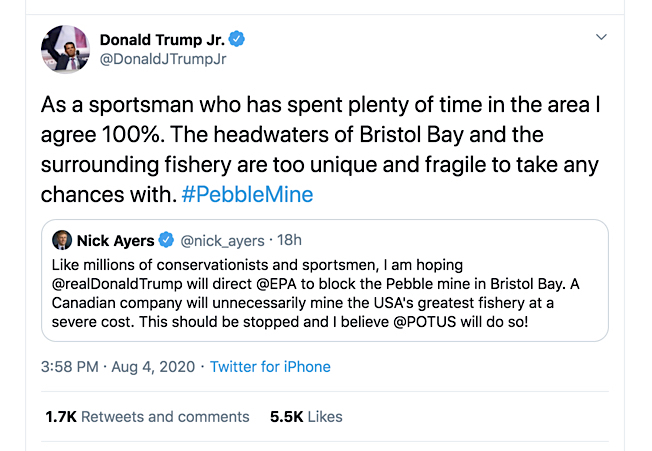

Opponents of Northern Dynasty Minerals’ (TSX: NDM) proposed Pebble copper-gold-molybdenum mine in Alaska found a new ally on Tuesday, as US President’s son Donald Jr. took to Twitter to oppose the project supported by his father’s administration.

Trump Jr. said he “100%” agreed with Vice President Mike Pence’s former chief of staff Nick Ayers in objecting the mine.

“The headwaters of Bristol Bay and the surrounding fishery are too unique and fragile to take any chances with,” the President’s first-born son tweeted.

His comments come less than two weeks after Northern Dynasty secured a final environmental impact review from the Army Corps of Engineers for the mine.

The decision opened the door for the Canadian miner to obtain the federal go-ahead as soon as late August.

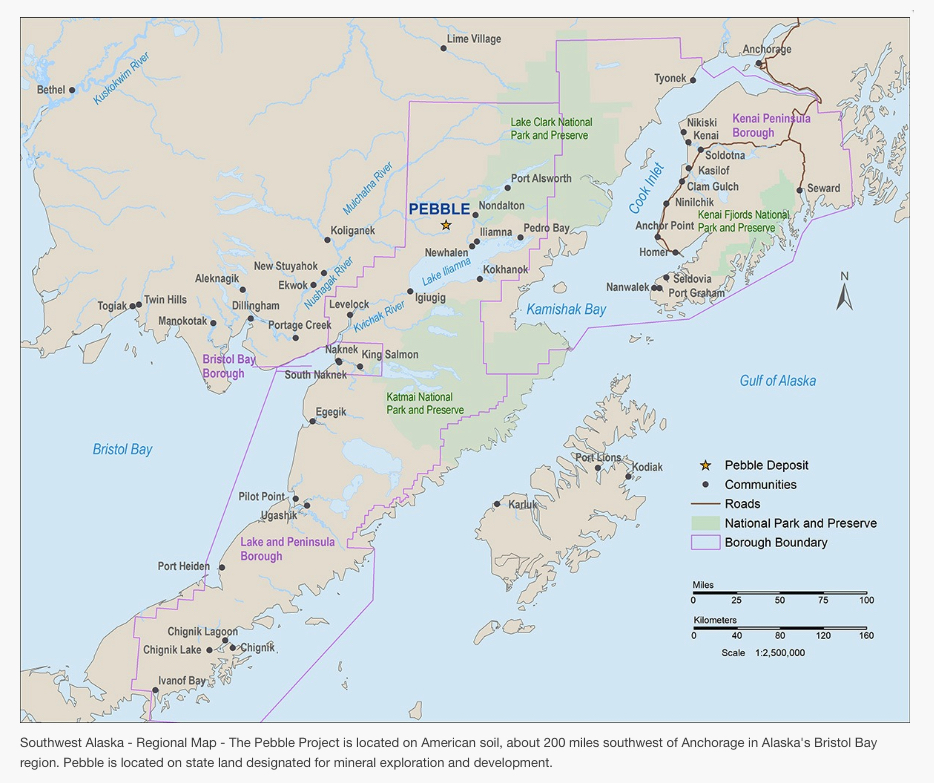

The Bristol Bay area, where the mine would be located, is the world’s largest commercial sockeye salmon-producing region. Opponents of the project have long feared its discharges could contaminate local waters, causing irreparable damage to the aquatic habitat.

Trump Jr.’s concerns are shared by a group of politicians, including US Sen. Dan Sullivan, R-Alaska.

“My staff and I are continuing to review the Army Corps of Engineers Final Environmental Impact Statement, but I am increasingly concerned that (the final review) may not adequately address the issues identified in the draft (review) regarding the full risks of the project as proposed to the Bristol Bay watershed and fishery,” Sullivan said. “I am also continuing to make sure that Alaska’s voices are being heard on this project at the highest levels of government – including the White House.”

Contentious project

Since Teck Resources’ predecessor, Cominco, began exploring the prospect in the 1980s, Pebble has divided conservationists, local activists, fishermen and regulators.

Northern Dynasty secured a 100% ownership in Pebble in 2005. Two years later, it entered into a 50:50 partnership with Anglo American (LON:AAL) to develop the massive deposit.

The Canadian miner became again the sole owner of Pebble in 2013, after Anglo American walked away from the project, in which it had invested $573 million.

Pebble’s permitting process has been surrounded by controversy and delays. Perhaps one of the most publicized issues was the US Environmental Agency’s (EPA) decision in 2014 to propose restricting the discharge of mining waste and other material in the area.

Criticism prompted the Vancouver-based company to submit a new, smaller mine plan that includes lined tailings, and discard the use of cyanide in the gold extraction process.

Pebble began moving forward after the election of Donald Trump in November 2016. In July last year, Northern Dynasty scored a big win as the EPA scrapped the proposed restrictions on mining operations in Bristol Bay, which prevented the project’s consideration.

The agency also issued a letter at the time, saying the project may result in substantial and unacceptable impacts to aquatic resources. That observation was a specific step in a sequence established to deal with inter-agency disagreements over Clean Water Act permits.

A draft version of the EIS released in February, however, indicated that the project could co-exist with the fisheries and water resources of the Bristol Bay area.

The news was followed in May by the EPA issuing a new letter that downplayed the possible loss of streams and other wetlands the project might cause.

$342 billion deposit

If permitted, Pebble would be North America’s largest mine, with a productive life of at least 20 years.

Headaches for Northern Dynasty, however, may not end up there. A coalition of local residents and national environmental groups has vowed to challenge the permit in court.

There is also the possibility that the next administration blocks it once again, as happened during Obama’s presidency, should Democrats win the White House in the fall.

Current resource estimate includes 6.5 billion tonnes in the measured and indicated categories containing 57 billion pounds of copper and 71 million ounces of gold, 3.4 billion pounds of molybdenum and 345 million silver ounces.

With those metals trading recently close to historic highs, Pebble is one of the richest deposits in the world based on resource estimates.

Gold prices recently topped $1,900 an ounce, about $10 of the all-time high. Copper has approached a two-year high, just short of $3 per pound. Silver is exchanging hands for more than $20 for the first time in seven years and molybdenum has recovered to $9 a pound from less than $5 two years ago.

At those prices, Pebble is worth a combined $342 billion.