Source: Sophic Capital for Streetwise Reports 08/10/2020

Sophic Capital details why UGE International is investment-worthy given current conditions in the renewable energy markets.

A Decade of Solar Energy Project Experience Differentiates UGE International

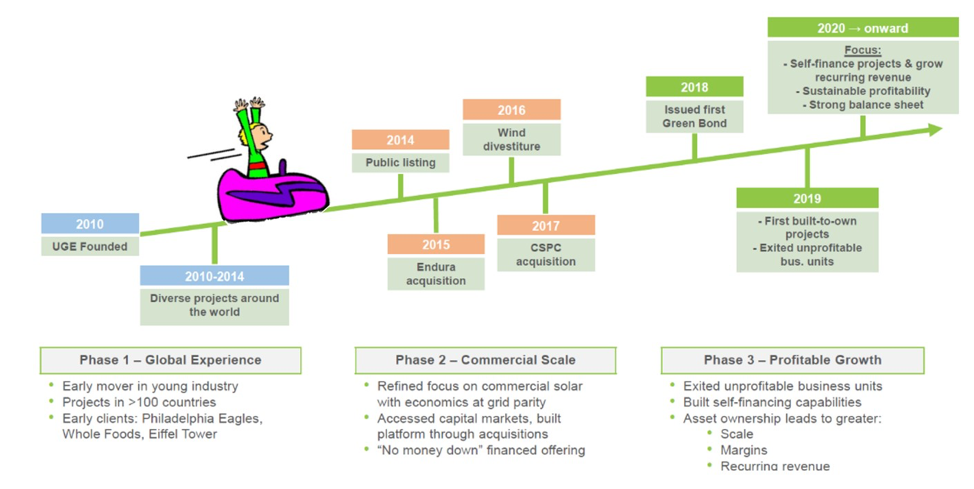

UGE International Ltd. (UGE:TSX.V; UGEIF:OTCQB), a Sophic Capital client, has been riding the solar coaster for a decade—long before ESG (environmental, social and governance) was an investing trend.

Founded in 2010, UGE International (UGE) is a solar and renewable energy solutions company focused on offering turnkey commercial as well as community solar projects in the Northeast USA and the Philippines. The company develops, engineers, deploys, finances and operates end-to-end solar projects in the 250-kilowatt (KW) to 5-megawatt (MW) range.

Based upon positive feedback that Sophic Capital has collected from due diligence calls with UGE customers, the company’s strong project management, engineering background and clear customer communications are resonating in the commercial real estate (CRE) and community solar sectors. In fact, UGE has exceeded customer expectations to the point where customers are not only expanding UGE’s footprint across their own property portfolios but also making referrals on UGE’s behalf. This is what differentiates a decade of solar project development experience from a late-comer that sees an opportunity simply because solar panel costs continue to decline.

Figure 1: UGE has successfully navigated various renewable sector challenges since its founding a decade ago. Source: Company reports.

UGE’s Community/Shared Solar Focus Is on Trend

As of 2019, U.S. community solar installations in over 40 states were generating more than 2,000 MW of cumulative power. As Sophic Capital highlighted in our August 4, 2020 report, “community solar,” or “shared solar,” or “solar gardens,” have been driving U.S. solar industry growth. This is because this model eliminates upfront capital investments by property owners and removes the planning and installation burden for them, while unlocking access to low-cost renewable energy for a large additional segment of energy users.

UGE’s community solar strategy focuses on projects that realize the following revenue and cost benefits:

- Utilize unused and inexpensive “land.” UGE leases unused CRE roof space from owners to generate power at lower cost than prevailing utility rates. These roof tops are analogous to cheap “land” and serve as low-cost, key capital inputs.

- Provide inexpensive electricity. UGE amplifies the benefits of cheap “land” by locating community projects in dense urban areas where energy demand is high; lower transmission costs for localized projects mean they provide power relatively cheaply compared to the grid. CRE owners leasing rooftops can also arrange to purchase the solar power generated on their roof tops by UGE’s projects through power purchase agreements (PPAs), usually at rates 20–50% below utility rates. For example, in New York, by UGE leasing roof space for US$1 per square foot, energy consumers on the community solar programs could save 10% off their electricity costs; this provides CRE owners with a new source of revenue and energy users lower electrical costs, with no additional burden placed on either group.

- UGE’s business model removes risk for property owners. UGE provides turnkey solutions. CRE property owners do not have to involve themselves in the design, deployment, financing or selling of generated solar power.

- Provide new revenues for CRE owners. By leasing CRE roof tops to install solar projects, UGE provides building owners with new revenues without placing additional burdens on them.

- Long-term, recurring revenues. Typically, project durations are 15 years in the Philippines and 25 years in the U.S. Once the project is deployed and commissioned, it begins generating recurring revenue for UGE.

