It’s earnings season, and as of Friday, profits for S&P 500 companies were down roughly 34 percent compared to the same time a year earlier, with 62 percent of companies reporting.

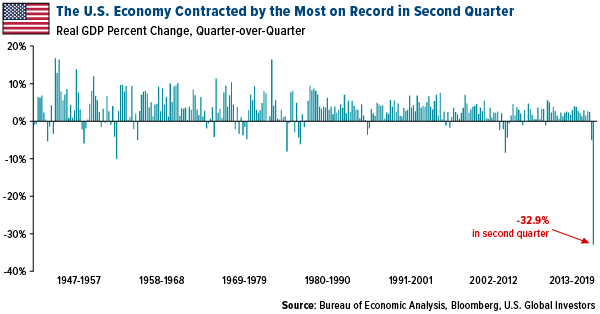

Coincidentally, that decline is close to the rate at which the U.S. economy shrank in the second quarter due to coronavirus lockdown measures. U.S. GDP plunged an historic 32.9 percent compared to the previous quarter, the fastest pace on record.

I know that sounds bad—and for the millions of Americans who are still out of work, it is—but I expect third-quarter GDP to be just as historic on the upside.

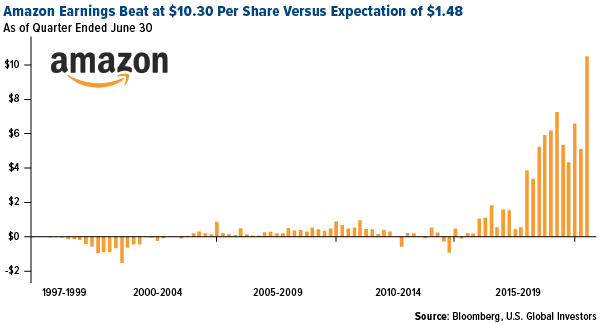

Not all companies have suffered in the age of COVID-19, though. Big tech earnings surged as a large percentage of the population was restricted to staying home, surfing the internet and making purchases online.

Retail giant Amazon had among the largest earnings beats, despite costs associated with the virus—protective gear, mostly, but also bonuses—reaching $4 billion. Earnings per share (EPS) came in at an off-the-charts $10.30, seven times above Wall Street’s expectation of $1.48. That’s the highest-ever EPS in the company’s 23 years as a publicly listed company. According to Amazon, video hours on Amazon Prime doubled during the three months. Online grocery sales tripled.

Copper Miner Ivanhoe Mines at an Advantage After Chile’s Charge Against BHP

Metal miners have also been reporting strong profits as prices for both industrial and precious metals were up during the quarter. Total earnings for those that have reported stand at more than $713 million, compared to estimates of $216 million.

Forty North American gold producers have reported so far out of 284. Sales have been right in line with expectations, but earnings have surprised to the upside, with Yamana Gold, New Gold, Sandstorm Gold and Dundee Precious Metals pulling off the biggest beats.

Two companies in the metals and mining space I’m looking forward to hearing from are Ivanhoe Mines and Franco-Nevada. Both are scheduled to report later this week.

For the two-year period, copper producer Ivanhoe has far outperformed copper prices and an index of global copper miners. Like most industrial metal producers, its stock price fell on fears the coronavirus would lead to mass mine closures and a global slowdown in demand for the red metal. Since hitting the bottom in mid-March, Ivanhoe shares have exploded more than 142 percent.

In a press release dated July 27, Ivanhoe founder and co-executive chairman Robert Friedland (pictured below, from when he visited our office in January 2018) calls 2020 an “extraordinary year” for metal prices. Copper is at a two-year high, silver at a silver-year high and gold at an all-time high.

“Our tier-one projects in Africa will produce all of these metals,” Robert says, referring to the company’s 100 percent-owned Western Forelands Project, Kamoa-Kakula mining license and Platreef Project.

Copper prices have been supported by global supply strains due to the pandemic, and further disruptions are a real possibility. On Friday, the Chilean government announced it would charge BHP, the world’s largest copper producer, for drawing too much water from the Chilean desert at the company’s Escondida copper mine.

Copper prices have been supported by global supply strains due to the pandemic, and further disruptions are a real possibility. On Friday, the Chilean government announced it would charge BHP, the world’s largest copper producer, for drawing too much water from the Chilean desert at the company’s Escondida copper mine.

Credit Suisse analysts rate this news as negative, as BHP could be fined, have its environmental permit revoked or even forced to close Escondida.

