Source: Streetwise Reports 08/04/2020

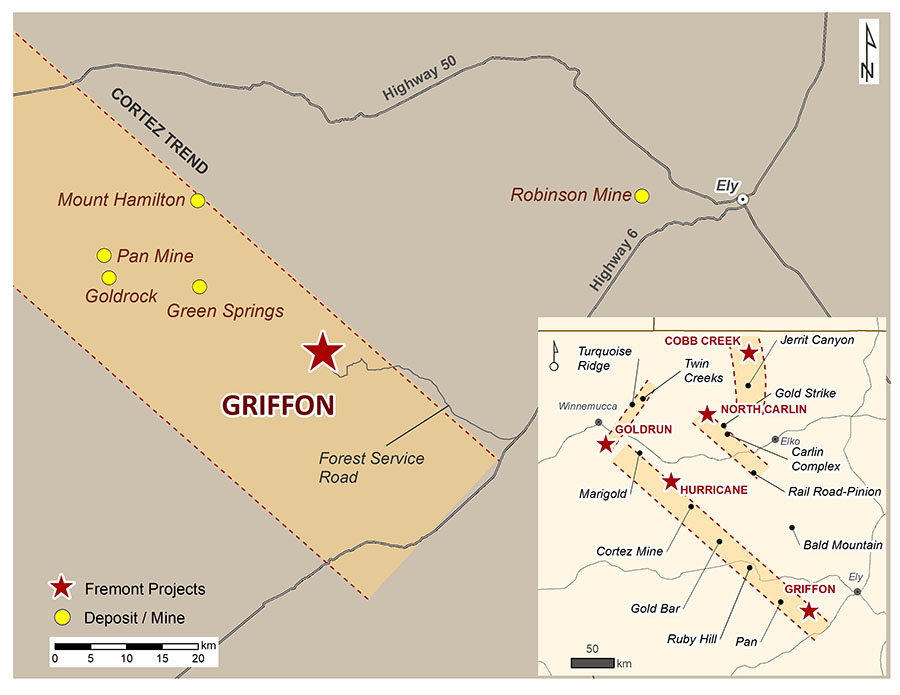

Fremont’s Griffon project in Nevada’s prolific Cortez Trend is being drilled for the first time since the 1990s.

Fremont Gold Ltd. (FRE:TSX.V; FRERF:OTCQB; FR2:FSE) went public in 2017 with the goal of making a new gold discovery in Nevada. Founded by geologists that have a track record of making multi-million-ounce gold discoveries, Fremont believes that the drill program underway at the Griffon property could help them realize that goal. Griffon is a past producing gold mine located in Nevada’s Cortez Trend, an area known for large gold mines such as Nevada Gold Mines’ Cortez Mine, which saw nearly 1 million ounces of gold production in 2019.

Fremont launched a phase I drill program at Griffon in June and has completed nine drill holes so far. The company reported the results from the first three drill holes several weeks ago and expects to release the next set of drill results sometime this month.

Although Fremont isn’t a well-known gold exploration company, the results from the first three holes have attracted the attention of several industry analysts, including Thibaut Lepouttre of Caesars Report and James Kwantes of Resource Opportunities.

“Hole three is clearly the best hole as it intersected just over 50 meters containing 1.05 g/t gold starting at a depth of just 29 meters; that’s excellent,” said Lepouttre. “We don’t have to wait long for news and as the remaining holes were located close to known mineralization, one could expect them to contain gold.”

Lepouttre added, “Fremont acquired Griffon just six or seven months ago, and this is the first time it is being drilled in about two decades. There are still plenty of drill targets and drill sites that have been permitted or will be permitted in the future. Fremont is really just getting started. This is the first time that anyone is giving it a really good look.”

“With gold at almost $2,000 an ounce, Nevada has become a hotbed of drilling activity and some stocks are already moving hard,” said James Kwantes of Resource Opportunities. “Shares of Resource Opportunities portfolio company Fremont Gold have not, despite some stellar drill results in the first three holes at their Griffon oxide gold project in Nevada. That spells opportunity at these price levels.”

A little background history on the property. “Griffon is a past producing Carlin gold mine that was last in production in 1999, when the price of gold was less than US$300 an ounce,” CEO Blaine Monaghan told Streetwise Reports. “Alta Gold, the previous operator, produced approximately 60,000 ounces gold from Griffon in 1998 and 1999. The Griffon mine was a very simple open-pit, heap-leach operation with cash costs below $200 an ounce of gold. Unfortunately, Alta Gold ran into operational issues at another mine, the gold price collapsed, and it went bankrupt. Although it hasn’t been drilled since that time, recent exploration work has identified a number of compelling drill targets.”

Griffon is a relatively new discovery, having only been found in the 1980s. “It was first drilled in 1988, and it only saw 214 drill holes, all shallow and almost all of it focused on delineating the deposits Alta Gold mined, leaving the remainder of the property essentially untested,” Monaghan said.

