Gold prices held support at $1,800 an ounce on Tuesday as investors continue to pile into safe-haven assets over worries about surging coronavirus cases.

Spot gold opened above $1,800 for the fourth consecutive trading day, rising by 0.4% to $1,809.98 per ounce as of 11:35 a.m. EDT. Gold futures for August delivery were down slightly to $1,813.10 per ounce, still within sight of record highs.

Falling optimism of a prompt recovery in the global economy, combined with rising diplomatic tensions and the current macroeconomic environment of low interest rates, has curtailed the risk appetite among investors and drive the price of gold — often a hedge against political and financial uncertainties — to near nine-year highs.

“We are seeing pressure on risk assets given the sentiment and concerns, particularly about China and US relations,” Michael McCarthy, chief strategist at CMC Markets, told Reuters.

Mid-year outlook

On Tuesday the World Gold Council (WGC) released its mid-year outlook for gold, reaffirming that the ongoing pandemic will likely have a lasting effect on asset allocation and continue to reinforce the role of the precious metal as a strategic asset.

Investors have embraced gold as a key portfolio hedging strategy this year, the Council says, particularly as expectations for a faster recovery from covid-19 are shifting towards expectations of a slower recovery, or even potential setbacks from additional waves of infections.

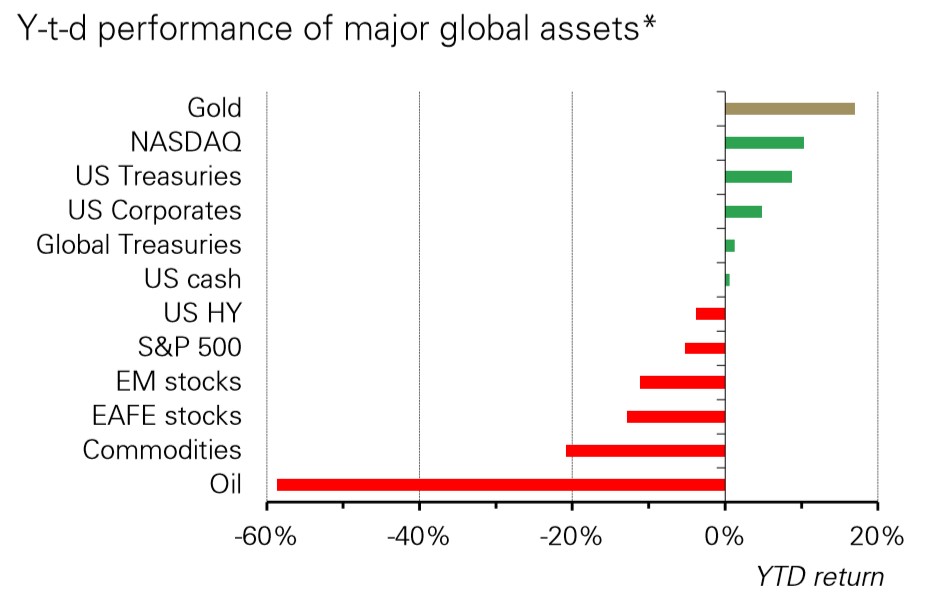

According to data compiled by the WGC, gold had a remarkable performance in the first half of 2020, increasing by 16.8% in US-dollar terms and significantly outperforming all other major asset classes.

The combination of high risk, low opportunity cost and positive price momentum looks set to support investment in gold and offset weakness in consumption from an economic contraction in H2 2020, the Council says.

By the end of June, the LBMA Gold Price PM was trading close to $1,770/oz, a level not seen since 2012, and reaching record or near-record highs in all other major currencies.

Though equity markets around the world rebounded sharply from their Q1 lows, the high level of uncertainty surrounding covid-19 and the ultra-low interest rate environment supported strong inflows. Like money market and high-quality bond funds, gold benefited from investors’ need to reduce risk, underscored by the record inflows seen in gold-backed ETFs.

With the IMF projecting a 4.9% contraction in global growth in 2020 due to the devastating effects of the covid-19 pandemic, the WGC expects the possibility of a recovery in H2 2020 being short lived as recurring waves of infections continue to set economies back.

For investors, the high levels of uncertainty could have a long-lasting impact on their portfolio performance. Against this backdrop, the Council believes gold can be a valuable asset that helps investors diversify risks and may positively contribute to improving risk-adjusted returns.