Gold prices continued to ascend on Tuesday, reaching their highest levels in nine years, as a softer US dollar and expectations of more stimulus measures to resuscitate pandemic-hit economies provide further support for the safe-haven metal.

Spot gold rose 1.2% to $1,839.58/oz by 11:30 a.m. EDT, having touched the $1,840/oz mark earlier in the session. US gold futures for August delivery advanced 1.3% to $1,840.80/oz after hitting $1,843.80/oz earlier, the highest for a most-active contract since September 2011.

Spot gold is one of this year’s best performing assets, with prices up almost 20%

“Gold is deriving strength from a broadly weaker dollar despite the improving market mood,” FXTM analyst Lukman Otunuga told Reuters. The dollar eased 0.1% against major currencies after touching a more than four-month low.

Gold’s resilience also defied a gain in global equities on the European Union’s historic 750 billion euro ($857 billion) stimulus plan and hopes for coronavirus vaccines.

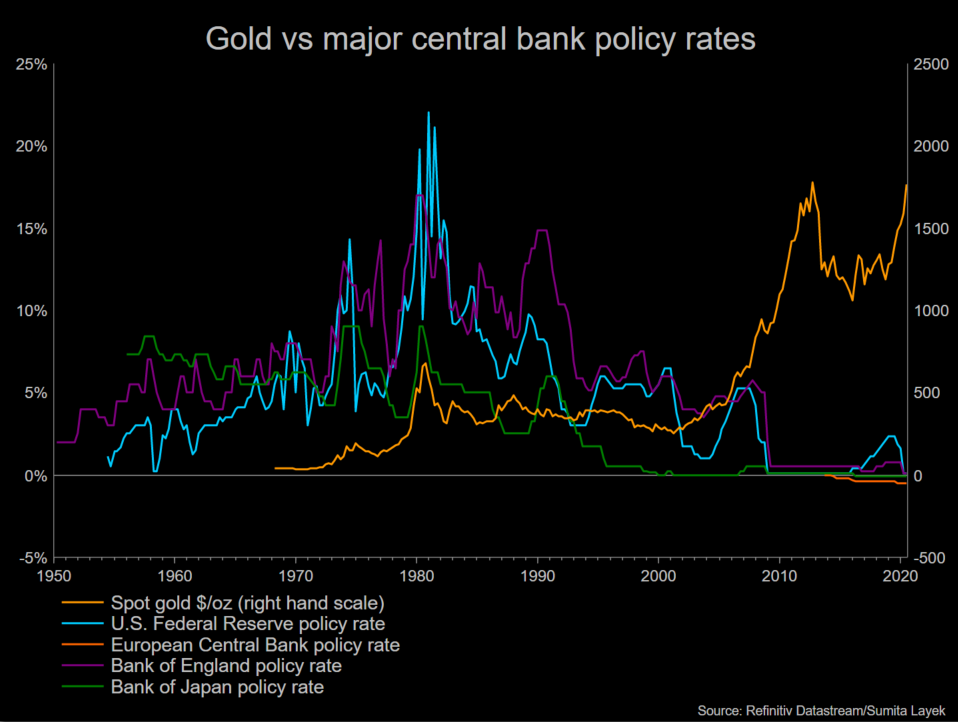

Gold is finding support from discussions about new fiscal stimulus, UBS analyst Giovanni Staunov told Reuters. Widespread stimulus tends to support gold because the metal is widely viewed as a hedge against rising prices and currency debasement.

Revealed in a recent poll by Reuters, gold prices are expected to push towards record highs over the next 18 months as the coronavirus crisis encourages investors to hoard the metal as a hedge against possible turmoil in the wider markets.

The poll of 42 analysts and traders returned a median forecast for gold to average $1,713/oz in 2020 and $1,800/oz in 2021 – a significant rise from projections of $1,639/oz and $1,655/oz in a similar survey back in April.

“The more uncertainty over the control of the virus and by association the global economy, the more bullish for gold,” said StoneX analyst Rhona O’Connell, adding that prices could reach record levels above $2,000 in 2021.

Spot gold is one of this year’s best performing assets, with prices up almost 20% and above $1,800/oz for the first time since 2011.

Silver run keeps running

As with gold, the price of silver also continued its ascension and clinched multi-year highs on Tuesday. Spot silver gained 5.5% to $21.01/oz and reached its highest point since July 2016.

“Silver is starting to outperform gold here,” IG Markets analyst Kyle Rodda told Reuters, pointing to increased appeal for precious metals generally. “On top of that, there’s likely to be an element of silver catching a bit on a rebound in global industrial activity.”

The metal, used in manufactured products ranging from solar panels to electronics, is receiving an added boost from supply concerns and bets on a rebound in industrial demand on top of the monetary policies that have helped to lift gold.

The two metals are the top performers in the Bloomberg Commodity Index this year as investors clamor for insurance against further economic fallout from the virus.

Even after recent gains, banks and traders are still predicting silver to climb even higher. Citigroup said in a report this week that it sees prices rising to $25 in the next six to 12 months, with the potential for $30 based on the bank’s bull case.

(With files from Bloomberg and Reuters)