Rockhaven Resources Ltd. [TSX-V:RK] (“Rockhaven”) is pleased to announce the results of an updated Preliminary Economic Assessment (“PEA”) for its 100%-owned and road-accessible Klaza Deposit, located in the Dawson Range Gold Belt of southern Yukon.

PEA Highlights:

Highlights from the PEA, with a base case gold price of US$1,450/oz and an exchange rate of C$1.00 equal to US$0.72 are as follows (all figures in Canadian Dollars unless otherwise stated):

• Pre-Tax NPV(5%) of $529 million and an IRR of 45%, and a Post-Tax NPV(5%) of $378 million and an IRR of 37%;

• Using a +/- 20% sensitivity analysis for gold price, Post-Tax NPV(5%) of $540 million and 49% IRR at US$1,740/oz gold and a Post-Tax NPV(5%) of $211 million and 24% IRR at US$1,160/oz gold;

• 12-year mine life producing total payable metals of approximately 750,000 ounces gold and 13.8 million ounces silver;

• Initial capital costs of $244 million, which includes $32 million in contingency costs. Life-of-mine (“LOM”) sustaining capital costs total $114 million;

• Average LOM operating cash cost of US$613/oz AuEQ* and total all-in sustaining cost of US$875/oz AuEQ*;

• Annual payable metal production exceeds 100,000 ounces AuEQ in years three through seven; and,

• Only the upper portions of three out of eleven known mineralized zones are included in Mineral Resources evaluated by this PEA, and there is excellent potential for value enhancement through additional exploration.

“This study demonstrates that Rockhaven’s Klaza Deposit could support a mine with a long life and robust economics,” stated Matt Turner, President and CEO of Rockhaven. “Since the last economic study was completed in 2016, closer spaced drilling has better defined the upper portions of the deposit, resulting in higher average grades in a superior resource category. We are very pleased with the results of this PEA and look forward to continuing to add value through additional discoveries while advancing the deposit through Pre-Feasibility. At its current ~C$35 million market capitalization, Rockhaven offers investors one of the most compelling valuations in the sector.”

AMC Mining Consultants (Canada) Ltd. (mineral resource, mining, infrastructure and financial analysis) was contracted to conduct the PEA in cooperation with Blue Coast Metallurgy Ltd. (metallurgy and processing), Knight Piesold Ltd (tailings and waste management). The PEA is based on the updated Mineral Resource estimate from the Klaza Deposit (see Klaza Property Technical Report dated June 5, 2018).

The reader should be cautioned that the PEA is preliminary in nature. It includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the results of the PEA will be realized.

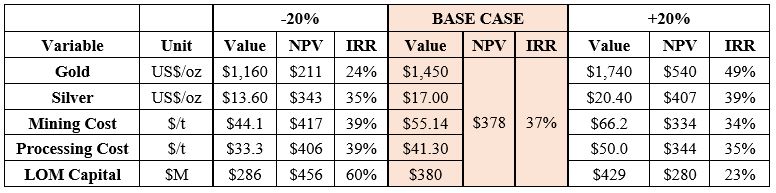

Economic Results and Sensitivities

Tables I and II show economic results with varying metal prices and assumptions, and summarize projected production.

Table I: Klaza Combined Open Pit and Underground Mining – Key Economic Assumptions and Results

2. Gold equivalent values for mining purposes assume base case metal prices and recoveries used in the PEA and are calculated using the following formula: AuEQ=1*Au+Ag/107.82+Pb/4.14+Zn/4.68

3. Overall payable % includes treatment, transport, refining costs and selling costs

4. Includes mine operating costs, milling, and mine G&A

Table II: Klaza Economic Sensitivity Analysis (Post-tax)

Capital and Operating Costs

The Klaza project has been envisioned as a combined open-pit and underground mining operation. Open-pit mining is anticipated to be completed by a contract mining company while the underground operation will be owner-operator with the equipment owned and personnel employed by Rockhaven.

