Source: Matt Badiali for Streetwise Reports 08/12/2020

Independent financial analyst Matt Badiali discusses opportunities in the natural gas space including what type of companies to avoid.

There is blood in the streets in West Texas…that means there’s an opportunity somewhere.

The Covid-19 pandemic hurt oil demand, which destroyed the oil price. The fall in oil prices forced many shale companies go bankrupt. And the impact continues to spread out through the entire market.

As investors fled, opportunities opened.

For example, home values in Midland, Texas, are down 5% over the last year, according to real estate website Zillow. I expect that decline to deepen in the second half of 2020. Some friends of mine are already investing in land nearby.

But real estate isn’t the only opportunity. The other is in natural gas.

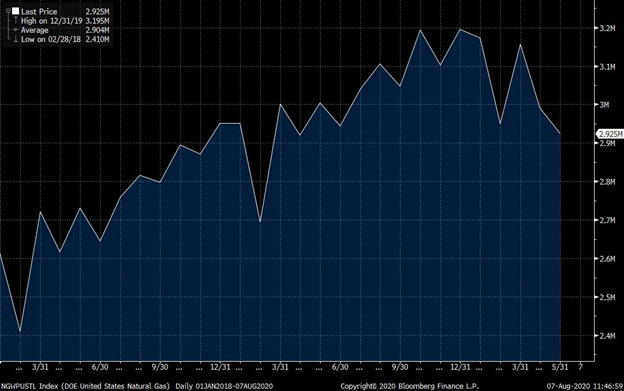

The collapse in oil prices hurt oil production…and natural gas production. You can see the decline in the chart below:

Natural gas is a natural byproduct of shale oil wells. It soared over the last decade, along with oil production. It doubled in the last fifteen years, from 1.8 trillion cubic feet per month in 2005 to 3.6 trillion cubic feet per month in 2019.

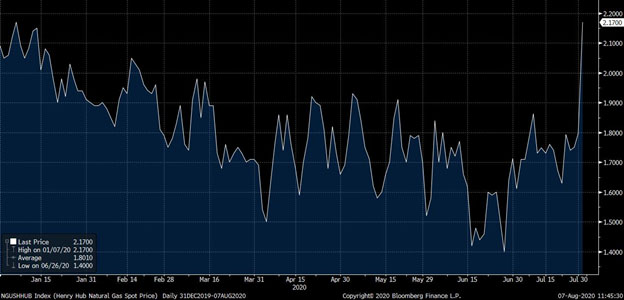

That massive increase in supply sent natural gas prices plummeting. In 2005, the price of natural gas hit $14.50 per million British Thermal Units (MMBTU). In June 2020 it fell to $1.40 per MMBTU.

However, that was the bottom. And it marks the lowest natural gas price we’ll see over the next decade.

The pinch in natural gas supply just began. And prices reacted, as you can see in the chart below:

The natural gas price jumped from its June low to within a penny of its highest price in 2020.

This will help gassy exploration companies. However, be careful when you do your research. There are debt bombs in this sector—companies that have a sizable chunk of long-term debt coming due.

For example, according to Bloomberg, TORC Oil & Gas Ltd. (TOG:TSX) has CA$92 million in debt due—33% of its total. And it doesn’t have the cash to handle that bomb (as of June 2020, it has zero cash on hand).

However, there are some companies that look appealing here. EQT Corp. (EQT:NYSE) is a $4.2 billion explorer that produces 95% natural gas. Its trailing 12-month free cash flows are at $135 million. Bloomberg estimates that will jump to $468 million by the year end for 2020.

Another play here is Canacol Energy Ltd. (CNE:TSX; CNNEF:OTCQX), a CA$487 million South American-focused exploration company. Like Torc, it has some debt due—just 5% or CA$16.4 million. Unlike Torc, Canacol has about $49 million in the bank to deal with it. It produces mostly natural gas—94%.

If you are looking for a place to “buy low,” natural gas is a great sector. The price is already rising, and companies are still dirt cheap. However, do your homework…there are a lot of companies sitting on debt bombs that can still cut share prices down.

Good Luck,

Matt Badiali

Reach Matt Badiali at www.mattbadiali.net.

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: CNE:TSX; CNNEF:OTCQX,

EQT:NYSE,

TOG:TSX,

)