Source: Peter Epstein for Streetwise Reports 08/13/2020

Peter Epstein of Epstein Research profiles Portofino Resources, including its two high profile gold projects in Ontario, one with an 18 g/t gold grab sample discovery.

Gold recently blasted through $2,000/ounce (oz). The spot price traded as high as $2,073/oz on Aug. 6, ~$150/oz above its 2011 all-time (nominal) high. Precious metals juniors have responded with big moves. Make no mistake, I realize that the gold price could move lower after such a robust run.

Modest, healthy pullback of 10% in gold price

In fact, it pulled back to ~$1,864/oz on August 11, down 10% from its high. Spot is now sitting at ~$1,946/oz Still, I believe gold (and silver) will remain strong through the first quarter of next year due to U.S. presidential politics and ongoing uncertainties surrounding COVID-19.

I also believe merger and acquisition (M&A) activity will continue to grow. As major and mid-tier producers become more active, earlier-stage juniors will follow. I suspect we will see bidding wars on the best small companies, like Zijin Mining Group Co. Ltd.’s recent acquisition of Guyana Goldfields.

There’s also the fact that metals/mining is not well represented across investor classes. As investors expand their horizons to include metals/mining stocks, especially precious metal juniors, we could see a tsunami of investment capital flowing into the sector.

Portofino Resources has two promising gold projects in Ontario

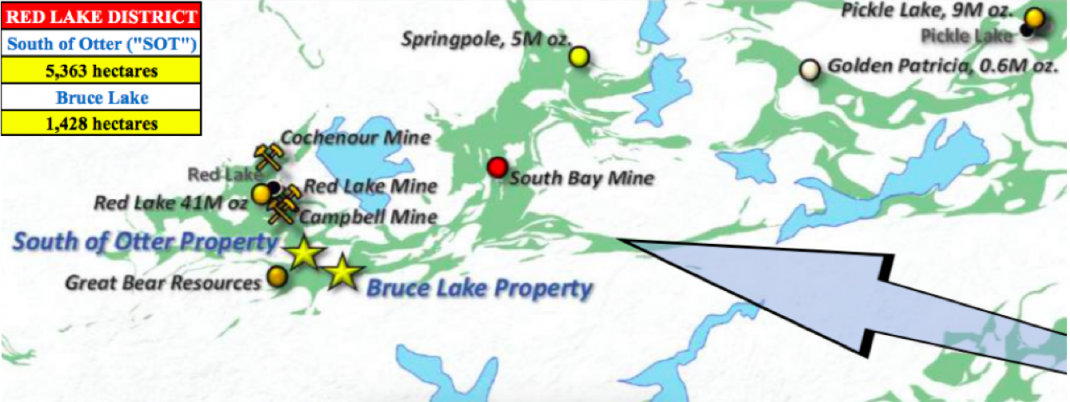

A company I’ve followed for years finds itself in the right place at the right time, yet has a market cap of just CA$10.3 million (US$7.8 million; morning of 8/12/20, CA$0.19/share). It has two properties in the world-famous Red Lake mining district and three in the nearby, up-and-coming, Atikokan camp.

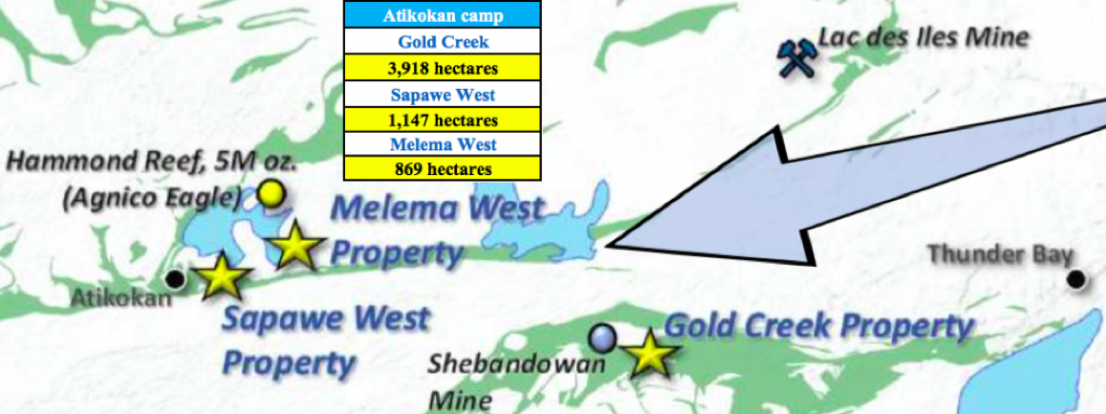

In Red Lake, Portofino Resources Inc. (POR:TSX.V; POT:FSE) has the South of Otter (SOT) and Bruce Lake properties. In Atikokan, Portofino has three more, Gold Creek, Sapawe West and Melema West. All five properties, covering 12,725 hectares, are in northwestern Ontario. They’re controlled by low cost, multiyear options to acquire 100% interests.

