Car sales are running at least 20% below 2019 levels with annualized June figures pointing to a 2020 light vehicle market of 76.6 million units. At the same time electric vehicle penetration rates continue to climb.

In Western Europe, according to Schmidt, a market researcher, for the first six months of this year, 216,000 battery-electric vehicles (BEVs, excluding plugin-hybrids) were sold.

That’s up 44% from last year and more than was sold on the continent in all of 2018. In contrast the overall market in Europe is down 24%. Brussels’ emissions regulation requires 2.5 million electric cars hitting the road this year and next.

China is also sticking to its goal of 25% market share for electric and fuel cell vehicles by 2025.

In China, the world’s largest car market, BEVs accounted for 67,000 out of a total market of 1.68m units in June with Tesla cornering 23% of the Chinese electric car market.

China’s passenger car association expects electric car sales to be significantly higher in the second half of 2020 compared to last year, when an unexpected change in Beijing’s subsidy scheme for green cars sent sales tanking.

China is also sticking to its goal of 25% market share for electric and fuel cell vehicles by 2025.

In the US the IEA anticipates that total BEV sales for 2020 will stay flat compared to last year at around 2.1 million units.

Lithium prices continue to languish

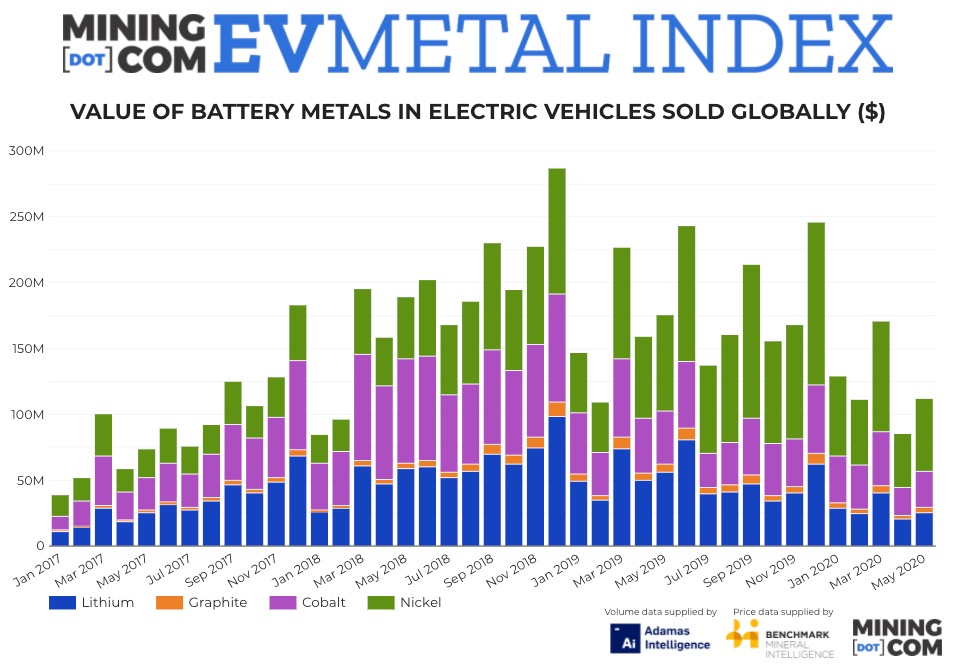

The MINING.COM EV Metal Index, which tracks the value of battery metals in newly sold EVs around the world bounced back by more than 31% in May, after dropping to its lowest level since January 2018 in April.

The surge comes despite continuing deterioration in the battery raw material market.

Lithium, graphite and cobalt prices eased again in May albeit slightly, while nickel used in the battery supply chain eked out a 2.5% month on month gain climbing back above $14,200 a tonne (100% Ni basis).

The deterioration in lithium prices according to Benchmark Mineral Intelligence data has been relentless – trading at just over $7,000 a tonne in June from more around $11,600 the same month last year and more than $17,700 in mid-2018.

Raw material deployment surges

Car sales are always lumpy and none more so than BEVs where changes in incentive schemes and government regulations play an outsize role in buying decisions, not just in China but in most developed markets (vide Norway with 70% EV sales penetration)

The massive jump in raw material deployed in May brought the value of the index back into triple digit territory with the value of battery raw materials tracked by the index in newly-sold EVs hitting $112m for the month.

At $609.7 million, year-to-date the index is still more than 25% below 2019 levels but only 15% below the same period in 2018.

Given the fact that lithium prices were hitting all-time highs above $20,000 a tonne during H1 2018 and cobalt was trading north of $100,000 versus just above $30,000 now, it’s testimony to the explosive growth of the global EV industry.