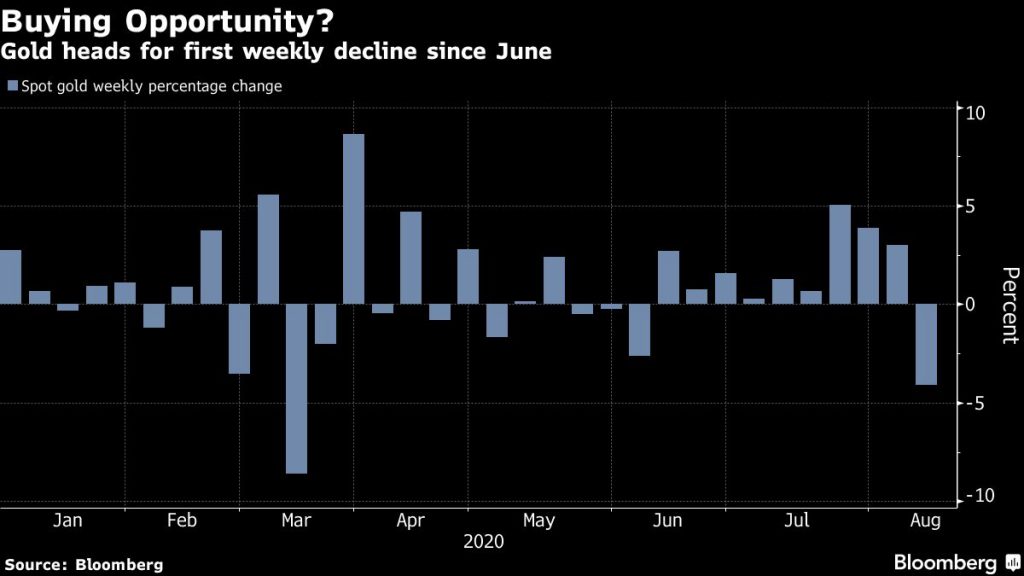

Gold prices declined on Friday as rising US treasury yields, steadying dollar, and a stalemate in stimulus negotiations prompted profit-taking in bullion, setting up its biggest weekly loss since June.

Spot gold was down 0.6% to $1,942.70 per ounce by 12:10 p.m. EDT, more than $100 an ounce below last week’s record. US gold futures fell 1.1% to $1,949.00 per ounce in New York.

Buying opportunity

Despite this week’s decline, gold is still up almost 30% this year as real yields turned negative amid stimulus measures to support the economy.

Credit Suisse raised its gold price forecast for next year to $2,500, seeing a “perfect storm” of factors pushing bullion to a fresh high.

“Barring further profit-taking, we think the longer-term uptrend is intact given US dollar weakness and the scale of stimulus and as we expect interest rates to remain low or negative,” Suki Cooper, precious metals analyst at Standard Chartered Bank, said in a note.

“Price dips are likely to be viewed as buying opportunities as the macro backdrop remains favorable for gold.”

“Everybody was eager for gold and the buying became so intense over the last few weeks that gold became overextended,” Robin Bhar, an independent analyst, told Reuters.

“Nothing goes up in a straight line … (with the) over exuberance, things needed to correct, so we are now consolidating.”

Under pressure

Gold prices are being pressured as the benchmark US treasury yield climbed to a near eight-week high, analysts said. Higher yields increase the opportunity cost of holding non-yielding assets such as bullion.

Gold also largely ignored economic data from top consumer China, which missed market expectations, and data showed that euro zone’s economy recorded its deepest contraction on record in the latest quarter.

Investors are now keeping a close eye on developments around fragile China-US relations ahead of key talks this weekend and potential updates from Washington regarding a new stimulus package.

“It could be the case that before the elections, there would be no further stimulus,” Bank of China International analyst Xiao Fu said. “Gold could then be lacking upward impetus that will imply the shorts or the profit-taking side will be winning momentum, pushing gold even lower.”

(With files from Bloomberg and Reuters)