Grid electrical power will provide the majority of the electrical power to the project over the life of the mine. An on-site camp is envisioned to house mine and mill personnel.

Mining

Open-pit mining is anticipated to commence in Year 1 and produce a total of 1,181 kt of mineralized rock over three years. Peak open-pit production will be 598 kt in Year 2. A total of 6,283 kt of mineralized rock is anticipated to be produced from underground operations over the 12-year mine life, beginning in Year 1. Peak underground production will be 688 kt in Years 5 through 7.

Underground mining will be accomplished using mechanized longhole open stoping on 25 m sub-levels. A minimum stope width of 3.0 m was used in this study with dilution of 0.25 m in the hanging wall and 0.1 m in the footwall. Underground access will be achieved via four separate declines for the each of the four main zones. The Central Klaza decline will start from the base of the open-pit.

Waste rock will be used to backfill underground stopes as they are mined and to construct the tailings dams. The remainder will be disposed of in waste dumps on surface.

Processing & Metallurgy

The Klaza process consists of comminution by crushing followed by semi-autogenous grinding and ball milling, with the ground product feeding a conventional sequential flotation circuit producing lead, zinc and arsenopyrite concentrates. The arsenopyrite concentrate is treated by pressure oxidation (POX), followed by cyanide leaching of the POX residue to recover the gold. Precious metals are also leached from the lead concentrate to increase the overall gold recovery to doré and enhance saleability of the concentrate. Final products from this process are precious-metal-rich lead and zinc concentrates as well as gold and silver as doré.

The processing plant will operate year-round at a rate of approximately 1,900 tonnes per calendar day, and will achieve full throughput by Year 2. The average LOM feed grade is projected to be 3.40 g/t Au, 79 g/t Ag, 0.6% lead and 0.7% zinc.

Base metal concentrates will be dewatered and containerized for shipment to smelters. Flotation tailings will be thickened and sent to a conventional tailings impoundment, and the leached pressure oxidation residue will flow through cyanide destruction and be sent to a double-lined hydromet residue storage facility.

Although this study assumes a relatively small 250 tpd onsite POX circuit would be used, an arsenopyrite concentrate could be produced for shipment to a smelter in Nevada or China. This was not considered in this study at this time but will be investigated as the project advances.

Process water will primarily be sourced from underground dewatering and surface run-off, with make-up from the nearby Klaza River as necessary.

Metallurgical testwork to support the PEA has been conducted on several composites from the Western Klaza, Central Klaza and Western BRX zones, as well as a Project-Wide Composite comprising a blend of material from these zones. Testwork included grinding, flotation and pressure oxidation work.

Opportunities to Enhance Value

This updated PEA reaffirms Rockhaven’s commitment to enhancing value at the Klaza project through engineering studies and resource expansion and definition. It has highlighted several key areas that can provide significant opportunities to further enhance the value of the Klaza project. These opportunities include:

- Infill drilling to better define areas of high-grade mineralization within the current inferred resource area;

- Additional drilling to better define and expand the Central BRX Zone which has seen limited work to date relative to the other zones;

- Additional drilling of potential near surface bulk tonnage targets within the Eastern BRX Zone, which has yielded high gold recoveries through cyanidation;

- Additional drilling beneath current Mineral Resources, where the deposit remains open at depth;

- Detailed drilling of other known mineralized structures in order to model and include these into future mineral resource estimations; and,

- Further metallurgical studies and investigation of potential smelter contracts for an arsenopyrite concentrate as an alternative to the on-site POX circuit that is currently envisioned.

