GT Gold Corp. (TSX-V:GTT) (the “Company” or “GT Gold”) is pleased to announce a maiden Mineral Resource Estimate in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards incorporated by reference in National Instrument 43-101 (“NI 43-101”) for the Saddle North project (“Saddle North”), Tatogga property in northern British Columbia, Canada.

Saddle North Mineral Resource Highlights:

• Indicated Resource of 298 Mt grading 0.28% copper, 0.36 g/t gold and 0.8 g/t silver for a total of 1.81 Blb of copper, 3.47 Moz of gold and 7.58 Moz of silver

• Inferred Resource of 543 Mt grading 0.25% copper, 0.31 g/t gold and 0.7 g/t silver for a total of 2.98 Blb of copper, 5.46 Moz of gold and 11.64 Moz of silver

• Amenable to open pit as well as bulk underground mining methods

• Potential for expansion with mineralization being open at depth as well as to the northwest and southeast

• The Mineral Resource forms the basis for a Preliminary Economic Assessment (“PEA”) expected to be completed by the end of 2020

“The company is pleased to announce another major milestone with the maiden mineral resource estimate for the Saddle North Project. We are proud of the value generated for our shareholders, especially considering this is one of the most recently discovered gold-copper porphyry world-wide, with the first borehole drilled as recently as late 2017.” stated Paul Harbidge, President and CEO. “The importance of having a geological model and a high quality of underlying data to more accurately segregate and estimate these resources will only play a stronger role as we move into our PEA work ahead. Entering the 2020 field season, we look forward to testing prospective greenfield targets in the Quash Pass area at Tatogga, in a region which is now beginning to show the signs of a newly emerging porphyry district in northern British Columbia.”

The effective date of the Mineral Resource is July 6, 2020. A supporting NI 43-101 Technical Report will be filed on SEDAR at www.sedar.com within 45 days.

These open pit and underground mine shape constrained Mineral Resources are summarized below in Table 1.

Table 1: Saddle North Mineral Resource

Notes to Table 1:

- 1Net Smelter Return (“NSR”) ($/t) = (Cu% x 2204.62 lb/t x Cu Recovery x payable% x Cu CAD Price) + (Au g/t ÷ 31.1035 g/ounce x Au Recovery x Au CAD Price x payable%) + (Ag g/t ÷ 31.1035 g/ounce x Ag Recovery x Ag CAD Price x payable%)

- 2All values in Canadian dollars unless otherwise stated

- Differences may occur in totals due to rounding

- The effective date for the Mineral Resource is July 6, 2020

- 3Transition-Sulphide boundary determined from visual logging (weak oxidation in transition material limited to fracture plane surfaces)

- The CIM Definition Standards (May 10, 2014) were followed for classification of Mineral Resources

Mineral Resources are reported using:

- Metal prices of USD $3.25/lb of copper, USD $1,500/oz of gold and USD $18/oz of silver

- Average density of 2.80 g/cm3

- USD $/CAD $ exchange rate of 0.76

- Metallurgical recoveries of 88% for copper, 67% for gold and 58% for silver

- Payable metal net of smelter costs at 89%

- Resources constrained within an open pit shell optimized with the Lerchs-Grossman algorithm and the underground within a minable shape applicable to bulk mining were provided to the Qualified Person by Moose Mountain Technical Services:

- For open pit, mining costs of $2.30/t, with an additional incremental depth cost

- Processing, General and Administrative costs sum of $9.00/t

- Open pit wall angle of minus 45 degrees

- 1NSR ($/t) incremental cut-off of $9.00 for the open pit

- For underground, a bulk mining shape based on a NSR cut-off of $16.00/t. The lateral and vertical continuity of the mineral resource provides a geometric configuration that is amenable to bulk tonnage underground mining methods.

Geological Model

The Saddle North Mineral Resource is delineated by forty-one HQ and NQ sized diamond boreholes totaling 31,401 metres. Topographic control was from a detailed LiDAR survey dataset, flown October 2018.