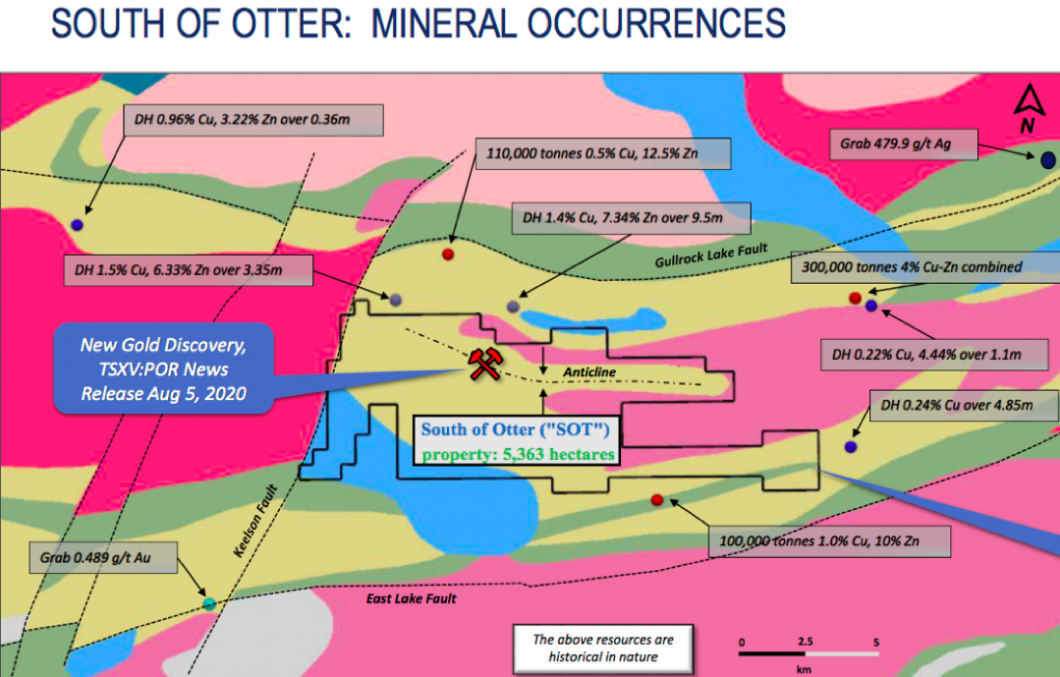

The 5,363-hectare SOT project is ~40 km southeast of Red Lake and ~9 km east of Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX) (GBR) very high-grade Dixie project. Importantly, the two projects share similar geology and structures.

Historically, SOT has been the subject of large-scale geophysical surveys targeting base metals. However, in 2001 Goldcorp completed a property-wide compilation and interpretation of prior data to assess the potential for gold.

Historical exploration indicates that significant mineralization extends across a 1.6-kilometer (km) long fault zone ~500 meters (~500m) south of previously identified gold soil anomalies and electromagnetic (EM) conductors. Twelve grab samples were collected along this (deformation) zone to test for gold, silver, copper and zinc.

New discovery at South of Otter, 18.0 and 8.2 g/t gold grab samples

Results from the 12 samples are in. Portofino hit pay dirt! Management is excited about this new discovery. Two samples returned 18.0 and 8.2 g/t gold, respectively. The company is currently conducting a trenching program to determine potential strike length and mineralized widths.

CEO David Tafel commented: “This new discovery is extremely exciting news for Portofino. The new gold showings are approximately 400m south of Goldcorp Inc.’s 2001 gold in soil anomalies. Due to overburden and lack of outcrop, limited work has been completed in this area. We have mobilized a crew to follow-up on this noteworthy discovery.”

Portofino has obtained an exploration permit for SOT. As part of the permit process, management consulted with, and received support from, all local indigenous groups. The permit is valid for three years and allows trenching, diamond drilling and line cutting.

