Gold advanced to a fresh record high on Wednesday – pushing towards the $2,050/oz mark after breaking through $2,000/oz on Tuesday – on the back of a weakening dollar, falling US treasury yields and expectations of more stimulus measures for the pandemic-ravaged global economy.

Spot gold rose 1.3% to $2,045.32/oz as of 11:20 a.m. EDT, after reaching an intraday high of $2,055.48/oz earlier in the session. Gold futures were up 1.4% to $2,049.50/oz on the Comex in New York.

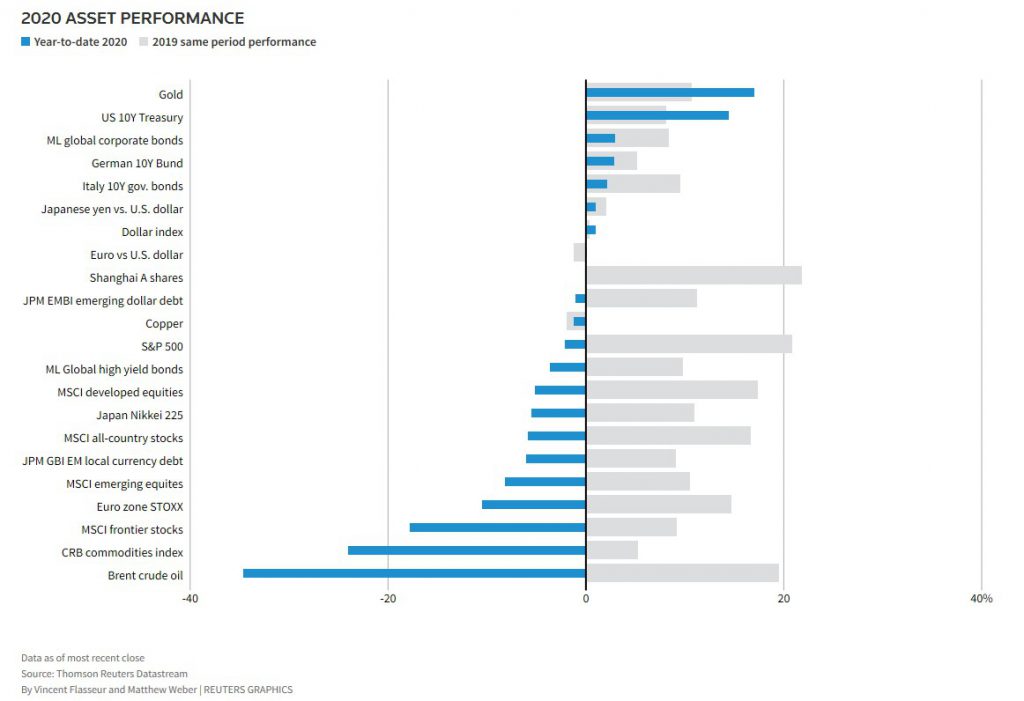

Bullion is up nearly 35% so far this year and is one of the best-performing assets in 2020. The precious metal is benefiting from heightened uncertainty around the long-term effects of the global health crisis, as more investors turn to safe-haven assets and an alternative store of value in a low-yield environment.

“What we’re seeing at the moment with the dollar, bond yields and gold are macro trades of concern – not just about the coronavirus but also about the fiscal cliff in the US,” Seema Shah, chief strategist at Principal Global Investors in London, told Reuters.

More stimulus expected

Gold’s mega rally could extend even further as governments and central banks respond to slowing economic growth with vast amounts of stimulus. Analysts at Goldman Sachs Group Inc. recently raised their price target to $2,300/oz, up from the previous forecast of $2,000/oz.

US Treasury Secretary Steven Mnuchin said the White House and Democrats are aiming to strike a deal on virus-relief legislation this week, even though the two sides remain far apart on some issues. Federal Reserve Bank of San Francisco President Mary Daly said on Tuesday the economy needs more support than originally thought.

“There are real concerns that without a (US stimulus) deal, we will be looking at a very tough fourth quarter for the US economy and therefore the global economy,” Shah said.

“The stage has been set for gold to continue to climb higher,” Paul Wong, market strategist at Sprott Inc., said in a report. “We see increased fiscal spending ahead, extremely accommodative monetary policy in place for years and a challenging economic recovery.”

(With files from Bloomberg and Reuters)