The geological model (see press release dated April 28, 2020) was used to domain and constrain mineralization. Mineralization is predominantly hosted in a suite of nested monzonite to quartz-monzonite porphyries. The tenor of copper, gold and silver mineralization has a strong correlation with the intensity of potassic alteration, with high-grade domains associated with strong potassic alteration grading outwards to low-grade mineralization in weak potassic alteration domains. Mineralization is associated with chalcopyrite and pyrite. Metal tenor improves with increasing density of porphyry-style A-veins. The mineralized porphyries and associated alteration and mineralization occur in the hanging wall of the northwest orientated Poelzer fault which dips steeply at 85 degrees to the southwest. The pipe-like mineralized system measures 1.2 kilometres north-south by 0.85 kilometres east-west by 1.6 kilometres vertically. Phyllic (quartz-sericite-pyrite) alteration occurs predominantly in the upper levels of the system and on the shoulders of the potassic alteration. There is a pervasive late chlorite-sericite alteration and minor to trace argillic alteration overprint. The mineralized porphyries are intruded by two late stage inter-mineral porphyries and a number of decimetre to metre scale dykes. Late-stage, centimetre scale, quartz-carbonate veins crosscut the earlier porphyry mineralization. High-grade gold and occasionally copper mineralization are commonly associated with these late quartz-carbonate veins but have not been modelled as the continuity of these veins cannot be established. The porphyry system is hosted in the Upper Triassic Stuhini Group volcano-sedimentary sequences, which in turn is overlain by the Late Jurassic Hazelton sedimentary sequences.

Geology was modelled using Leapfrog Geo incorporating logged lithology and alteration front contacts from which three-dimensional wireframe models were constructed. Potassic alteration logged intervals were used to construct the weak, moderate and strong alteration wireframes. Key lithologies for use in the mineral resource estimate were the porphyries, inter-mineral porphyries and dykes which were all used to construct three-dimensional wireframes.

Mineral Resource Estimate

Estimation domains were derived using univariate exploratory data analysis to group like populations which showed consistency for all three metals and were therefore used for all three metal estimations. Three lithological domains were constructed for porphyries P1, P2/P4 and P3/P5. Weak, moderate and strong potassic alteration intensity domains were constructed. Box plots and cumulative frequency distributions were compared to delineate the eight unique mineralized domains, noting there was no strong potassic alteration in porphyry P1. Contact plots were used to define soft boundaries between mineralized domains with hard contacts at inter-mineral porphyries and dykes. In addition, no grades were estimated in the footwall of the Poelzer fault.

The average sampling length of the Saddle North porphyry system is 1.5 metres (approximately 39% of the sample data). Assay grades were capped at 3.0% for copper, ranging between 1.75 g/t to 7.0 g/t for gold and between 2.0 g/t to 8.0 g/t for silver, for the different intensities of potassic alteration. The capping of assays in the weak and moderate potassic alteration zones reduced the impact of the late stage, high-grade gold in quartz-carbonate veins, described above. Capped assays were composited at 15 metres, breaking at lithological and potassic alteration domain boundaries.

Variography (correlograms) were used to model the grade continuity and to determine the search ellipse dimensions for the interpolation of copper, gold and silver separately within the combined potassic alteration domain. The geological model wireframes were key inputs to the resource estimate to define contacts between all mineralized porphyries and all potassic alteration fronts. The azimuth and dip of the potassic alteration fronts were measured and applied at the block scale in the estimation of block grades. Estimations were done using Maptek Vulcan three-dimensional software.

Mineral resource model blocks measured 15 metres in all dimensions. Metal grades were estimated using ordinary kriging in ten passes with search ranges increasing from 40 x 60 x 25 metres to 200 x 350 x 50 metres. For indicated material, estimation passes required a minimum of two holes using a minimum of six samples and a maximum of nine. Inferred material required a minimum of a single borehole using a minimum of three samples and a maximum of nine within modelled geological domains to half (67.5 m) the borehole spacing. Approximately 13% of inferred mineral resource block grades were estimated using a single borehole.

Grade estimates were controlled by high-grade and low-grade indicators. These indicators were used to identify grade populations within the potassic alteration zones. High-grade composites within populations were spatially constrained to within 60 metres of drilling.

Block model densities were determined based on 7,780 measurements. The average density per lithology unit was assigned to the corresponding blocks.

The block model was validated separately for each metal, copper, gold and silver in three ways:

- Visual comparison of block values with underlying borehole composite values

- Comparison to declustered composites using swath plots and histograms

- Comparison with an inverse distance estimate

Mineral resources classified as indicated required a minimum of three boreholes within a distance of 135 x 135 x 50 metres. As described above in grade estimation, approximately 61% of the indicated blocks used two holes at search distances less than 135 x 135 x 50 metres. Mineral resources classified as inferred required a minimum of two boreholes within a distance of 200 x 350 x 50 metres or a minimum of one borehole within a search distance of 67.5 x 67.5 x 50 metres. Approximately 13% of inferred blocks were classified by one borehole. Classification search distances were based on variography.

