Drive For Show And Putt For Dough

Brownfield Is The Better Bet —

Most of the stories I’ve been giving you lately are the junior gold exploration stocks with strong potential for a new discovery.

Watching a junior explorer make a new discovery is like watching a golfer crack a 300 yard drive off the tee. It is so much fun.

Over the years, however, my brain has become more closely linked to my bank account.

And my brain knows that there is a better way to invest in the gold sector.

There is no question the lowest risk, highest reward place to invest money in the gold mining space is with a good team taking a brownfield play into production.

With the right brownfield asset, you create hundreds of millions in market cap with a low risk, two-foot, tap in putt.

Brownfield by definition means lots of infrastructure and permits in place with tens of thousands of meters of drilling. Greenfield is high risk exploration, brownfields is low risk development.

Greenfield is Driving For Show, Brownfield is Putting For Dough.

And the brownfield play I’ll show you tomorrow—a former gold-silver producer in the Americas–is a like a two-foot tap-in putt for what could be close to a $1 billion payday—or almost 10X the current market cap of this company.

Brownfield development is about developing the sure thing. This is where you manufacture money, not hit and hope. With brownfield development you know all of the variables that you are working with.

At these gold prices–$1900/oz and counting!–brownfield development projects are capable of minting money and doing it very quickly.

I believe this company is the best brownfield development story in the market today. It’s a former producer in the Americas. The US$200 million in infrastructure is still there—3000 ton per day mill, power, camp, lab etc.—complemented by another estimated US$50 million of drilling.

Oh yeah, water and mining permits and over 200,000 oz of gold in waste dumps ready to go is there too.

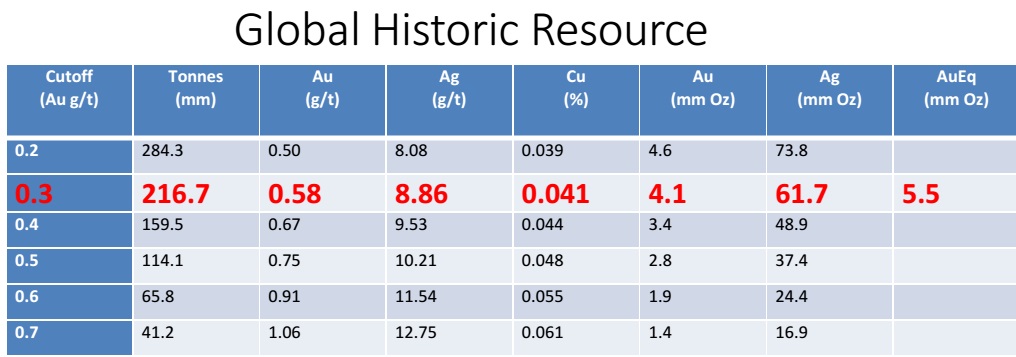

In 2017, a multi-billion dollar global engineering company verified a 5.5 million ounce equivalent resource in the ground.

Now, that is NOT 43-101 compliant, but the 1700 drill holes totalling 120,000 metres of drilling by a major gives me a HIGH degree of confidence in this number.

The current table of resources is not intended to be declared in a public instrument such as a NI43-101 report.

To me, that resource alone is worth at least 3x times the current share price, just to value the gold in the ground at US$44/oz that is the average peer valuation (as per Haywood Securities most recent comp sheet).

For me–that takes all of the risk out of the story.

THE ASSET IS THE STEAK

THE EXPLORATION POTENTIAL IS THE SIZZLE

I’ve spoken to both the lead geologist on the project now, and to the man who put this asset into production originally. It is a project that he worked on decades ago when gold was a fraction of the $1,900 per ounce price we currently have.

He told me that decades ago, drilling mostly stopped at 70 meters–where they could mine profitably at $400 per ounce gold at that time.

But they know the gold runs much deeper…….down to 200 meters. There are potentially millions of more ounces—in and around the same open pits!!!

