Icecap, a platform that tokenizes diamonds on the Ethereum blockchain, launched this week a bid/ask trading marketplace targeting diamond investors.

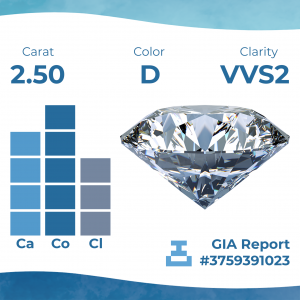

In a press release, Icecap said the new platform uses the Ethereum ERC721 Non-Fungible Token (NFT) standard to give GIA-graded and GCAL-verified diamonds their own digital tokens, which represent the rights to a single specific diamond stored in a vault. The tokens then function as globally-tradable assets on crypto marketplaces.

“We believe there is currently a $10 billion potential market opportunity for investors to diversify into diamond assets, a market that until now has largely been untapped,” Jacques Voorhees, Icecap’s founder and CEO, said in the media brief. “Until now, the diamond industry has been structured as a one-way flow of diamonds from mine to consumer. But a diamond investor needs to sell as well as buy, and today that means buying at retail and selling at below wholesale, to a dealer, retailer, auction house, or perhaps even to a pawnshop. In that scenario, an investor might lose 50% or more of the purchase price of the stone. That dynamic is what has made diamonds to date untenable for asset diversification.”

According to Voorhees, blockchain technology, and in particular tokenization using the ERC721 standard, solves the problem of investor’s loss. “Icecap can now mint a unique digital token and assign it to a specific diamond. The token is then traded easily, back and forth, on marketplaces like OpenSea where it incurs only a 1% exchange fee. The token can be redeemed for the diamond at any time by the owner of the token,” the executive said.