Although UGE’s project economics in the U.S. and Philippines look different, both are attractive. For example, in New York (typically rooftop projects) and Maine (more ground-mounted projects) total project net present value (NPV) averages about US$2/KW. In the Philippines, NPV is about US$1.20/KW. UGE defines “project margin” as the difference between the project’s NPV when the project commences operation and the cost to get the project to that point. The company’s project margin in the U.S. and Philippines ranges from US$0.60 to US$0.80/W.

With over a decade of solar energy experience, UGE has simplified solar project development to a series of simple stages. Although each stage requires executing several complex steps, UGE has refined their approach to almost a cookie-cutter-like process. And as mentioned before, much of this turnkey development is invisible to CRE property owners—UGE handles project development, commissioning and management. This cookie-cutter process typically proceeds as follows:

- Find an opportunity, produce an initial design and an offer, then commit the property owner into a binding agreement.

- Secure interconnection approval (acceptance and costing by the local utility of connecting the project to the grid), which is the most significant variable. This entails initial design engineering work by UGE.

- Once interconnection is secured, UGE will complete the full project engineering and permitting. UGE will finalize costing and finalize the project’s financial model with final assumptions and reach notice to proceed (NtP), where the project is ready for construction.

- Contract the relevant third party to manage subscribers (assuming a community solar project) so subscribers can start signing up for the project’s solar power.

- Engage debt partners to finance project construction and permanent debt once the project is operational.

- Hire a subcontractor, order equipment, mobilize subcontractors on site and build the project.

- As project construction nears completion, find tax equity providers (in the U.S. only) who will monetize the tax credits available for such projects.

- Complete the mechanical and electrical installation, commission the project to reach “final completion.”

- Receive permission to operate from the utility: the project is now fully financed and operational.

UGE Has Successfully Pivoted for Higher Margin Growth

UGE has ambitious targets to grow revenue significantly from 2019 levels (of around US$5 million) over the near term. As Sophic Capital highlighted in our August 4, 2020, U.S. solar industry report, solar panels and the all-in cost of solar energy have seen substantial cost reductions in the past decade, which has been a tailwind for UGE and the U.S. solar industry. To this end, this past March, UGE announced a 6.6MW project in Westchester, NY—its largest yet, at approximately 12 to 15 times the size of UGE’s average project.

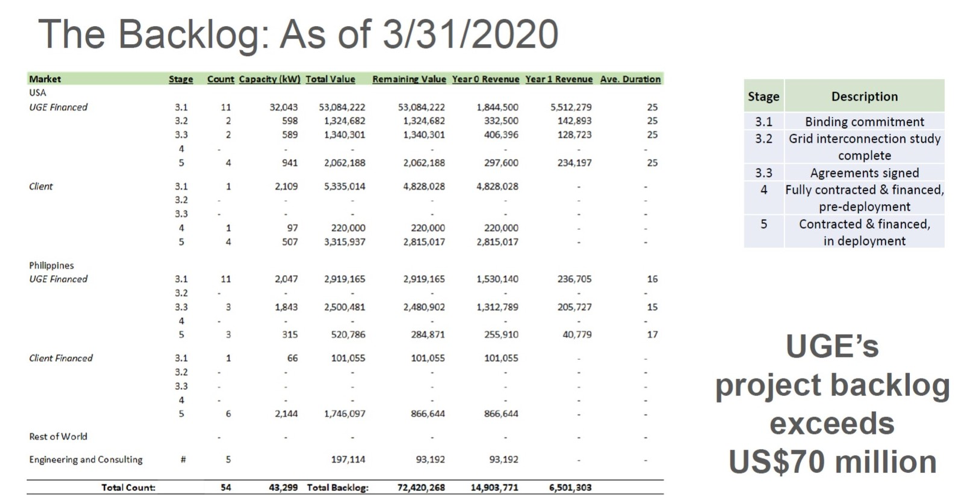

UGE also won substantial new projects in its March 31 quarter to increase its project backlog to over US$70 million, which we examine in more depth in this report.

