Source: McAlinden Research for Streetwise Reports 07/30/2020

McAlinden Research Partners reports on the conditions driving the accelerating silver market, and sees “more upside on the horizon.”

Summary: The rally in silver prices has accelerated this summer, pushing spot prices to a six-year high this week. While the debasement of the dollar by huge fiscal and monetary stimulus has played a role in the broader outperformance of precious metals, silver has benefited from a rebound in industrial activity, as well as historically low relative pricing when compared to gold. [Related exchange-traded funds (ETFs): iShares Silver Trust (SLV), Global X Silver Miners ETF (SIL).]

The precious metals have had quite a run over the last few months, and silver has been at the top of the heap.

To receive all of MRP’s insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on July 22.

Spot prices have now pushed above $21/oz, the highest level in six years, according to analysts at Commerzbank. This new high is in stark contrast to the 11-year low silver hit back in March.

Industrial Growth Powered by Solar Boom

Silver has great appeal in times of economic recovery because it is not only a safe haven asset, but an industrial metal as well, sporting applications in everything from electronics to solar panels. The reopening of Chinese factories in recent weeks and a rally in base metals such as copper also is supporting demand.

Investors have picked silver as a way to play this “green” recovery, Colin Hamilton, analyst at BMO Capital Markets, told the Financial Times. Governments across the world have approved more than $50 billion of environmentally friendly stimulus measures this year, according to BMO.

Earlier this year, the Silver Institute released a report, produced on its behalf by CRU Consulting, estimating that demand for silver in photovoltaic (PV) cells, used for solar power, will be a cumulative 888 million ounces between this year and 2030. BMO is even more bullish on silver’s utility to the solar industry, projecting around 1.5 billion ounces of PV demand from 2020 through 2030.

Technicals and Fundamentals

It also helps that, until recently, silver was likely the cheapest it has ever been, in relation to gold.

While the wave of volatility and the resulting liquidity crunch brought on by the height of the Covid-19 pandemic wiped out precious metals prices at the time, it only strengthened the long-term case for precious metals—particularly silver.

Back in March, we wrote that silver was the most attractive play in precious metals, trailing the price of gold by more than it ever had before. Back then, the gold-to-silver ratio was so extended that it had just broken a 5,000-year-old record, peaking around 125. This ultimately set the stage for the dramatic rebound in silver prices that we are now seeing.

Though the ratio has now tightened to just below 90 on the back of silver’s surge, that is still well above the longer-term average of about 60.

As Kitco writes, the silver market is currently on pace to surpass gold’s performance for the year. With its latest rally, silver prices are up 26% year to date. Meanwhile, gold prices are up 21% for the year. Silver’s outpacing of gold looks likely to continue, as the CFTC’s disaggregated Commitments of Traders report for the week ending July 14 showed that, although money managers decreased their speculative gross long positions in Comex gold futures by 2,410 contracts to 177,400, silver futures rose by 3,404 contracts to 65,615. At the same time, short positions on silver fell by 3,207 contracts to 22,988.

Fiscal and Monetary Stimulus Spell Weak Dollar, Strong Precious Metals

Though, on a technical basis, silver was a rocket ship waiting to take off, the catalyst that launched it was the US Federal Reserve’s continued commitment to keep fixed income yields near all-time lows for the foreseeable future. Additionally, cheap money continues to debase the value of the dollar. The Fed’s balance sheet has expanded by nearly $3 trillion, or 60%, since the beginning of the year.

The dollar will be further depressed by a strengthening euro after a summit of European Union leaders in Brussels finally came to agreement on a huge spending program, including a €750 billion rescue fund. The euro on Tuesday climbed to its highest against the U.S. dollar in more than four months, as ING analysts told Reuters that they are looking for “more gains to $1.20 later this year,” because the recovery fund agreement is significant enough “not to prompt investors to exit their long euro positions,” particularly against the dollar.

“The €390 billion of grants and €360 billion of loans that are now being talked about [in Europe] mean additional mountains of debt and further currency debasement,” said Daniel Briesemann, analyst at Commerzbank, in a note. “Gold should therefore profit as a store of value. Further financial aid to overcome the corona crisis is likewise being discussed in the U.S. This is also necessary given that the first corona emergency aid packages will soon come to an end.”

While some worry that the lack of inflation could pare the hedging value of precious metals, we believe that inflation will recover more quickly than most expect as part of a V-shaped economic recovery.

The U.S. Dollar Index (DXY) may be a grave indicator of just how close the greenback is to correction territory. Over the last three months, the DXY down more than 5% and Barron’s warns that the index’s monthly closing chart shows that the dollar stalled at a 33-year trendline of resistance. Over the last few decades, the DXY piercing that trendline has been the signal of an even more accelerated decline on the horizon. At the time of this writing, the DXY is holding around 95.18. Barron’s projects that, if the index falls below 95, that would indicate a further decline of at least 10%.