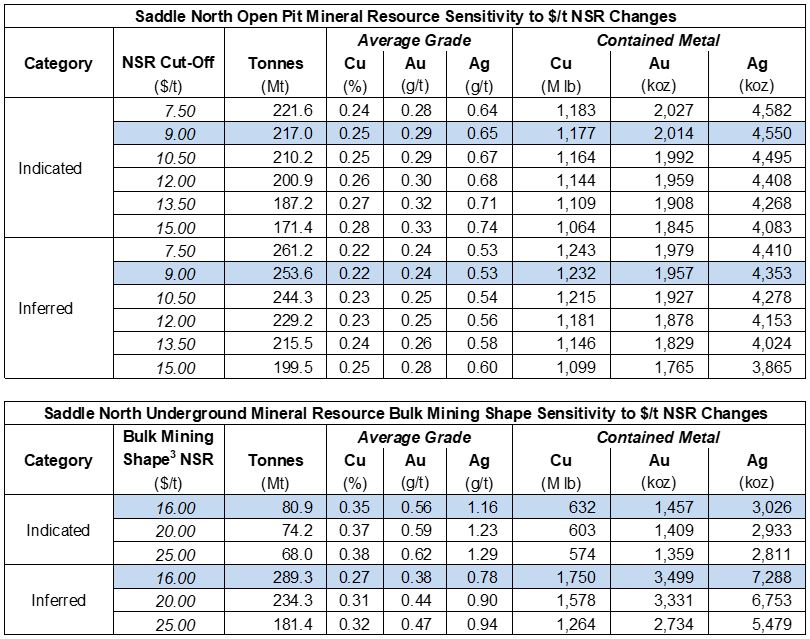

NSR cut-off sensitivities for the Saddle North Mineral Resource are presented in Table 2.

Table 2: Mineral Resource Sensitivity to changes in NSR Cut-Off1, 2

1See Table 1 notes for assumptions

2Transition-Sulphide boundary ignored for sensitivity analysis

3All material within the bulk mining shape at the stated $/t NSR is included at $0/t NSR Cut-off

Further details regarding the foregoing estimate, including the estimation methods and procedures, will be detailed in the pending NI 43-101 Technical Report, which will be filed on SEDAR (www.sedar.com) under the Company’s profile within 45 days from the date of this news release.

Data Verification

The data described above is supported by using industry standard QA/QC procedures consisting of the insertion of certified standards and blanks into the sample stream and utilizing certified independent analytical laboratories for all assays. Historical QA/QC data and methodology on the project were reviewed and will be summarized in the NI 43-101 Technical Report. The qualified person detected minor but no significant QA/QC issues during review of the data.

All geological data used in the mineral resource estimate was reviewed and verified by Next Mine Consulting Ltd. (NMC). A qualified person from NMC made two site visits in June of 2020. Site visits included:

- review of GT Gold’s logging and sampling techniques

- viewing of core from seven Saddle North boreholes

- confirmation of borehole collar field locations

Additional discussion on the project mineral resource data verification will be included in the forthcoming NI 43-101 Technical Report to be filed on SEDAR within 45 days.

Qualified Persons

The independent Qualified Person for the mineral resource disclosure for the project is Richard Flynn, P.Geo., Principal, Next Mine Consulting Ltd., who has reviewed and approved the contents of this release. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Michael Skead, FAusIMM, Vice President Projects, is the Qualified Person for the Company and has validated and approved the technical and scientific content of this news release.

Risk Factors

GT Gold is aware this project is subject to the same types of risks that large base metal projects experience at an early stage of development in northern British Columbia. The Company has engaged experienced management and specialized consultants to identify, manage and mitigate those risks. However, the types of risks will change as the project evolves and more information becomes available.

COVID-19 Update

GT Gold has taken proactive measures to protect the health and safety of employees and communities from COVID 19, and exploration activities in 2020 will have additional safety measures in place, following and exceeding all the recommendations made by British Columbia’s Chief Medical Officer.

2020 Exploration Update

The 2020 exploration program will initially focus on diamond drill-testing new greenfield exploration targets in the Quash Pass area, where two large-scale anomalous trends and several adjacent individual targets have been identified. The Quash Pass target area is located approximately seven kilometres southwest of the known mineralization at Saddle North and Saddle South. The Company is in the process of mobilizing to the field, with drilling anticipated to begin in late July 2020.

About GT Gold

GT Gold is focused on exploring for base and precious metals in the geologically prolific terrain of British Columbia’s renowned Golden Triangle. The Company’s flagship asset is the wholly-owned, 46,827 hectare Tatogga property, located near Iskut, British Columbia, upon which it made two significant discoveries in 2017 and 2018 at its Saddle prospect: a precious metal rich vein system at Saddle South and a gold-rich copper porphyry system at Saddle North.

For further information, please contact:

| GT Gold Corp.

Paul Harbidge President and Chief Executive Officer Tel: (236) 427 5744 Website: www.gtgoldcorp.ca |

GT Gold Corp.

Shawn Campbell Chief Financial Officer Tel: (236) 427 5744 |

|

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects”, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will be taken”, “occur” or “be achieved”. Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.