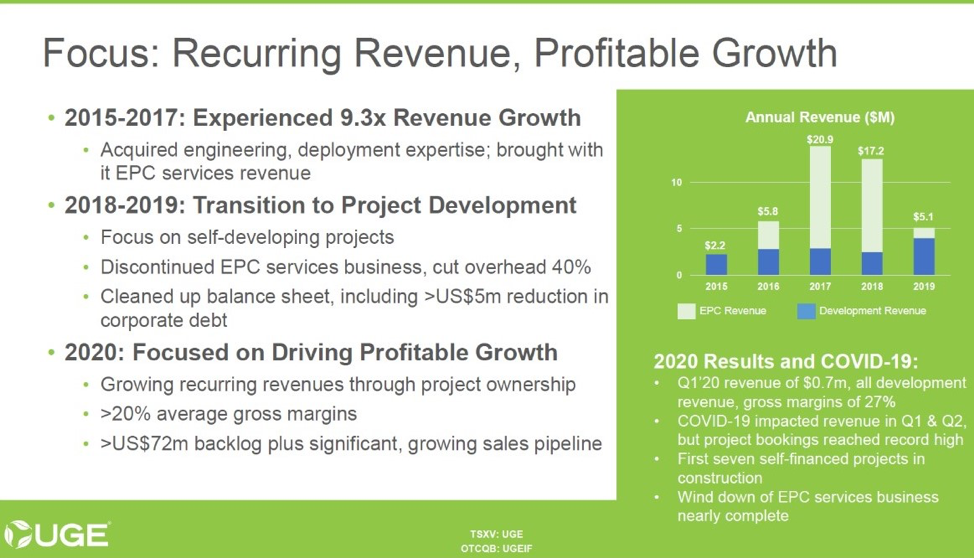

UGE has been pivoting its business model since early 2019. Previously UGE generated revenue via two distinct streams:

- UGE would previously build projects for third-party solar developers (known as engineer, procure and construct or EPC). This business generated gross margin well below 20%. UGE exited its EPC business in 2019 to focus on the higher margin opportunity of ‘self-developed’ projects, where it develops, finances, builds and operates its own commercial and community solar projects.

- UGE’s current focus is on self-financed commercial and community solar projects. Under this model, UGE develops, finances, builds and owns end-to-end projects. These projects generate high-margin (upper 20% range) recurring revenue. Knowledgeable solar investors we’ve spoken with are duly impressed by this margin profile and recurring revenue. It should be noted that this revenue stream requires upfront capital to pay for construction and commissioning costs, which UGE finances with specialty finance partners. UGE’s backlog of new projects in this new focus segment has already begun to witness very impressive growth—140% in just the first quarter of this year.

- The company’s revenue pivot (exiting lower margin business) had a short-term adverse revenue impact. UGE’s revenue pivot away from the low margin EPC business to self-financed, “own and operate” projects has resulted in project revenue being recognized relatively later.

For UGE’s self-financed and owned projects, revenue on the income statement is not recognized until projects are operational (revenue for projects built for third parties is recognized sooner). This pivot, combined with COVID-19, which prevented the company from making construction progress from March 2020 until recently, adversely impacting revenue in recent months. Management believes the revenue growth picture should improve in the September 2020 quarter and beyond, all else equal. At the same time, we note UGE’s margin has steadily improved since the company’s revenue pivot (e.g., 27% in Q1 2020 and FY 2019 versus 10% in FY 2018).

Figure 2: UGE’s 2019 pivot to higher-margin self-owned projects focuses on recurring revenue and profitable growth. Source: Company reports.

Investor Alert – UGE’s Stock Price Doesn’t Seem to Reflect Its Robust Backlog

We believe that UGE’s growing backlog is not being reflected in the share price. The company exited the first quarter (ending March 31) with approximately US$72 million of backlog, making it the strongest quarter for new bookings in the company’s history (up from US$30 million in the prior quarter). The company’s published backlog information suggests that over 90% of this backlog pertains to projects in the U.S. Management believes that this backlog could climb to US$100 million by the end of the year, regardless of temporary slowdowns due to COVID-19.

New York and Maine have been driving recent backlog growth. New community solar regulations are driving Maine’s backlog growth. Within the NYC market, in 2019, the Climate Modernization Act (CMA) mandated the installation of solar or a green roof for buildings above a certain size that are either (a) new buildings or (b) undergoing envelope renovations. Solar roofs pay owners money (directly or indirectly) whereas green roofs have maintenance costs. Given this, we expect solar roofs to be more prevalent on NYC commercial real estate roof tops over time.

UGE has additional opportunities for New York City community solar projects, including ground-mounted projects where CMA does not apply. In New York, the resultant CMA market could be in the US$1 billion range over the next decade. Thus far, this opportunity is roughly US$30–40 million, of which the company has won a very respectable share of this new business (likely in the range of one-third).

In the Philippines, where import tariffs are much lower than the U.S., labor costs are lower, sunlight is plentiful and the cost of electricity is relatively high, the company has natural tailwinds to help it win additional new business.

UGE’s US$72 million backlog warrants a deeper look, since it could be hiding more value than investors may expect. Typically, backlog refers to expected future revenue streams (the total value of contracts which get converted into revenue over the course of the contract.) Thus, at first glance it may be tempting to assume UGE’s US$72 million backlog refers to future revenue to be recognized over a 15- to 25-year time frame.