The crew is exploring the area to determine the extent of mineralization, and will determine the steps required to deliver a drill program later this year.

Less of a focus, but still attractive is the Bruce Lake property. From the new corporate presentation: “The Bruce Lake Property contains gold-in-soil anomalies discovered as part of a reconnaissance soil sampling program completed by Laurentian Goldfields. Portofino has recognized the existence of regional magnetic high anomalies coincident with the gold-in-soils anomalies that it believes are significant. Gold associated with banded iron formations are excellent exploration targets especially when the property has gold in soils associated with a magnetic anomaly.”

SOT or not, Gold Creek could also be a company-maker

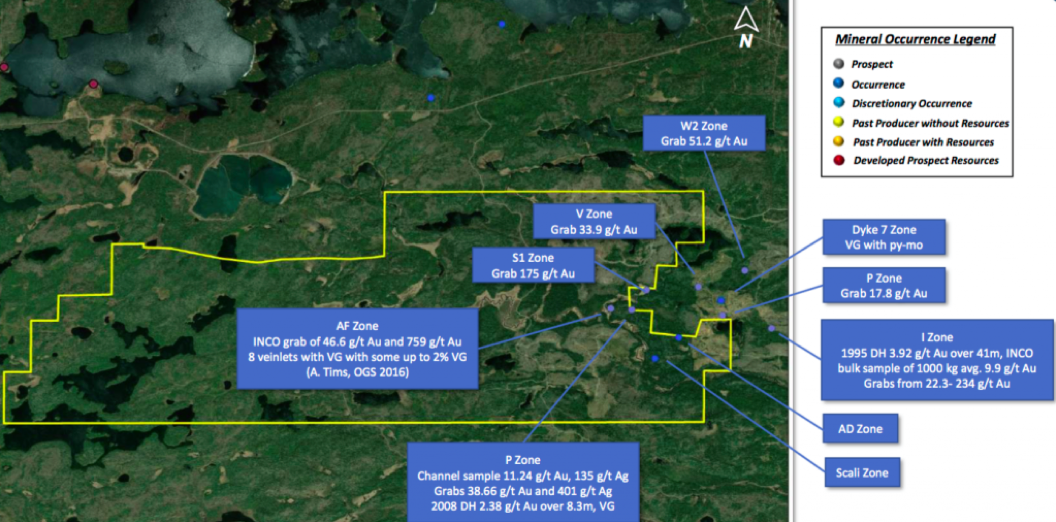

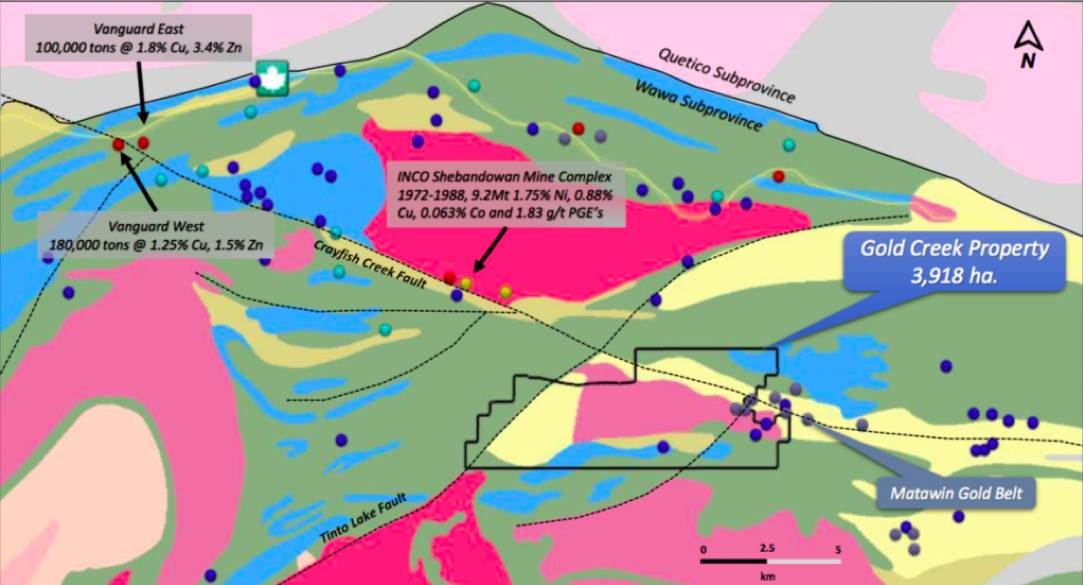

Management recently staked seven claims, nearly quadrupling the size of its Gold Creek property from 1,024 hectares (ha) to 3,918 ha. The new claims cover structural features that management believes are extensions of known gold-bearing horizons. Gold Creek hosts zones of significant high-grade gold mineralization.

