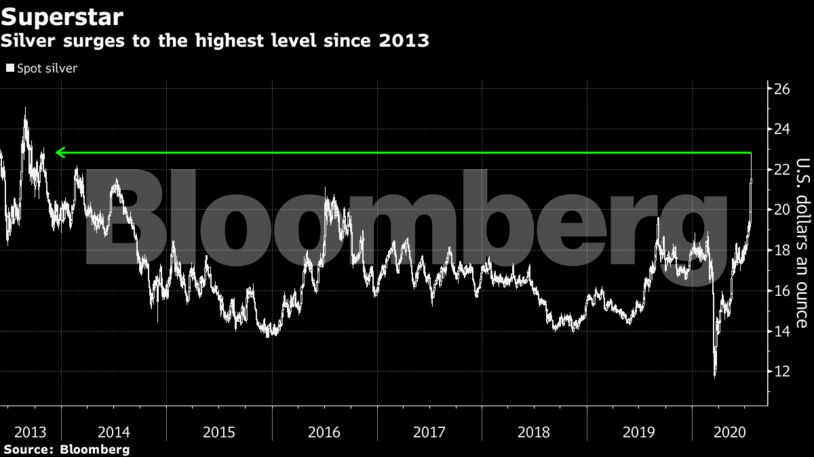

Silver futures climbed to the highest in seven years on expectations there will be more stimulus to help the global economy recover from the coronavirus pandemic.

Spot silver advanced 6.2% to $22.71 an ounce by 1:20 p.m. EDT, while silver futures on the Comex exchange rose by as much as 1,4% to $22.90 an ounce.

Silver prices have risen around 15% this week. Some analysts see the movement as the start of a bull run powered by low interest rates, resurgent investment demand, disrupted production and a recovery in industrial consumption.

“It’s a typical low-liquidity summer market where prices tend to be easier to push, especially when momentum has been established as per the trifecta of support,” Ole Hansen, head of commodity strategy at Saxo Bank A/S told Bloomberg.

“The closer gold gets to its record high the stronger the magnetic field will become and that could see it challenge that level before long.”

Analysts at Citi said prices could rise to $25 over 6-12 months

Lower returns on bonds have made it more attractive to hold gold and silver, and investors are stockpiling both in the hope they will hold their value as central bank stimulus unleashed during the pandemic erodes other assets. Gold prices also kept their upward momentum on Wednesday, passing the nine-year peak set during the previous trading day.

Consumption of silver in industries, such as solar panels and electronics, is also likely to increase as the economy rebounds, while silver mine output is projected by consultancy Metals Focus to fall 7% this year as the novel coronavirus interrupts operations.

At the same time, a weakening dollar is making silver cheaper for buyers with other currencies, fuelling the rally.

Analysts at Citi said in a note prices could rise to $25 over 6-12 months – outperforming gold – as investors move to protect their wealth and global economic activity improves.

However, a Reuters poll of 42 analysts and traders conducted this month said silver would average $20.03 an ounce next year.

Technical indicators show silver is overbought, suggesting that prices will struggle to move immediately higher.

Any weakness is a chance to buy, some traders say.

“A deep setback lower is looming,” tweeted Gianclaudio Torlizzi at consultancy T-Commodity. “I will be using the correction as opportunity to charge long. A new bull market has started.”