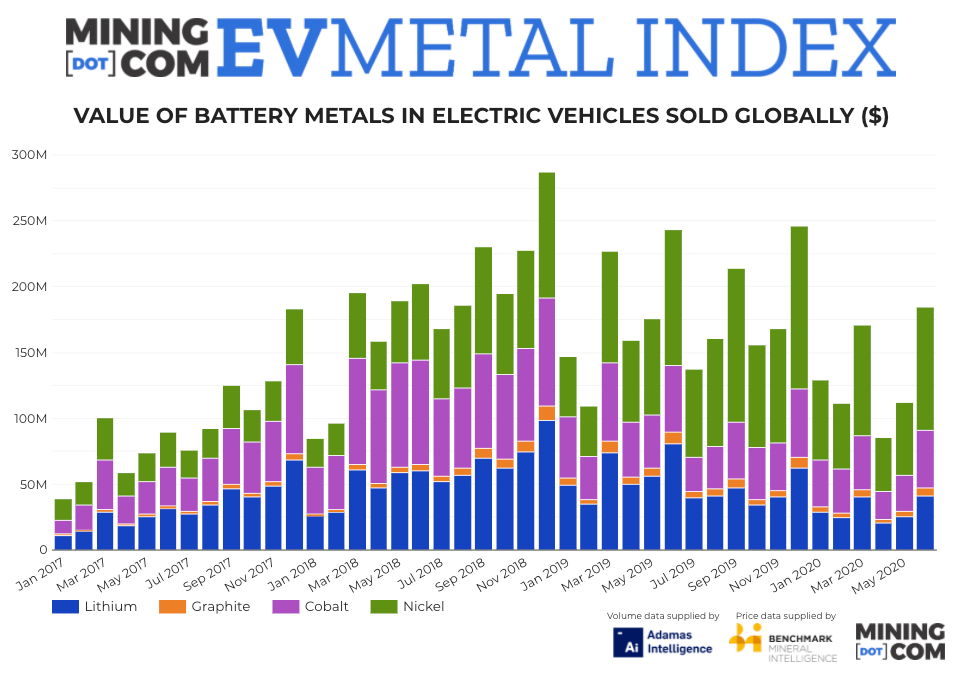

The MINING.COM EV Metal Index, which tracks the value of battery metals in newly sold passenger EVs around the world surged 64% in June, after dropping to its lowest level since January 2018 in April.

The jump in raw material deployed in June lifted the value of battery raw materials tracked by the index in newly-sold EVs to $184 million for the month.

At $794 million year-to-date, the index is still more than 25% below 2019 levels although, as testament to the youth of the electric vehicle market, is almost double the value of the same period in 2017.

Lithium and graphite prices eased again in June albeit slightly, while nickel and cobalt eked out a 2.4% and 3.2% month on month gains.

Nickel sulphate index prices climbed back above $14,500 a tonne (100% Ni basis) while sales-weighted cobalt chemicals used in the battery supply chain fetched some $31,300 according to Benchmark Mineral Intelligence data.

The deterioration in lithium prices has been relentless – trading at just over $7,000 a tonne in June from more around $11,600 the same month last year and more than $17,700 in mid-2018.

2020 vision is bright

Car sales are always lumpy and none more so than BEVs where changes in incentive schemes and government regulations play an outsize role in buying decisions.

Beijing deflated its domestic EV market in June last year when it unexpectedly slashed subsidies. In July last year the EV Metal Index tanked 43.6% following the incentive scheme adjustments, but with action shifting to Europe and more certainty about Chinese green car policies, the second half of 2020 should remain robust.

September could be the breakout month with volumes surpassing 100,000 units in Western Europe

According to Scmidt, September could be the breakout month with volumes surpassing 100,000 units in Western Europe – thanks to increased deliveries of Tesla on the continent and the launch of Volkswagen’s ID.3 which alone has racked up more than 30,000 in advance orders.

If Europe does go down this road, there is still a chance (granted an outside one) that 2020 could come close to the 2019 index which ended the year at $2.1 billion.

LFP gains

European carmakers favour higher energy density, longer-range NCM (nickel-cobalt-manganese) cathodes, which together with Tesla’s NCA (nickel-cobalt-aluminum) account for the vast majority of batteries in passenger EVs.

The continued adoption of nickel-rich cathode chemistries like NCM811 (which Tesla also uses in China for higher range models instead of NCA) also boosted raw material values per vehicle with the first half 2020 nickel sub-index surpassing the full year 2017 total.

The battery mix is likely to change this year, with LFP (lithium-iron-phosphate) units gaining market share, not least because Tesla has opted for this technology for its entry level Chinese Model 3s where range is less of a concern for motorists.

LFP batteries are significantly cheaper than NCM, but not likely to catch on outside China for light-duty vehicles, meaning market share growth should not come at the expense of cobalt, nickel and manganese demand.