However, this is not the case. UGE’s backlog refers to the unlevered (excluding debt) NPV of committed projects, less value already realized. Without getting too deep into a corporate finance discussion, this refers to the present value of all of UGE’s projects, ignoring the debt required to finance the projects today, or the absolute higher bound of what a buyer with the means to finance construction of backlog projects would be willing to pay for it.

It is also interesting to note the revenue potential arising from UGE’s total backlog of US$72 million. After UGE’s existing projects are funded, constructed and operational, the total annual recurring revenue that should be realized on a continuing basis (Figure 3) is around US$6.5 million per year. This does not include the year 0 revenue (upfront payments from client-financed projects and government incentives) of US$14.9 million, which is anticipated to be recognized over the next 24 months. The total revenue potential, including operation over the entire 15- to 25-year span of these projects, is close to US$200 million, which is much higher than the headline US$72 million backlog number.

Figure 3: Unlocking value in the backlog could be a very significant catalyst for UGE’s stock. Source: Company reports.

After considering project build costs and a few assumptions, UGE’s current committed projects could be worth almost CA$1/share. Our discussions with industry contacts suggests that UGE financed projects that reach the binding commitment stage are worth anywhere from 30% to 40% of their NPV. In Figure 3, UGE-financed projects in the U.S, and Philippines have a NPV of around US$65 million. At the low end of the 30% range, that equates to roughly CA$26 million. If we subtract the US$3 million of net debt (debt less cash) reported March 31, we are left with around CA$23 million, or about CA$0.95/share. Therefore, as UGE demonstrates the value of its backlog, the stock looks cheap at $0.385 (closing price as of Aug. 7, 2020). At the same time, given the activity in the solar market, we expect UGE to add more projects to its backlog over the near term.

Crystalizing Backlog Value Key to Unlock Stock Potential

Before summarizing the potential value yet to be unlocked in UGE’s share price, we note that management’s interests are aligned with shareholder interests. Share structure and corporate governance are very important aspects of small cap stocks that Sophic Capital always pays attention to. With only 25 million shares outstanding and over 50% insider ownership, shareholders should benefit as a shareholder-aligned management team executes on UGE’s thoughtful pivot towards a higher margin business.

Management’s ambitious growth plans should put the company on the path to being cash flow positive around the first half of 2021. At that point, generally, sophisticated investors begin to pay closer attention to stocks. As a result, meaningful value could surface from UGE stock if the company’s revenue pivot is successful and the stock begins to pass more screening criteria for a greater number of investors.

Now the good stuff! While generating revenue from backlog is the most logical next step for UGE, strategically selling a project could be an important and relatively quicker means to unlock shareholder value. We believe UGE’s US$72 million project backlog contains significant value relative to its stock price. Demonstrating this value, by converting backlog into revenue, or perhaps selling one or more projects to third parties, are important steps in unlocking this latent value.

Of these two courses of action, revenue conversion is the more natural next step for the company. In this regard, and based on management’s comments, we would expect to see anywhere from 30% to 80% organic revenue growth over the next couple of years, as UGE’s backlog starts to convert into revenue over the next 24 months or so. It is important to bear in mind that this does not imply the entire US$72 million backlog will be converted into revenue over the span of 24 months as we have previously examined. However, this process could take time to reflect value back to UGE’s stock.

A more immediate means to demonstrate value could perhaps be for UGE to sell a project. Such a hypothetical sale could provide two benefits. First, it would immediately signal the value of UGE’s backlog by validating it in the market. Second, proceeds from this hypothetical sale could enable UGE to meaningfully pay down its US$3.4 million debt, which would then lead to a higher per share value for UGE’s remaining projects (recall, we subtract the value of debt from project value to arrive at a per share project value).

Based on management’s comments, the company could approach cash flow break even around the first half of 2021. While UGE has been executing its revenue pivot, core operating costs have been stable in the US$2.5–3 million per year range. Therefore, once the company begins to generate US$10 million or so of annual revenue, or around US$2.5 million of quarterly revenue, we expect the company to approach cash flow breakeven. We expect the Company could attain this important milestone around the first half of 2021, which would be an important step towards attracting more investors to the stock. If UGE’s management can unlock value from its US$72 million backlog, UGE’s current share price could be considered cheap.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) Sophic Capital’s disclosures are listed below.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: UGE International. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of UGE International, a company mentioned in this article.

Sophic Capital Disclosures / Disclaimers

UGE International has contracted Sophic Capital for capital markets advisory and investor relations services. The information and recommendations made available here through our emails, newsletters, website, press releases, collectively considered as (“Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. You hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Company’s Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser under the securities legislation of any jurisdiction of Canada and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisory, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor.

( Companies Mentioned: UGE:TSX.V; UGEIF:OTCQB,

)