Nexus Gold Corp. [TSXV:NXS, OTC:NXXGF, FSE:N6E] is pleased to report it has received initial assay results from the first six holes of the recently completed phase one drill program at the Company’s 100% owned McKenzie Gold Project, located in Red Lake, Ontario.

This first round of drilling conducted in the St. Pauls Bay area was designed to test depth extensions of surface rock sampling conducted by the company in June and November of 2019, and to test historic drill intercepts encountered by the properties previous owners in 2001-2005.

Of the first six holes drilled (784 total meters), six returned elevated gold assays while the last three holes MK2020-004, 005, and 006, all contained zones reporting visible gold. Significant gold results were returned from hole MK 2020-006 which intersected a zone containing a blue gray quartz vein and returned values of 13.25 grams-per-tonne (“g/t”) gold (“Au”) over 2.75 meters from 68.75 to 71.50 meters, which includes one meter of 36.20 g/t Au.

Drill holes MK-2020-005 and 006 were drilled from the same location and successfully intersected the same blue grey vein in both holes, the vein was intersected at 44 meters in hole MK 2020-005 and at 69.5 meters in hole 006. Based on these findings the company decided to expand its drill program from 1000 meters to 2000 meters and continued drilling. Results from the remaining seven holes (MK-2020-007 to 013), approximately 1,200 meters, are currently pending and expected later this month.

“We’re pleased with the progression of the results received from the first few holes,” said president and CEO, Alex Klenman. “These initial holes produced similar results to historical drilling in the same area, i.e. narrow intercepts of 1 to 7 g/t gold over various lengths between 1 and 4 meters. Holes 5 and 6 began showing greater concentrations of these types of intercepts, culminating with the best result of 13 grams over almost 3 meters. Results were getting more interesting the further we got into the drill program, so naturally we’re eager to see what the next batch of assays reveal and to see if we can both extend intercept lengths, and continue to see additional significant mineralization,” continued Mr. Klenman.

| Hole ID | UTM E | UTM N | DIP | AZIMUTH | ELEV | FROM | TO | LENGTH (METERS) | Au G/T | |

| MK-20-001 | 437729 | 5652199.7 | -50 | 360 | 382 | 41.25 | 41.75 | 0.5 | 5.75 | |

| 86 | 90 | 4 | 1.41 | |||||||

| Including | 89 | 90 | 1 | 4.30 | ||||||

| MK-20-002 | 437601 | 5652153.5 | -50 | 360 | 370 | 50.2 | 50.7 | 0.5 | 5.21 | |

| MK-20-003 | 437601 | 5652153.5 | -65 | 360 | 370 | 107.5 | 108 | 0.5 | 1.82 | |

| MK-20-004 | 437651 | 5652138.7 | -50 | 360 | 370 | 130 | 131 | 1 | 7.43 | VG |

| MK-20-005 | 437684 | 5652197.3 | -50 | 360 | 381 | 10 | 11 | 1 | 1.57 | |

| 44 | 45 | 1 | 1.61 | VG | ||||||

| 46 | 47 | 1 | 3.42 | |||||||

| 93.9 | 94.4 | 0.5 | 5.27 | |||||||

| 100.5 | 107 | 1.5 | 1.07 | |||||||

| MK-20-006 | 437684 | 5652197.3 | -65 | 360 | 381 | 12.5 | 13.5 | 1 | 1.25 | |

| 15.5 | 18 | 2.5 | 1.01 | |||||||

| 28 | 29 | 1 | 1.34 | |||||||

| 68.75 | 71.5 | 2.75 | 13.25 | |||||||

| Including | 69.5 | 70.5 | 1 | 36.20 | VG |

Table 1: Notable intercepts, initial six holes, 2020 maiden drill program, McKenzie Gold Project, Red Lake, Ontario

“This is a really positive start, visible gold in core is always exciting,” said Vice President of Exploration, Warren Robb. “Our efforts are to now try and define the nature and extent of this mineralization, and to determine how these structures relate to the contact with the Dome stock and the Balmer Assemblage volcanics,” continued Mr. Robb.

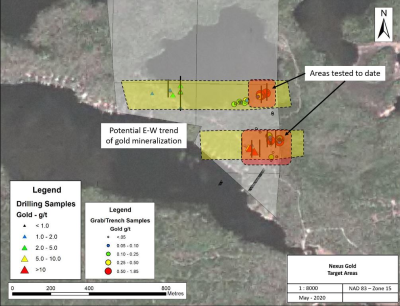

The initial phase one diamond drill program was intended to test the mineralization potential of several gold targets occurring within an east-west trending corridor along the southern contact of the Dome Stock occurring within volcanic rocks of the Balmer Assemblage.

Historic drilling conducted in 2005 along this corridor returned significant values, including 7.49 grams-per-tonne (“g/t”) gold (“Au”) over 8.2 meters, 15.54 g/t Au over 0.8m (includes 13.08 g/t over 0.3m and 17.02 over 0.5m), 4.47 g/t gold over 1.4m, and 2.15 g/t Au over 5.5m.

