Gold prices climbed back above the $2,000 an ounce level on Tuesday as renewed tensions between the US and China boosted demand for haven assets.

The US dollar also continued to decline, with the dollar index now at its lowest since May 2018, making gold relatively cheaper to hold than other currencies.

Spot gold was up 0.6% to $2,000.04 per ounce by 11:30 a.m. EDT after reaching intraday high of $2,014.70. US gold futures for December delivery also advanced by 0.6% to $2,012.90 per ounce.

“We’re getting back in the saddle,” Stephen Innes, chief market strategist at AxiCorp Ltd., said in a note. “After plunging 10%, washing out leveraged players and retail buyers who arrived late to the party, gold has made an enduring comeback.”

Bullion has surged over 30% this year on the back of massive stimulus measures from central banks and governments trying to help economies recover from the covid-19 pandemic. The metal is often considered a hedge against inflation and currency debasement during times of economic uncertainty.

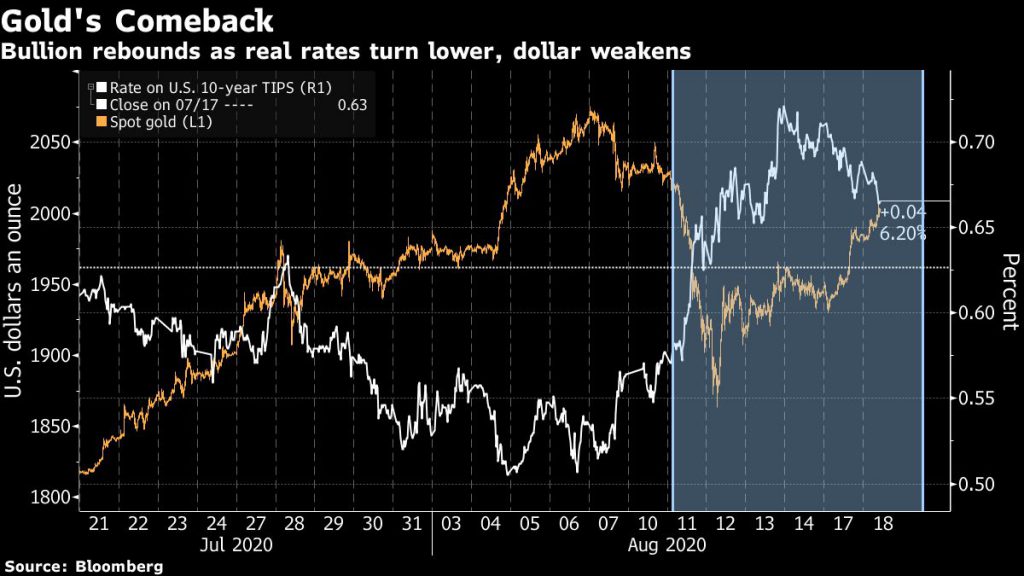

Earlier this month, the price of gold rallied to an all-time high before posting its first weekly drop in more than two months due to an uptick in real yields.

“It’s really is about the return or the perception of a return,” Michael Hewson, chief market analyst at CMC Markets UK, told Reuters. “The dollar has lost its attraction when it comes to return now relative to two years ago.”

Gold, with its reputation for relative safety, is also drawing investors as the United States ratchets up pressure on China’s Huawei, Hewson added.

On Monday, gold jumped as much as 2.4%, drawing momentum from investment guru Warren Buffett’s Berkshire Hathaway buying a surprising stake in major gold miner Barrick Gold.

The top gold-backed exchange-traded fund — SPDR Gold Shares — also expanded to 1,252.38 tonnes with an estimated value of $80.86 billion held in trust.

As real interest rates remain below zero and investors expect more stimulus measures, analysts including those at Goldman Sachs Group see further increases for gold. Last week, Goldman’s Jeffrey Currie said “we’re not out of this crisis yet,” with the potential for stimulus to last into 2021.

(With files from Bloomberg and Reuters)