MRP highlighted the dollar to precious metals correlation a number of times over the last year and a half, especially in regard to the effect of real rates and expansion of the monetary base, going back to March 2019, when we released our “Time for Gold” Viewpoint report. Back then, spot prices for the yellow metal were around $1,300/ounce. Since then, gold has surged to about $1,838/ounce, a gain of more than 40%. Recently, real rates in the U.S. plummeted and went negative, while multi-trillion-dollar stimulus packages have undoubtedly pushed the monetary base to new heights.

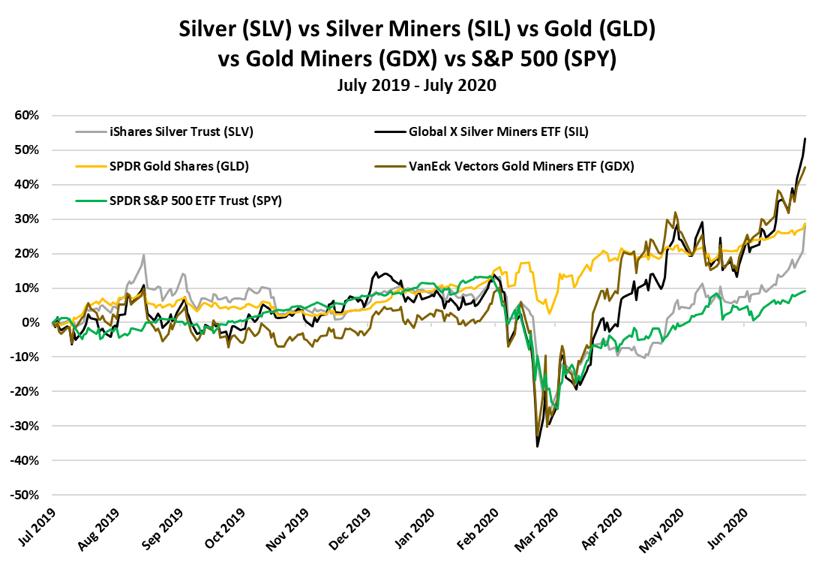

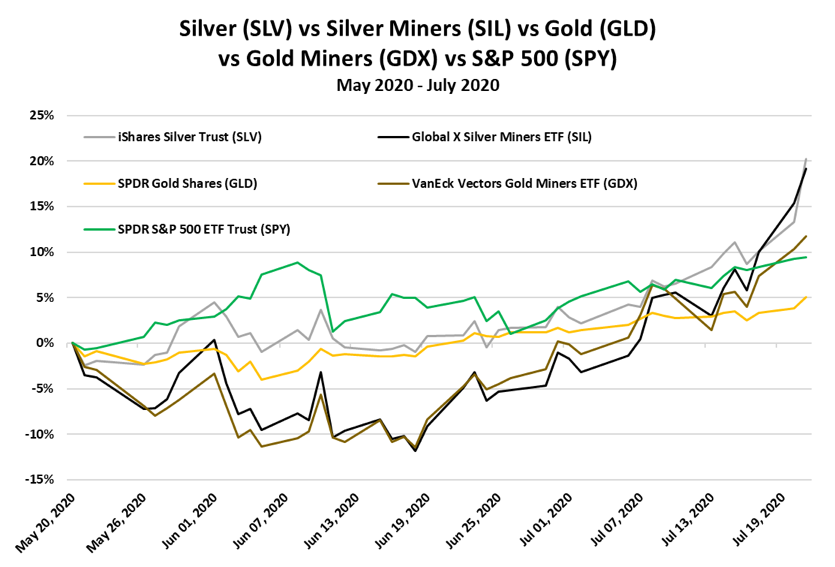

Just about a year ago, we noticed that silver had largely missed out on the early portion of the gold rally. As a result, we added long Silver & Silver Miners to our list of themes on July 22, 2019. Since then, the iShares Silver Trust (SLV) and Global X Silver Miners ETF (SIL) have returned 28% and 53%, respectively, outperforming the S&P 500’s 9% over the same period.

Following a broad rebound in silver prices and miner stocks, the SLV and SIL handily beat out gold and gold miner ETFs, after soaring 20% and 19% over the last two months. The SPDR Gold Shares (GLD) and VanEck Vectors Gold Miners ETF (GDX) rose just 5% and 12%, respectively.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm’s mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients’ attention. MRP’s research process reflects founder Joe McAlinden’s 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.