I agree that this is negative for BHP, but it could be positive for copper prices, not to mention other copper mining jurisdictions, especially those that are friendlier to metal producers and that have an abundance of fresh water. That includes the Democratic Republic of the Congo (DRC), where Ivanhoe operates.

“We are blessed with incredibly high-grade deposits in areas that have an abundance of clean, sustainable hydro power potential—providing us with a distinct advantage in our goal to become the world’s ‘greenest’ miner,” Robert said in June, speaking of the Kakula Mine, which sits on the mighty Congo River.

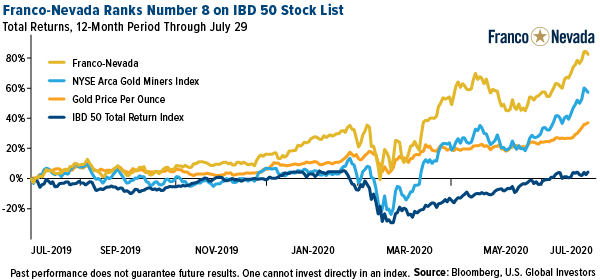

Franco-Nevada Rises to Number 8 on IBD 50 Stock List

I’m also expecting a strong report from Franco-Nevada. The world’s largest gold royalty company is up more than 83 percent for the 12-month period, beating gold producers and the price of the yellow metal.

It’s also beating the IBD 50 Index, which I’m including above because Franco-Nevada is now a member of the IBD 50 Stock List, the publication’s flagship screen of leading growth stocks. On Thursday the stock climbed to number eight on the list and is currently ranked first in the Mining-Gold/Silver/Gems Group based on its earnings potential. Analysts are looking for earnings growth of 41 percent in the second quarter, according to IBD.

Good for Gold: U.S. Yields Hit All-Time Lows

Spot gold continued to trade near all-time highs Thursday and Friday in its quest to break through $2,000 an ounce. Supporting the yellow metal was a falling U.S. dollar and anticipation of another round of fiscal stimulus. The real yield on the 10-year Treasury closed at a record low last Tuesday. The bond continued to trade lower throughout the week, falling to negative 95 basis points.

Last week I shared with you my thoughts on gold being overbought, and whether this should prompt selling. In the period between 1980 and 1999, taking your profits was a good strategy after gold became overbought, but that same strategy has not worked in investors’ favor since 2000.

In the oscillator chart below, you can see that gold looks overbought at 2.14 standard deviations for the five-year period, so it’s important for investors to be cautious. A correction in the short term wouldn’t be unexpected. However, over the long term, I still believe gold will continue to head higher. Gold has been in a “golden cross” for around 18 months now, since January 2019, when the metal went above 1 standard deviation and then reverted to the mean. Afterward, it traded up.

Click here to see my complete analysis.

Congratulations, Thunderbird!

Some of you may not know that besides my roles at U.S. Global Investors and HIVE Blockchain Technologies, I am also an independent director at Thunderbird Entertainment, which was involved with the production of 2017’s Blade Runner 2049, among many other films and TV shows. The company trades in Toronto under the ticker TBRD.

I’m pleased to tell you that Thunderbird recently received some well-deserved accolades. Among them were an Emmy and four Leo Awards for the Netflix family series The Last Kids on Earth, three Leo Awards for the Canadian sitcom series Kim’s Convenience, and a Leo Award for the documentary TV series Highway Thru Hell. Congratulations to all who were involved! Kudos especially to CEO Jennifer Twiner-McCarron.

Upcoming Webinars

We are still trying to settle on a new date for the webinar co-hosted by me and Kevin O’Leary of O’Shares ETFs and Shark Tank. Some of you have already expressed interest in attending. If you’d like to be among the first to get the details as soon as they become available, please email us at info@usfunds.com.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Solactive Global Copper Miners Index includes international companies active in exploration, mining and/or refining of copper. The index includes a minimum of 20 and a maximum of 40 members. The IBD 50 Index tracks the performance of stocks listed in the IBD 50, a proprietary list of the 50 top-ranked companies updated and published daily in Investor’s Business Daily. Companies are ranked based on superior earnings, strong price performance, and leadership within their respective industries.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. A basis point, or bp, is a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% (0.0001).

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE. Effective 8/31/2018, Frank Holmes serves as the interim executive chairman of HIVE.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2020): Amazon.com Inc., BHP Group Ltd., Yamana Gold Inc., Sandstorm Gold Ltd., Dundee Precious Metals Inc., Franco-Nevada Corp., Ivanhoe Mines Ltd.