Gold’s monster rally took a pause on Friday as the US dollar received some respite from investors looking for a hedge against the deepening rift between Washington and Beijing. However, bullion is still on track for a ninth straight weekly gain — the longest of such streak in about a decade.

Spot gold was 1.2% lower at $2,035.26 per ounce by 11:25 a.m. EDT, having hit another record high of $2,072.90 in early trade. US gold futures also retreated 1.1% to $2,044.90 per ounce in New York.

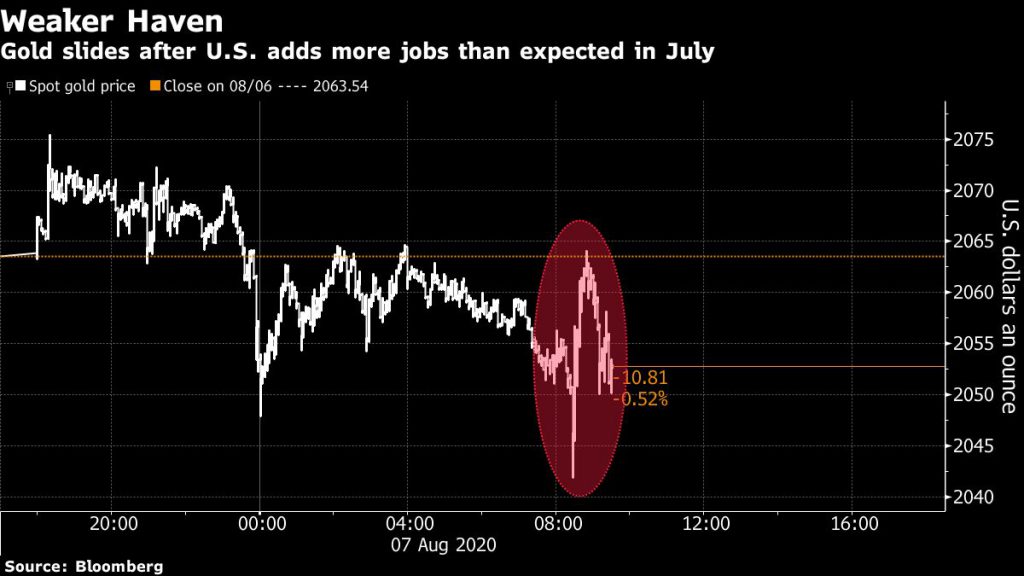

In addition to a stronger dollar, the latest US jobs data showed better-than-expected figures, indicating that a economic rebound is making headway. Payrolls increased by 1.76 million in the month of July, beating estimates for a 1.48 million gain, while the unemployment rate fell by more than expected.

The combination of those two factors put pressure on gold prices, particularly the rebounding dollar, said Phil Streible, chief market strategist at Blue Line Futures in Chicago.

“There is a bounce in the dollar in the last 24 hours and it is key to the profit-taking we are seeing in gold,” OANDA analyst Craig Erlam told Reuters.

“However, the momentum is still very much with the bulls and $2,100 for gold is likely in the near term,” he added.

Bullion is still up more than 35% year to date, on pace for its biggest annual gain in over four decades. Further gains are predicted — Bank of America Corp. reiterated its forecast that gold may reach $3,000 an ounce in 18 months.

(With files from Bloomberg and Reuters)