Griffon was picked up by another Nevada company that did little to no work on the property in the 2000s, and in 2012, Pilot Gold, now Liberty Gold, acquired it. Fremont picked up the property from Liberty Gold at the end of 2019 and has wasted no time in getting to work.

“Pilot/Liberty conducted a lot of exploration – mapping, soil sampling, and geophysics – to identify drill targets at Griffon,” Monaghan said. “They permitted the project, bonded it, but they never got around to drilling it. Liberty has been divesting their non-core assets to focus on their Black Pine project and we were lucky enough to be in the right place at the right time to acquire Griffon.”

Because of the “first-class exploration work that Liberty had done, we could get in there immediately and get started,” Monaghan said. “The project has tremendous exploration potential.”

Fremont began a phase 1, 2,000-meter, 10-hole drill program at the end of June and on July 21 announced assay results from the first three drill holes with drill hole GF-20-3 returning 50.3 meters of 1.05 grams per tonne gold starting at 29 meters.

“Drill hole GF-20-3 met and exceeded our expectations. Thick, near surface, and oxidized, drill hole GF-20-3 reinforces our belief that Griffon holds tremendous opportunity for the discovery of a new Carlin-type gold deposit,” Monaghan said.

“We are very pleased by what we have seen. Our goal at Griffon is to outline a sizeable gold deposit and prove it up to the point where it will be of interest to a gold producing company. The results we’ve seen from the first three drill holes provides us with the encouragement we need to get back in there with an even bigger program,” Monaghan explained.

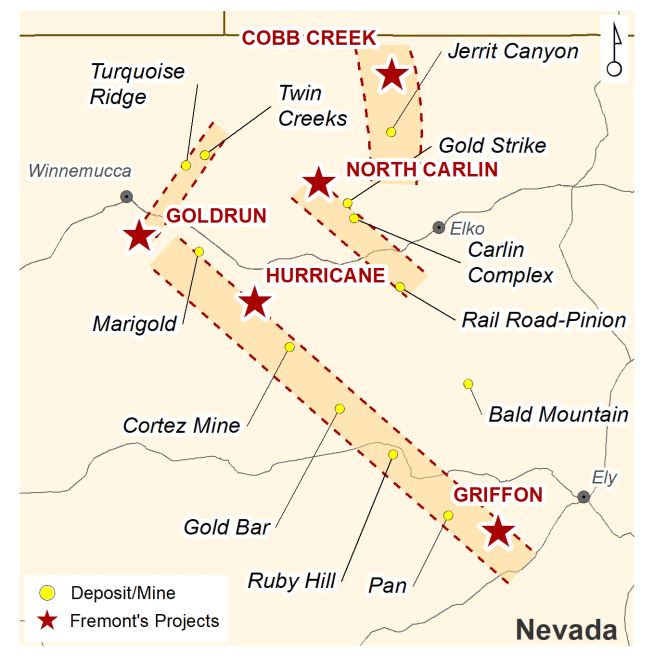

Fremont holds four additional projects in Nevada: Cobb Creek, North Carlin, Hurricane and Goldrun. Although focused on Griffon, Fremont would like to conduct a drill program at Cobb in the near future.

“Cobb Creek has a historical resource, but it’s not permitted so we need to conduct the same sort of exploration work that Liberty did when it first acquired Griffon to identify the targets that we think have the best chances for success, and then start the permitting process,” Monaghan said. “Cobb is a great number two but it will take more time to get it to the drilling stage. However, it absolutely warrants a drill program.”

Fremont is helmed by an experienced management team and board. “They have a track record of creating shareholder value through discovery and M&A,” Monaghan said. Founder and President Dennis Moore is a geologist who has been involved with numerous discoveries in South America including Tocantinzinho and Cuiú in Brazil. Chairman Dr. Alan Carter is the president and CEO of Cabral Gold and has worked for several senior mining companies, including Rio Tinto and BHP Billiton. Monaghan himself has raised more than $100 million for mineral exploration projects and has worked for five companies that were acquired. Michael Williams, chairman of Aftermath Silver and a founder of Underworld, acquired by Kinross, and Randall Chatwin, vice president, associate general counsel of B2Gold and former VP, assistant general counsel of Goldcorp, round out the board of directors.

Fremont raised CA$1.5 million in February through a non-brokered private placement. “That was enough to fund the phase one drill program at Griffon,” Monaghan said. “The advantage of that financing for Fremont is that it was a six-cent unit with a full warrant at 10 cents. All of the warrants are in the money, and if the warrants were to be exercised, it would bring in CA$2.5 million.”

Fremont has 81.5 million shares outstanding and 119.1 million shares fully diluted. Management and insiders hold 17%.

“For investors looking at a gold exploration company, Fremont checks all the boxes. We’re in Nevada, a great jurisdiction. We have excellent advanced-stage projects. We’re drilling them, we’re advancing them. And we have a great team that is aligned with shareholders,” Monaghan concluded.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Fremont Gold. Click here for important disclosures about sponsor fees. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Fremont Gold. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: FRE:TSX.V; FRERF:OTCQB; FR2:FSE,

)