The regional geology is comparable to world-class districts such as the Timmins and Kirkland Lake Camps in northeastern Ontario. Significant gold mineralization has been traced along a 1.5 km strike length.

Grab samples have returned values up to 759 g/t gold (Ontario Geological Survey [OGS] property visit). OGS reported another grab sample of 46.6 g/t. Diamond drilling in 2008 assayed up to 2.3 g/t gold over 8.3m (including visible gold). Other contiguous zones hosted grab samples of 86 g/t and 43 g/t gold.

Portofino commenced ground prospecting, mapping and sampling at Gold Creek on July 13. Several occurrences, both historical and possibly new zones of mineralization, were examined and sampled. Samples have been submitted to the lab, results are expected this month.

CEO David Tafel commented: “We are very pleased to have been able to expand our Gold Creek land package. The historical high-grade gold values, geological analogy to some of the more prominent gold camps in Northeastern Ontario and limited prior exploration equate to a high-potential, value-creating project. We look forward to receiving and reporting the sample results from our initial exploration program.”

Two nearby historical resources, <2 km north and <5 km south of the project, reported grades of 0.5%–1.0% Cu (copper) + 10.0%–12.5% Zn (zinc), about 5 g/t gold equivalent. Less than 5 km west is the past-producing INCO Shebandowan complex that mined 9.2 million tonnes of high-value rock from 1972–1988.

Grades were reported to be 1.75% nickel and 0.88% copper, plus some cobalt and platinum group elements (PGEs). The gold equivalent grade from the nickel and copper alone is 4.8 g/t.

Pipeline of properties also includes Melema West and Sapawe West

In June, Portofino announced the execution of a binding agreement to acquire six claims (869 ha) in the Atikokan district, also in northwestern Ontario. The Melema West property is ~5 km north of the Quetico Fault. Agnico Eagle Mines Ltd.’s (AEM:TSX; AEM:NYSE) Hammond Reef gold deposit is ~19 km to the northwest. It hosts a large Measured and Indicated resource of >4.5 million ounces of gold.

Grab samples last year assayed up to 10 g/t gold. The vein system is 1–15m wide and was mapped over a strike length of 170m. Positive gold values suggest an additional gold-bearing structure potentially exists at Melema West. Recent land acquisitions by Agnico contiguous to Melema West support the idea that Portofino is on the right track.

In May, Portofino executed a binding agreement to acquire three claims totaling 1,147 hectares. The Sapawe West property is ~9 km northeast of Atikokan, just north of the Quetico Fault, and 2.5 km west along strike of the past-producing Sapawe Gold mine. Portofino has initiated the compilation and reinterpretation of all available historic data on the property and is proceeding to develop exploration targets for a summer field program.

Conclusion

With M&A on the rise, a potential takeout of Great Bear, Pure Gold Mining Inc. (PGM:TSX.V; PUR:LSE) or Premier Gold Mines Ltd. (PG:TSX) would generate even more excitement in the Red Lake/Atikokan areas. In addition to Agnico, Australia-listed, CA$10B, Evolution Mining Ltd. (EVN:ASX) and Canada’s CA$8B Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) are active in the region and could comfortably afford to expand via acquisitions.

This would shine a bright light on the roughly dozen remaining juniors that have all, or substantially all, of their precious metals properties in northwestern Ontario. To recap, Portofino has two very promising properties South of Otter (with a new grab sample discovery) and Gold Creek.

Both could be company makers. Yet, the company’s market cap of CA$10.3M (US$7.8M) seems awfully low compared to GBR with a market cap of >CA$700M. GBR’s Dixie is obviously far more advanced than Portofino’s SOT and Gold Creek, but it’s still pre-maiden resource.

In a raging bull market, $10M companies that make meaningful discoveries can become $100M companies. Portofino Resources remains a highly speculative bet, but the reward could be spectacular.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources was an advertiser on [ER] and Peter Epstein owned shares and warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: POR:TSX.V; POT:FSE,

)