At $1,900 per ounce gold there is so much more that can be profitably mined. This project is…potentially now…I’m not allowed to say FOR SURE…exponentially bigger than anyone believes.

This is what I do. I find the undiscovered gold plays that the top management teams have been working on and bring them to you first.

Today the shares of this company trade at a deep discount to what the resource is worth today (vs its peers)…but at just a tiny fraction of what the exploration potential here is.

This isn’t rocket science…in this red hot gold market there have been plenty of arm’s length acquisitions of gold resource that have established the going rate.

What I’m seeing is that gold resource in the ground is worth an average of US$44 per ounce and for the Americas, it’s commonly more—like, up to $145/oz.

At $44/oz AuEq, just the 5.5 million ounces (remember that’s not officially 43-101 compliant!) that have already been confirmed are worth US$242 million. This company has ONE THIRD that market cap.

That leaves huge upside if they:

A) find more gold or

B) the Market wisely chooses to up-value these ounces as they are in the Americas, in the same pit that was produced before, and see that infrastructure is still in working order. (The previous owner started the mill every quarter to keep it warm!!)

This is a low risk development play with an already huge resource—with the crazy upside of a resource that could be 2-4x that with the (much) higher gold price now. In the Americas.

What we are looking at here is a tap-in putt. A two-footer straight up the hill.

The kicker for me is that the man behind this company has a documented track record of quickly monetizing undervalued assets like this:

1 – Taking his former mining company from a $1 million market cap to a $520 million sale to a larger miner

2 – Sold another mining company for $350 million

3 – Taking yet another stock from a $1 million starting valuation to $800 million within two years and eventually a market valuation of $13 billion

That is why this gold stock is 5.5 million ounce brownfield development tap-in gift to you.

Meanwhile the upside is every bit the equivalent of a big time exploration punt.

There Are Few Big Projects In Safe Jurisdictions

At current gold prices many of these projects come back to life and create big time cash flow.

And this already successful team will do it virtually risk free. I can summarize the appeal of brownfield development in this gold market in four simple words….

THE ROCKS DON’T CHANGE!!!

Most of the infrastructure spending has also been done. Power lines, access to water, permits, roads, everything is already in place. Updating capex should be very little, and they turn on production and have a cash cow up and running incredibly quickly.

This mine operated when gold was just $400 per ounce. It ran for four years and made some nice money.

But not all of the gold was mined. That’s a fact. In fact, it’s likely that not even close to all the gold was mined.

Only three years ago one of the largest independent resource evaluators estimated there was at least 5.5 million ounces equivalent of non-43-101 compliant resource there.

Again….the rocks haven’t changed. But the economics of those rocks have changed because the price of gold has more than quadrupled since the first go round.

5.5 million ounces….with even more exploration potential remaining.

There is huge demand for projects of this size.

DO NOT MISS MY E-MAIL TOMORROW!!!

As an e-mail subscriber of mine you know that together we have been on a tear in this red-hot gold market with junior exploration stories.

Tomorrow the brownfield gold stock that I’m sending you is different.

This one is a tap-in, a two-foot putt.

The company is already on the green and just needs to tap in that putt.

The large but non-compliant gold is there. Millions and millions of known ounces.

The infrastructure is there. Very little spending is required to turn this into a cash cow.

Investors have an added bonus of HUGE exploration upside. Nobody has ever drilled this project with current gold development economics in mind.

Today was about getting you ready. Tomorrow I give you all of the specifics:

1 – The name of this huge brownfield development project

2 – An exact look at what I think this asset and stock are really worth

3 – The team behind the project including the geologist who was here decades ago and the Chairman who is a serial builder and seller of companies

4 – The most important part……THE NAME AND TICKER of this (non-compliant!) 5.5 million ounce tap-in.

They don’t come much bigger or easier than this brownfield opportunity.

I love exploration stories but I know that this is the kind of stock that true investors want to own.

All the reward without all of the exploration risk.

Tomorrow. First thing. Watch your in-box!