The initial drill program at McKenzie expanded upon 2005 drilling and to follow up on anomalous rock samples that were collected as part of the 2019 fall prospecting program completed in the St. Paul’s Bay area of the property. The prospecting program traced the mineralized contact corridor to the property’s eastern boundary to further determine areas of interest on the property’s southern end. The focus of the prospecting was concentrated in and around Perch Lake, in the Saint Paul’s Bay area, located in the southernmost section of the property.

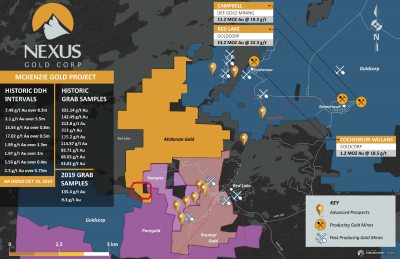

Figure 1: McKenzie Gold Project, Red Lake, Ontario, with phase one drill location in red

Figure 2: Phase one drill locations, McKenzie Gold Project, Red Lake, Ontario

About the McKenzie Gold Project

The 100%-owned McKenzie Gold Project is a 1,398.5-hectare high-grade gold prospect located in the heart of the historic Red Lake gold camp, in western Ontario, Canada. Areas of high-grade gold mineralization have been established within the northern portion of the claim block (McKenzie Island), with significant gold values having been drilled along a 600-meter strike in the southern portion of the property (St. Paul’s Bay area).

As reported in a Company news release dated October 11, 2019, Nexus received a compilation summary of important historic data from project geological consultants, Rimini Exploration. The compilation integrated the regional geological and regional geophysical data, thus allowing the Company’s geological staff to compare these trends to the information obtained through ground exploration conducted to date on the property. The more comprehensive data from the summary, coupled with the new data from the phase two prospecting program, was utilized in determining suitable areas to drill test.

The Rimini compilation summary produced historical data the Company was previously unaware of regarding multiple historical grab samples taken on the McKenzie claim block. The Company had previously disclosed several high-grade historical grab sample results on the property, including 331.14 g/t Au, 18.02 g/t Au, 212.8 g/t Au, 313 g/t Au, 18.02 g/t Au and 9.37 g/t Au. In the summer of 2019 Nexus conducted it’s first ground reconnaissance program at McKenzie and results returned notable sample assays, including 135.4 g/t Au and 9.3 g/t Au (see Company news release dated June 25, 2019).

Additional high-grade historical grab samples previously unknown to the Company and revealed in the Rimini summary include several high-grade assays, including 142.49 g/t Au, 115.2 g/t Au, 114.57 g/t Au, 93.71 g/t Au, 68.03 g/t Au, 53.01 g/t Au, and 16.65 g/t Au from areas located on McKenzie Island (north block).

The data compilation summary also indicated that little to no exploration has been conducted over the actual lake portion of the claim block. The Company has noted from the regional data that a number of northerly trending geophysical trends extend within the lake itself and is viewing these trends as potential faults or breaks within the Dome Stock.

Preliminary review of lake sediment sampling conducted on the property in 1989 indicates coincidental anomalous gold geochemical values occurring. Historical values obtained from the analysis of +150 mesh screened lake sediment samples returned values of 0.159 ounce-per-ton (5.45 g/t) Au, 0.154 ounce per ton (5.28 g/t) Au, and 0.116 once per ton (3.98 g/t) Au. The Company intends to conduct more exploration activity within the lake-bound portion of the project area to determine the prospectivity of a large underexplored section of the property.

Options

The Company also announces that it has granted 1,000,000 incentive stock options to certain arms-length consultants engaged by the Company, in accordance with the terms of its incentive stock option plan. The options vest immediately and are exercisable at a price of $0.105 for a period of thirty-six months.

* Note the reported lengths are intercepts and are not true widths

* Grab samples are selected samples and are not necessarily representative of mineralization hosted on the property

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person and has reviewed and approved the technical information contained in this release. The historic drill data contained in this release was verified by the QP by comparing reported assay data with Certificates of Analysis documented. The QP has verified mineral showings and areas of select sampling and the collars of reported historic drill hole locations. It is the QP’s opinion that the data as presented is adequate and can be relied upon for use in this press release.

About the Company

Nexus Gold is a Canadian-based gold development company with an extensive portfolio of eleven exploration projects in Canada and West Africa. The Company’s West African-based portfolio totals five projects encompassing over 750-sq kms of land located on active gold belts and proven mineralized trends, while it’s 100%-owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario, the New Pilot Project, located in British Columbia’s historic Bridge River Mining Camp, and four prospective gold and gold-copper projects (3,700-ha) in the Province of Newfoundland. The Company is focusing on the development of several core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its growing portfolio.

For more information please visit nexus.gold

On behalf of the Board of Directors of

NEXUS GOLD CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.