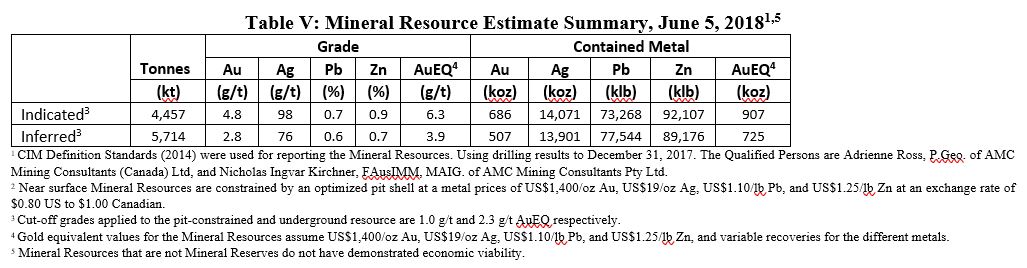

Mineral Resources

The basis for the PEA is the Mineral Resource estimate completed by AMC Mining Consultants (Canada) Ltd. in the NI 43-101 report with an effective date of June 5, 2018 entitled “Technical Report Describing Updated Diamond Drilling, Metallurgical Testing and Mineral Resources on the Klaza Property, Yukon, Canada” which is filed on SEDAR.

A summary of this resource estimate is shown in Table V:

The Klaza property is 100% owned by Rockhaven Resources Ltd. and covers an area of 287 km2. It is favourably located within the southern part of Yukon’s Dawson Range Gold Belt, in an area that hosts an historical gold mine, rich placer gold deposits and key infrastructure such as road access.

The Klaza property is located 50 km west of the village of Carmacks and is road accessible by a two-wheel drive road from the Klondike Highway. Rockhaven’s exploration since it acquired the project in late 2009 has included over 100,000 m of diamond drilling and 24,000 m excavator trenching.

Drilling at the Klaza property has identified eleven main mineralized zones and numerous subsidiary structures which have a cumulative mineralized strike length greater than 10 km. The zones are hosted within a 1.8 km-wide structural corridor consisting of Mid-Cretaceous granitic country rocks. Low to intermediate sulphidation veins host gold, silver, lead and zinc mineralization.

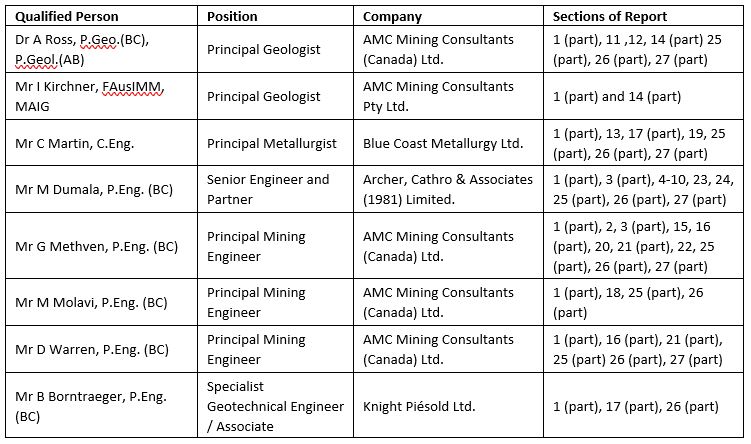

Qualified Persons

A Technical Report supporting the PEA in accordance with National Instrument 43-101 will be filed on SEDAR (www.sedar.com) within 45 days.

The PEA was prepared under the direction of AMC Mining Consultants (Canada) Ltd. by independent industry consultants, all of whom are Qualified Persons (QP) under terms of NI 43-101 and have reviewed the technical content of this press release and approved its dissemination. QPs contributing to the PEA are listed in the following table.

All other technical information, not pertaining to the PEA, in this news release has been reviewed and approved by Matthew R. Dumala, P.Eng., of Archer, Cathro & Associates (1981) Limited and Rockhaven’s designated QP.

The Qualified Persons under the terms of National Instrument 43-101 have reviewed the technical content of this press release for the Klaza property and have approved its dissemination.

About Rockhaven

Rockhaven Resources Ltd. is a mineral exploration company focused on growth through the advancement of its Klaza project. For additional information concerning Rockhaven or its Klaza project please visit Rockhaven’s website at www.rockhavenresources.com.

Matthew Turner

President, CEO and Director

Rockhaven Resources Ltd.

T:604-687-2522

mturner@rockhavenresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.